A.O. Smith's Long-Term Outlook Still Looks Solid Despite Short Report

Shares of A.O. Smith (AOS) have slumped about 11% over the last two days following a bearish research report released by short seller J Capital Research.

You can read their 66-page report here, but the firm makes the following key allegations against A.O. Smith's business practices and outlook:

You can read their 66-page report here, but the firm makes the following key allegations against A.O. Smith's business practices and outlook:

- Short-term performance in China, which accounts for 34% of A.O. Smith's sales, is overstated due to channel stuffing

- A.O. Smith has an undisclosed distribution partner in China that could be responsible for up to 75% of its sales in that region; the partner accepts the firm's inventory and helps finance distributors, allowing A.O. Smith to report better gross margins and sales growth in periods of weaker demand

- Since the macro outlook is deteriorating and distributors have too much inventory from 2018 channel stuffing, the firm's China revenue could fall by as much as 21% in 2019 versus management’s claims of a 6-8% decline

- A.O. Smith could have used its overseas cash (84% of cash is in China) for distributor loans to improve its short-term sales. Its cash could be held in escrow and thus be untouchable until distributors' loans are repaid, which isn't guaranteed in a weakening market

J Capital Research anticipates "the multiple of the stock to re-rate materially in the near term as a result of a crisis in confidence" and expects that 2019 revenues will eventually disappoint due primarily to weak results for China.

Spruce Point Capital Management, an investment manager focused on short-selling, also piled on, backing many of the claims made by J Capital Research. Both firms target 40% to 60% downside for A.O. Smith shares, based largely on the assertion that the growth story in China is over but not yet priced into the stock.

To their credit, investors at these firms conduct a lot of diligent research. They send investigators to China. They call up or visit distributors. They scrutinize every minuscule detail and change in financial filings. They look for dirt on each member of the management team.

Basically, their resources enable them to produce primary research that individual investors can only dream of conducting. Their detailed analysis is almost always worth reading for the educational value alone – you'll learn something factual about a business that you didn't know before.

With that said, short-sellers publicizing their investment opinions don't often have the most wholesome intentions. They make money by driving a stock's price lower, and as quickly as possible.

Short-sellers don't own the stock, but instead usually borrow it from a broker-dealer and buy it back later (hopefully at a lower price). During this period, the short-seller pays borrowing costs as well as any dividends paid out on the borrowed stock.

In other words, if they can highly publicize an apparently well-researched short report on a company that causes its stock price to plunge, fast profits can be made, even if their findings turn out to be wrong. Fear is a powerful factor.

I don't think it's a coincidence that the short sellers waited to drop their report on A.O. Smith until now, a week after the U.S.-China trade war escalated. A.O. Smith has the largest exposure to China of any S&P 500 firm I know of, so many investors were already feeling wary of the firm's short-term outlook.

It's also important to remember that no matter how much research someone does, no one can escape the inherent uncertainties that can make investing so difficult.

I always find this excerpt from the Sequoia Fund's fourth-quarter 2018 investor letter to be a great reminder of that. These folks have one of the best long-term performance track records and conduct extremely detailed research:

“There is unfortunately no way to know when your worries about a company’s fundamental prospects will start to weigh on its stock price – or even if they’re valid in the first place…Predicting the future is hard, even when you work as diligently at it as we do."

Short-sellers taking shots at companies like A.O. Smith don't exactly share Sequoia's humble demeanor. Instead, they must exude confidence in an effort to get more investors to part with their holdings.

Of course, there's always a chance the short-sellers are right. I'd say the odds are usually no better than a coin flip in most cases, but they certainly aren't zero either.

Let's start with the first allegation against A.O. Smith – channel stuffing has driven the company's recent growth in China but is no longer working.

Operating as a public company is hard. Shareholders are demanding, and analysts maintain estimates they expect to see met every 90 days. There's pressure to continuously deliver results that please the market, and that can create perverse incentives to game the system.

