Kraft Heinz's Turnaround Struggles Come to a Head

Kraft Heinz (KHC) reported a bombshell earnings report this evening, validating investor concerns over the company's struggling turnaround. The bad news included:

- A $15.4 billion non-cash impairment charge related to the value of its Kraft natural cheese, Oscar Mayer cold cuts, and Canadian retail businesses

- An investigation by the SEC into the firm's accounting policies related to its procurement area

- 2019 guidance calling for a 10% decline in EBITDA, missing analyst estimates by nearly 15%

- A 37% dividend cut to accelerate deleveraging and position the company for more acquisitions to continue consolidating the industry

Kraft Heinz's Dividend Safety Score was in our "Borderline Safe" bucket (41 to 60 points) for more than a year leading up to its dividend cut. Since early November its score sat at 41 points, hanging onto the very bottom rung of our "Borderline Safe" category.

In November 2018 we published a note reviewing the company's dividend safety and turnaround efforts (see here). Specifically, we talked about how companies with scores close to 40 and below can be murky situations to evaluate. Typically they have a lower margin of safety and thus rely more heavily on favorable business conditions to maintain their payouts.

As conservative investors, we prefer to invest in companies that score above 60 (our "Safe" and "Very Safe" dividend categories). With that said, to understand and learn from Kraft Heinz's decision to reduce its payout, it's worth beginning by repeating our concluding marks on the company from November:

Kraft Heinz still owns some popular brands and enjoys industry-leading profitability thanks to 3G Capital orchestrating aggressive post-merger cost cutting. However, those cost savings have apparently come at the expense of the company's product development and marketing efforts, which has left Kraft Heinz struggling worse than most major packaged food and consumer staples companies.

While management is saying all the right things about shifting the company's product mix to healthier options and using digital advertising to maximize returns on investment, thus far Kraft Heinz's turnaround has been all promise, with little benefit to the top or bottom line.

And given the company's somewhat high payout ratio and large amount of debt, if Kraft Heinz can't start delivering on its turnaround plan quickly (in 2019), then the risk of its frozen dividend being cut could increase.

While the stock's current yield is certainly generous, conservative income investors may prefer to look at other companies with safer dividends, superior growth potential, and less hair from a heavy debt load and struggling turnaround effort.

Sure enough, Kraft Heinz's turnaround plans hit another snag in the fourth quarter. Here's how management explained the situation on the earnings call:

“We said on our last call that we expected our EBITDA growth rate to improve beginning in Q4…while this turned out directionally accurate, Q4 constant currency adjusted EBITDA was significantly below the expectations we previously outlined…this was driven by shortfalls in the United States. To be more specific, while the one-off factors we outlined in Q3 by and large fell away as expected, anticipated savings did not materialize, particularly in our procurement area. And to a lesser extent, we had higher than anticipated costs in both manufacturing and logistics.”

The good news is the company delivered 2.4% organic net sales growth and claimed market share gains in the "vast majority of [its] categories, even categories that have been declining for quite some time."

However, constant currency adjusted EBITDA fell 11.5% compared to the prior year period. Management admitted to being "overly optimistic" about its ability to offset cost inflation with its savings programs, which were challenged by unfavorable supplier negotiations and delayed manufacturing projects.

Unfortunately, management expects these challenges to continue in 2019, forecasting EBITDA to decline by $700 million (-10% versus 2018) at the midpoint of its guidance range. About half of the decline is due to continued cost inflation net of weaker-than-expected savings, with most of the remainder driven by currency headwinds and divestitures.

Many investors had concerns that 3G Capital, a Brazilian private equity firm which owns nearly half of the company, was overly aggressive in cutting costs following the Kraft-Heinz merger in 2015. Rather than invest in marketing and new product innovation to drive sustainable earnings growth, operations were stripped down to the bone.

The company touted the industry-leading margins it achieved but had little to show in the way of profitable organic growth and pricing power. With that trend now set to continue through 2019, coupled with the $15.4 billion write-down on two of the firm's biggest brands, it appears the firm's intense cost savings efforts have indeed come at the expense of its brand equity.

