Booms Come, Dividends Endure

AI enthusiasm hit a fever pitch in the third quarter, powering a 17% surge in the so-called Magnificent Seven technology leaders and lifting the S&P 500 by 8% to extend its year-to-date gain to 15%.

I have never been a believer in forecasting macro events, much less the future course of technological development. But AI deserves more discussion this quarter as OpenAI's spending spree helped lift many tech stocks and some of our holdings.

I have never been a believer in forecasting macro events, much less the future course of technological development. But AI deserves more discussion this quarter as OpenAI's spending spree helped lift many tech stocks and some of our holdings.

The maker of ChatGPT signed a five-year agreement with Oracle that is expected to top $300 billion in spending on computing power beginning in 2027. This news sent Oracle's stock surging more than 35% on September 10, briefly catapulting its market value above $1 trillion (and filling me with some regret over trimming our large position in July).

Shortly after, Nvidia unveiled plans to invest up to $100 billion in OpenAI as it builds AI data centers with Nvidia's systems. Upon completion, the 10 gigawatts of planned infrastructure would consume as much electricity as New York City, roughly three times Google's entire data center footprint.

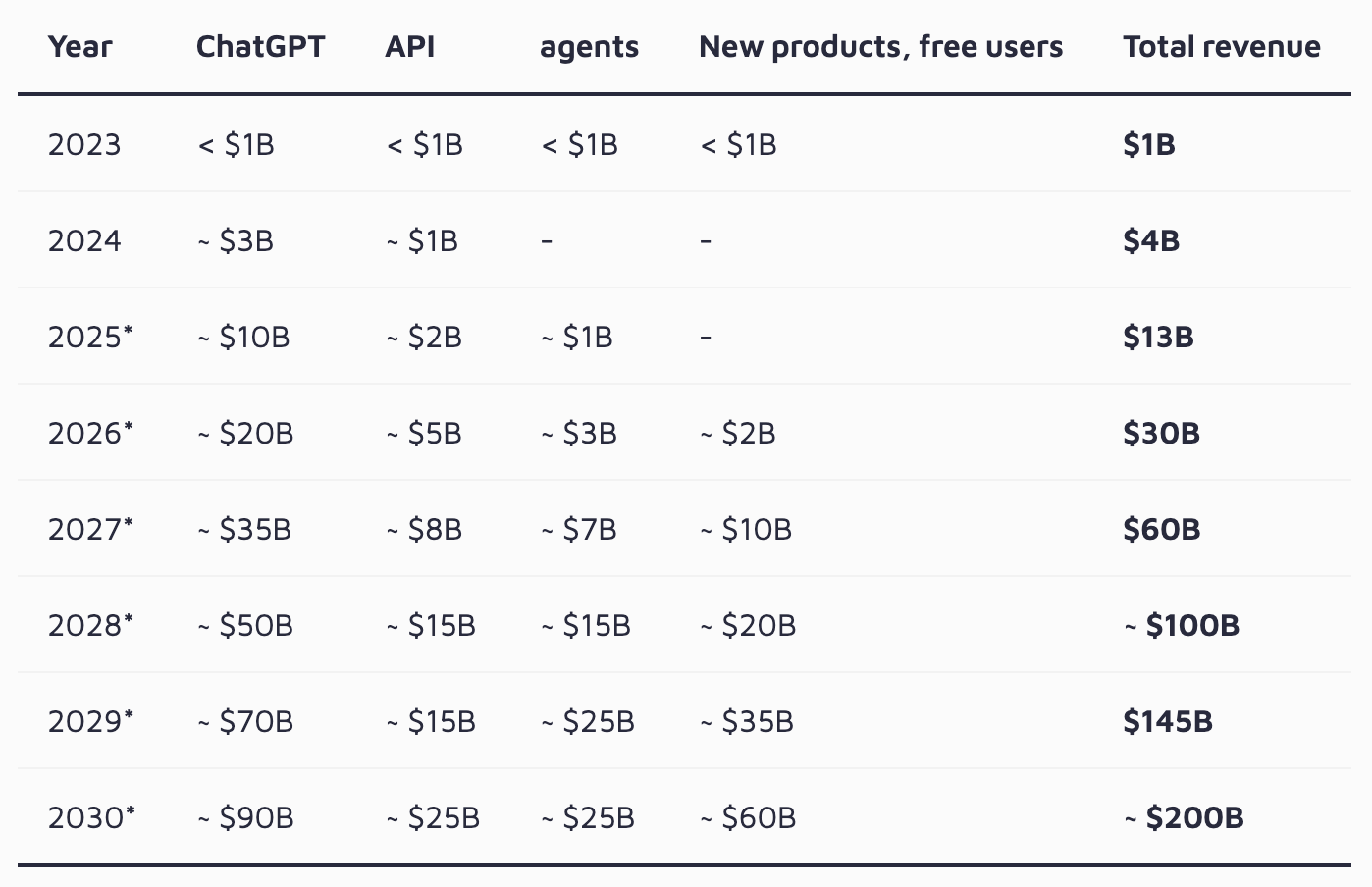

Even before these announcements, OpenAI projected it would burn through about $115 billion by 2029 on research, operations, and near-term infrastructure. By comparison, its first-half revenue totaled just $4.3 billion — very impressive for a young startup but a drop in the bucket against its capital needs.