Channel stuffing, or selling excessive amounts of inventory to distributors when they don't need it, is a cheap lever to pull in an effort to hit short-term sales and earnings targets.

From what I've read, the economic environment in China remains turbulent, which likely makes managing inventory levels more challenging for A.O. Smith and its distributors.

Channel stuffing allegations would make me feel more uncomfortable if China's economy was performing well, but A.O. Smith's water heater business was still lagging.

Market share losses in good times could be an indicator that the firm's competitive advantages are eroding, and it has chosen to engage in questionable activities to game short-term results instead of taking its medicine and seeking a sustainable, long-term solution to drive profitable growth.

I wouldn't be surprised if A.O. Smith's distributors have elevated inventory levels that linger throughout 2019 if China's housing market continues to cool. Management has already called out the inventory build that took place in 2018:

"We believe 2018 Chinese sales increased at least 5%, due to the customer inventory build in the first half 2018. We are assuming continued weakness in the Chinese economy and relatively flat consumer demand for the full-year in 2019.

Without the impact of the 2018 channel inventory build, we are projecting full-year sales to be down approximately 6% to 8% in local currency terms, the majority of which will occur in the first half of this year." – CEO Kevin Wheeler

Whether or not channel inventories return to more normal levels by the third quarter or sometime in 2020 really has no bearing on my long-term view of the company.

We've held shares of A.O. Smith in our Long-term Dividend Growth portfolio since July 2015, and I didn't buy the stock based on my outlook for any single quarter or year. I bought it with hopes to hold the business forever.

I still expect China's water heater and treatment markets to be much larger in 10 years than they are today, though the growth trajectory certainly won't be linear.

I also expect A.O. Smith to maintain a strong market share position like it has done for more than a decade while continuing to navigate evolutions such as the rise of e-commerce water heater sales and more competition from lower-priced rivals.

As a long-term dividend growth investor, I'm not going to worry much about a down year in China, as long as it's not specific to A.O. Smith. Channel stuffing would be disappointing from an ethical standpoint, but I don't see enough evidence today to believe that's a critical risk factor.

For now, I'll give management the benefit of the doubt and chalk up the inventory build to normal industry cycles in China. After all, A.O. Smith targets the premium end of the market, so it probably gets hit the hardest when demand softens and some consumers look to trade down.

The short-sellers' balance sheet allegations bother me more. Again, there's no proof of any shenanigans today, but I would likely sell the stock if the short sellers' allegations were true and management failed to disclose such a risk.

The concern here is that 84% of A.O. Smith's cash balance sits in China, and the short sellers claim that the company "may have used its cash for distributor loans to prop up sales."

Specifically, the company's alleged undisclosed partner in China extends credit to distributors, who buy A.O. Smith's products. To provide these loans, this "cash-poor" partner needs to borrow.

The short-sellers think A.O. Smith provides its partner with an "entrusted loan, meaning that AOS would extend the loan to" the partner, or "AOS may guarantee the loan by depositing cash in escrow."

Such an activity would potentially subject the firm to some credit risk in the event that its Chinese distributors cannot sell all of their inventory and pay back their loans in full. It would also mean A.O. Smith doesn't have easy access to its cash.

The good news is that any masked lending going on here is at least backed by a hard asset – water heaters – though their liquidation value in a recession probably isn't great.

If A.O. Smith is engaging in such an operation, the company should absolutely disclose it in its filings while also characterizing part of its hefty cash balance as restricted. I'd like to think the firm's auditors (Ernst & Young) were already on top of these matters and there's nothing to worry about, but you never know for sure.

At the end of the day, I plan to continue holding our shares of A.O. Smith and believe this dividend aristocrat deserves the benefit of the doubt for now.

Much of the short-sellers' bear case hinges on the short-term performance of the Chinese water heater market, which is unpredictable and not critical to my long-term thesis. In fact, J Capital Research even states that it believes steady-state growth for the company will be around 2% in the long term.