While Kraft Heinz expects EBITDA and earnings per share growth from 2020 onwards, investors are understandably skeptical. Confidence is already dwindling in management's capital allocation skill, and the company's dividend cut only added fuel to the fire.

As we noted in another excerpt from our November analysis below, Kraft Heinz was not facing any liquidity challenges leading up to its dividend cut. However, the big unknown was how eager 3G Capital might be to swing for a major growth investment which could further pressure the balance sheet and dividend:

The good news is that Kraft Heinz still has solid liquidity. In addition to the $1.4 billion of cash it holds, the firm has an untapped credit revolver with $4 billion of capacity that doesn't expire until July 2023. Furthermore, average annual debt maturities through 2022 sit at a manageable $3 billion.

In other words, there does not appear to be a pressing need to conserve cash.

The big question is how committed management will remain to the payout if cash flow growth continues to disappoint and urgency to improve the firm's portfolio of food brands increases (either organically or via a large acquisition).

After all, this team seems willing to make big capital allocation moves if their previous offer to buy Unilever for more than $140 billion is any indication, and it's hard to say how wedded 3G Capital is to the dividend.

With Kraft Heinz's dividend consuming over $3 billion of cash each year, that's a lot of money that could go towards deleveraging, higher marketing and R&D investments, and more acquisitions.

