TJX to Evaluate Dividend Policy in Light of Retail's Rapidly Changing Environment

The coronavirus outbreak has prompted a growing number of retailers to temporarily close their stores to help slow the spread of the virus.

On March 19, TJX (TJX) announced actions it was taking in response to "the rapidly changing market uncertainty" caused by the global pandemic.

The off-price retailer stated it was closing practically all of its stores for two weeks, as well as its online businesses, distribution centers, and offices. As expected from a well-respected operator like TJX, the firm plans to pay its impacted associates for two weeks during these closures.

No one knows how quickly stores will ultimately reopen, but there's a very non-zero chance that closures last well beyond a couple of weeks as more dramatic social distancing actions are mandated across the country to combat the coronavirus.

With sales essentially going to zero overnight and no certain timetable for business to resume, TJX is taking several actions to further strengthen its financial position, including:

On March 19, TJX (TJX) announced actions it was taking in response to "the rapidly changing market uncertainty" caused by the global pandemic.

The off-price retailer stated it was closing practically all of its stores for two weeks, as well as its online businesses, distribution centers, and offices. As expected from a well-respected operator like TJX, the firm plans to pay its impacted associates for two weeks during these closures.

No one knows how quickly stores will ultimately reopen, but there's a very non-zero chance that closures last well beyond a couple of weeks as more dramatic social distancing actions are mandated across the country to combat the coronavirus.

With sales essentially going to zero overnight and no certain timetable for business to resume, TJX is taking several actions to further strengthen its financial position, including:

- Drawing down $1 billion from its revolving credit facilities.

- Suspending its share repurchase program.

- Evaluating its dividend program.

- Reviewing all operating expenses.

- Reducing capital expenditures.

None of these actions are surprising except for TJX's decision to evaluate its dividend program. TJX has paid a higher dividend each year since going public in 1987 and announced plans last month to increase its dividend by another 13% in 2020.

It's hard to imagine the company temporarily reducing or even suspending its payout, but we are also living in unprecedented times, especially for consumer-facing retailers.

TJX's dividend cost $1.1 billion last year, about 40% of the firm's free cash flow. It's a meaningful line item to evaluate for companies going into cash preservation mode.

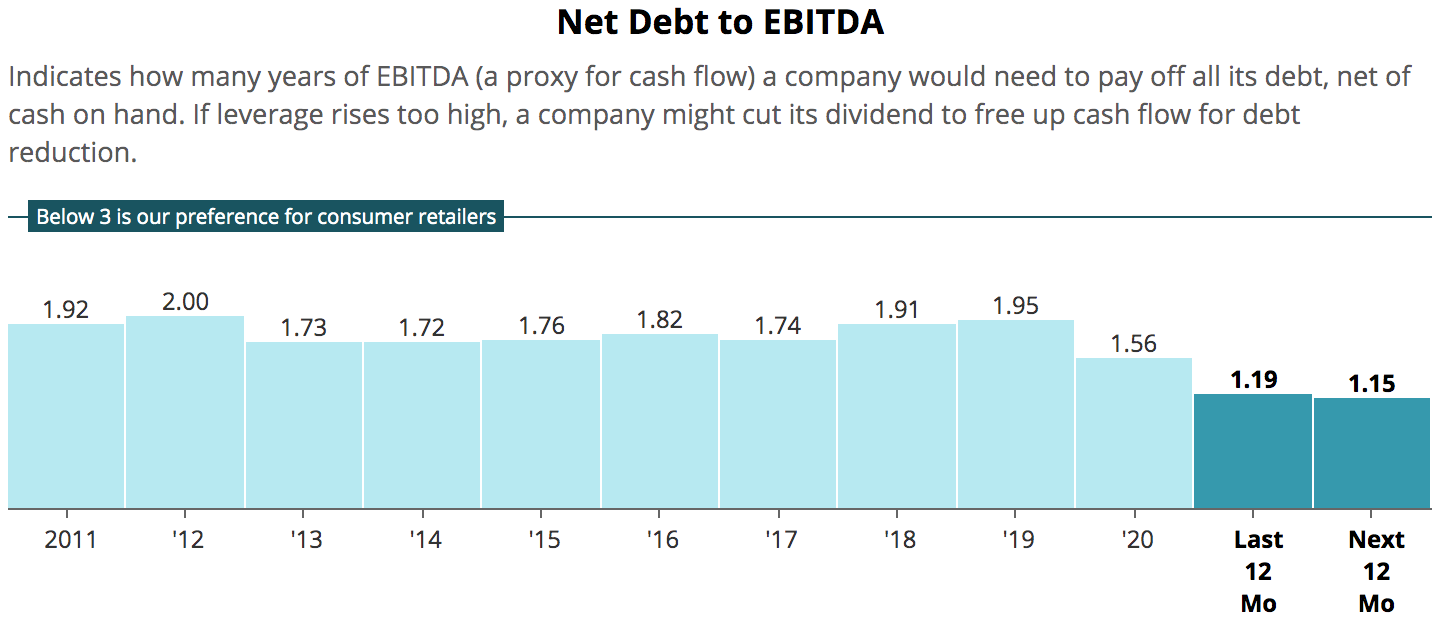

The retailer had $3.2 billion of cash in February and added another $1 billion by tapping its credit revolver. TJX maintains low leverage and an A+ credit rating from Standard & Poor's, indicating it should have ample access to low-cost capital.

In fact, we estimate that management could add nearly $3 billion of debt to the balance sheet and TJX's leverage ratio would only rise to 2.0x.

If we had to guess, TJX may choose to hold its dividend flat rather than move forward with its planned 13% increase.

However, if management begins to believe that its stores may be closed for much longer than two weeks, it's not beyond the realms of possibility that the dividend could be temporarily suspended to preserve cash out of an abundance of caution.

The company followed up its initial statement with another one that seems to hint more at a short-term dividend suspension (emphasis added):

“TJX is a great Company with a great retail model. I want to reiterate that TJX entered 2020 in a very strong financial position. We consider the actions that we announced today as just prudent steps we are taking to further strengthen our financial liquidity and flexibility during this uncertain environment. Additionally, while we are evaluating our dividend in the near term, I want to emphasize that we remain committed to paying our dividends whenever the environment normalizes for the long term, as we have been for decades..."

A temporary dividend reduction would ensure ongoing fixed expenses (selling, general, and administrative costs totaled $7.5 billion last year) can be comfortably covered without stretching the balance sheet more than necessary.

Once on more stable footing whenever the virus subsides (likely later this year), perhaps TJX could then consider paying a supplemental dividend to make income investors whole and keep it on track to reach dividend aristocrat status in a couple of years.

All of this is just speculation for now, but the company's unexpected remark leads us to downgrade TJX's Dividend Safety Score to Borderline Safe until more clarity is provided.

If stores reopen across the country in the next couple of weeks, then TJX's Dividend Safety Score could be upgraded quickly. Either way, we remain optimistic about the firm's long-term outlook and plan to continue holding our shares in our Long-term Dividend Growth portfolio, even if the dividend hits a short-term bump.

It's also worth noting that the peak sales period for retailers is in the second half of the calendar year, so the demand freeze could have come at a worse time.

Once business returns, TJX should be especially well positioned to take advantage of the excess inventory that weakened department stores and specialty retailers will be looking to unload.

After all, most of these businesses weren't in great shape to begin with. In fact, only three of the 19 apparel retailers and department stores we cover had Safe or Very Safe Dividend Safety Scores heading into the coronavirus pandemic.