I'd be more worried if allegations were about the company's products being faulty, or if A.O. Smith already had a slim margin for error due to a high payout ratio and significant debt, but that's far from the case here.

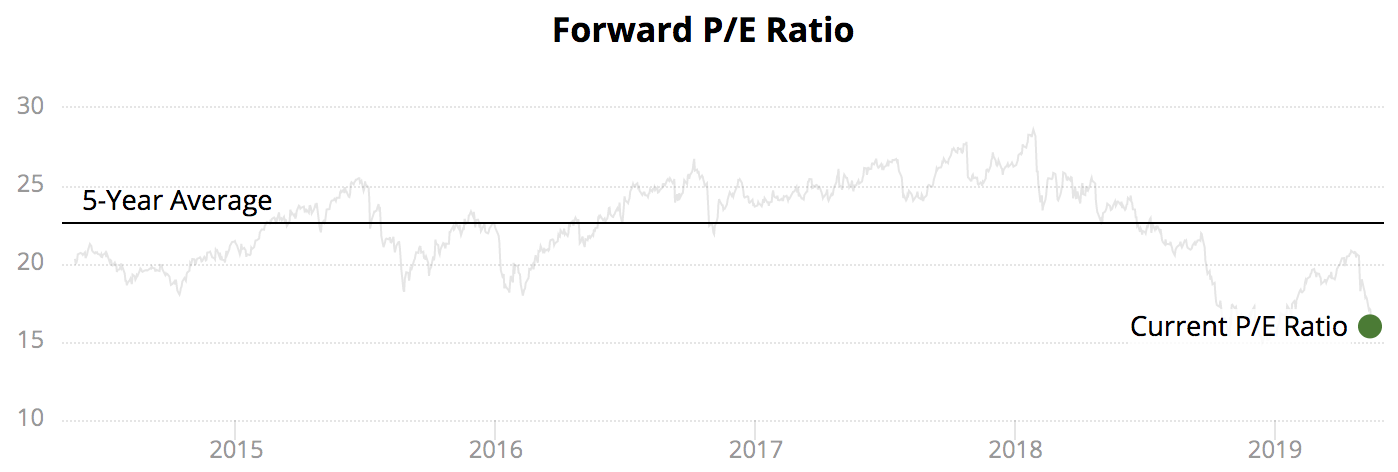

From a valuation perspective, the stock's forward P/E ratio has contracted sharply from above 25 in early 2018 to about 16 today, its lowest level in at least five years. It's also slightly below the Industrials sector average of 16.2.

In other words, unless the firm's earnings are about to take a big hit, a lot of growth fears already appear to be priced in. Shares of A.O. Smith would likely take another beating if China's economy slipped into a recession and investors started panic selling, but that's always been a risk.

You have to have a strong stomach to hold most industrial stocks, especially small and mid cap stocks that are primarily engaged in only a couple of different business lines. A.O. Smith is no exception, although the U.S. generates over 75% of its profits and is characterized by steadier demand trends since most of the mature market there is for water heater replacement sales.

Owning a stock that's under attack by a short seller is never pleasant, and it can take several quarters or even years to determine who was right. Maintaining a reasonably diversified portfolio provides protection against unexpected events that can crop up at any given company.

I don't expect 2019 to be a great year for A.O. Smith and realize its short-term performance will likely remain tied to the strength of China's housing market. However, I plan to continue holding the stock and believe its long-term outlook remains intact for now. We will continue monitoring the situation.

Update – management issued a statement Friday evening rejecting the short-seller's report, saying it made "inaccurate, unfounded and misleading allegations designed to negatively impact A. O. Smith's share price for J Capital's own benefit." The company also noted that all of its cash in China is held "in A. O. Smith-owned, unencumbered bank accounts," shooting down J Capital's claim that much of its cash could be held in escrow accounts.