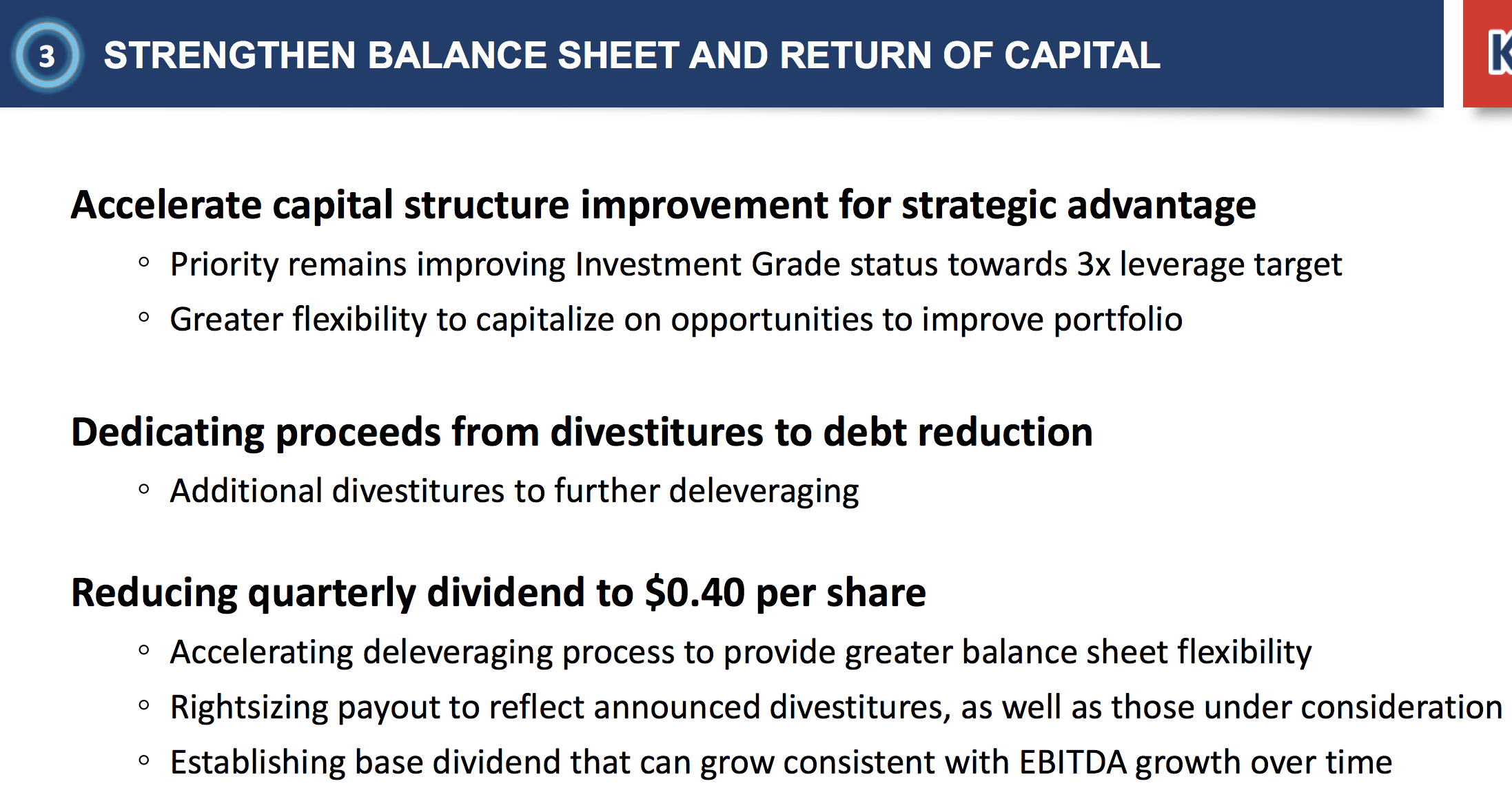

On the latest earnings call, management said reducing the dividend, along with executing more divestitures of non-core assets, will allow Kraft Heinz to deleverage faster in order to position it for more industry consolidation (i.e. acquisitions):

“Given the industry backdrop and opportunities in front of us, we now see even greater strategic advantage in accelerating our deleveragingtowards our ongoing 3 times leverage target and strengthening the term structure of our debt. To do this, we are undertaking two specific actions. First, we intend to dedicate the divestiture proceeds…to debt reduction.

Second, today we are announcing a reduction in our quarterly dividend…this will not only provide us greater balance sheet flexibility, it will also establish a base dividend we can grow consistent with EBITDA growth over time. And we are comfortable that this level of dividend can accommodate the two divestitures we have already announced, as well as those we are currently considering.

These initiatives will accelerate the strengthening of an already solid balance sheet with a fully funded pension plan and continue to position Kraft Heinz for industry consolidation.”

Consolidation is natural in many slow-growing industries since a larger company can squeeze out more operating efficiencies to expand its profits, all else equal.

However, investors have lost confidence in 3G Capital's reputation as a savvy dealmaker. One analyst on the call even asked management why they would continue seeking consolidation opportunities since it appears that synergies from combining Heinz and Kraft have been largely wiped out given the ongoing slump in EBITDA.

If everything goes well it will likely take many quarters, if not a couple of years, for management to regain investors' confidence, even despite the 26.7% ownership stake that Warren Buffett's Berkshire Hathaway has in the company.

After accounting for their double-digit tumble in after-hours trading, Kraft Heinz shares will yield around 4% at the lower dividend rate. While many of the company's brands are struggling, due to years of underinvestment and the challenged categories they compete in, Kraft Heinz will very likely remain a dividend-paying cash cow for years to come.

Existing shareholders have to decide if they believe 3G Capital and Berkshire can right the ship and find the next big deal that creates long-term shareholder value. Expectations appear low due to increased uncertainty about the company's long-term outlook, but it's not an easy task to turnaround a business this large. Our preference would be to move on to companies with safer, faster-growing dividends and clearer paths to profitable growth.

As it relates to other large packaged food companies, Kraft Heinz does not seem likely to be a canary in a coal mine. It's true that consumer preferences are evolving quickly and private label competition is intense across numerous product categories, but this particular business appears to have been mismanaged more than others. 3G Capital's involvement has also resulted in a much greater emphasis on consolidating the industry via acquisitions, which have taken priority over the dividend.

Meanwhile, earlier this week General Mills reaffirmed its sales and earnings guidance for its fiscal year ending in May 2019, and Mondelez also reiterated its 2019 outlook and long-term growth targets. While Kellogg issued disappointing guidance earlier this month, due largely to its oversized exposure to the cereal market, it still expects positive organic sales growth and flat operating profit in 2019.

In other words, none of these businesses appear to share Kraft Heinz's dire outlook for the year ahead. No dividend portfolio will ever be perfect, but maintaining a healthy level of diversification and staying focused on companies with "Safe" and "Very Safe" Dividend Safety Scores can help reduce unpleasant surprises.