OpenAI CEO Sam Altman has framed this as a build-it-and-they-will-come problem. He wrote recently that with 10 gigawatts of compute, AI might cure cancer or provide a personal tutor to every student on earth. "If we are limited by compute, we'll have to choose which one to prioritize. No one wants to make that choice, so let's go build."

Meta CEO Mark Zuckerberg struck a similar tone, saying it is better to risk wasting a couple hundred billion dollars than risk falling behind if artificial superintelligence arrives sooner than expected. In his words, "the risk is probably in not being aggressive enough rather than being somewhat too aggressive."

That mindset captures the fear of missing out driving this arms race. Overspending is admitted to be wasteful, but being late is treated as the greater sin.

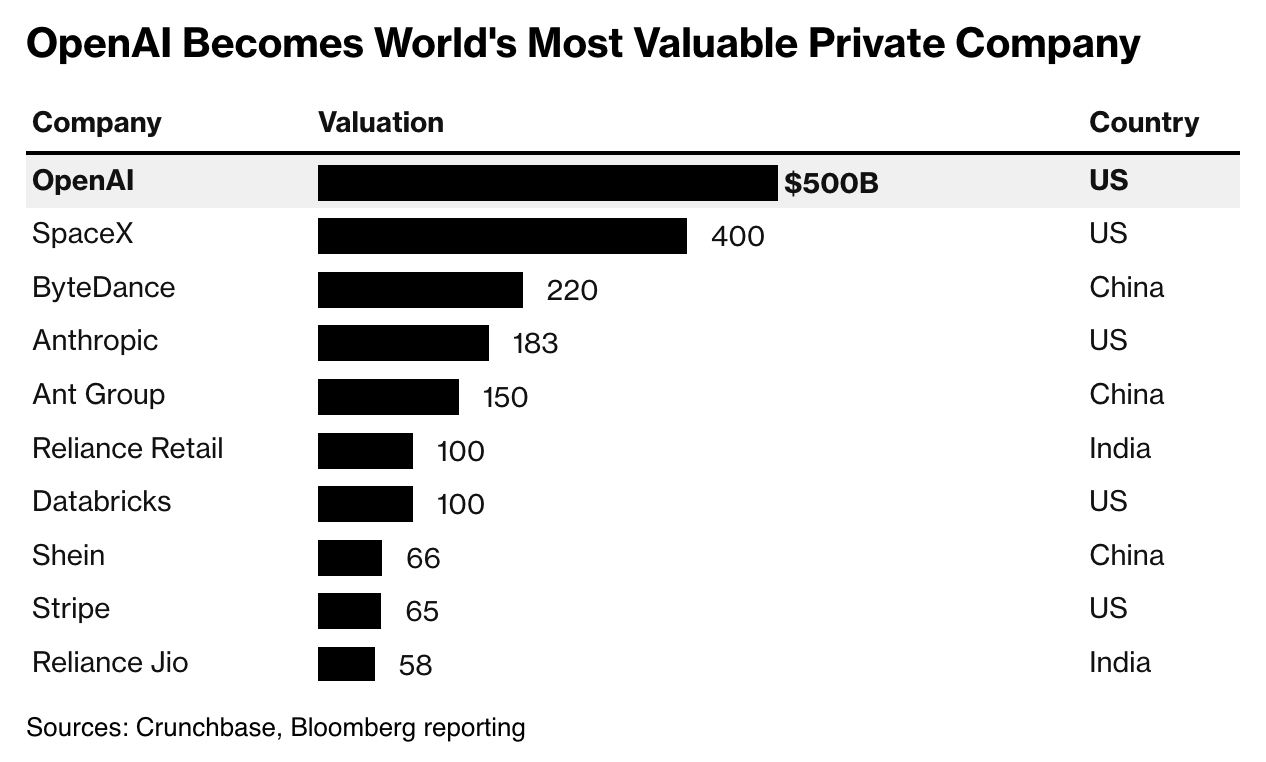

Investors are happy to drink the Kool-Aid for now. Earlier this week, OpenAI sold shares at a $500 billion valuation, more than 50 times sales. And in July, an AI startup founded just months earlier raised money at a $12 billion valuation despite having no revenue or products.

While spending on data centers is accelerating, AI services have yet to go mainstream. If all goes well, OpenAI forecasts its revenue will soar to $200 billion by 2030, driven by paid ChatGPT plans, ads shown to free users, businesses embedding the technology into everything from apps to robots, and new consumer products that expand its reach.

But early evidence shows how far there is to go. An MIT study in August found that 95% of companies running AI pilot programs failed to generate a return on their investment. And a Bain & Co. report in September estimated that AI firms' revenue could fall about $800 billion short of what is needed to fund the computing power required to meet projected demand by 2030.

In many ways, OpenAI and the broader AI landscape represent the opposite of dividend growth investing. These companies are committing enormous sums with little visibility into when those investments might generate steady cash flow. That can be an acceptable gamble for growth investors, but it is not the kind of profile that supports safe, reliable dividends.

For income-focused investors like us, that is speculation, not investing.

History shows that transformative technologies can change the world without rewarding early backers. The automobile and airline industries revolutionized society but destroyed vast amounts of shareholder value.

Even the internet, perhaps the closest parallel to AI, saw trillions invested during the dot-com era but very few enduring winners. Bill Gates' famous 1995 "Internet Tidal Wave" memo flagged key early web destinations. Most have since faded into obscurity.

Being right about the technology was not enough. Investors also had to be right about who would capture the value.

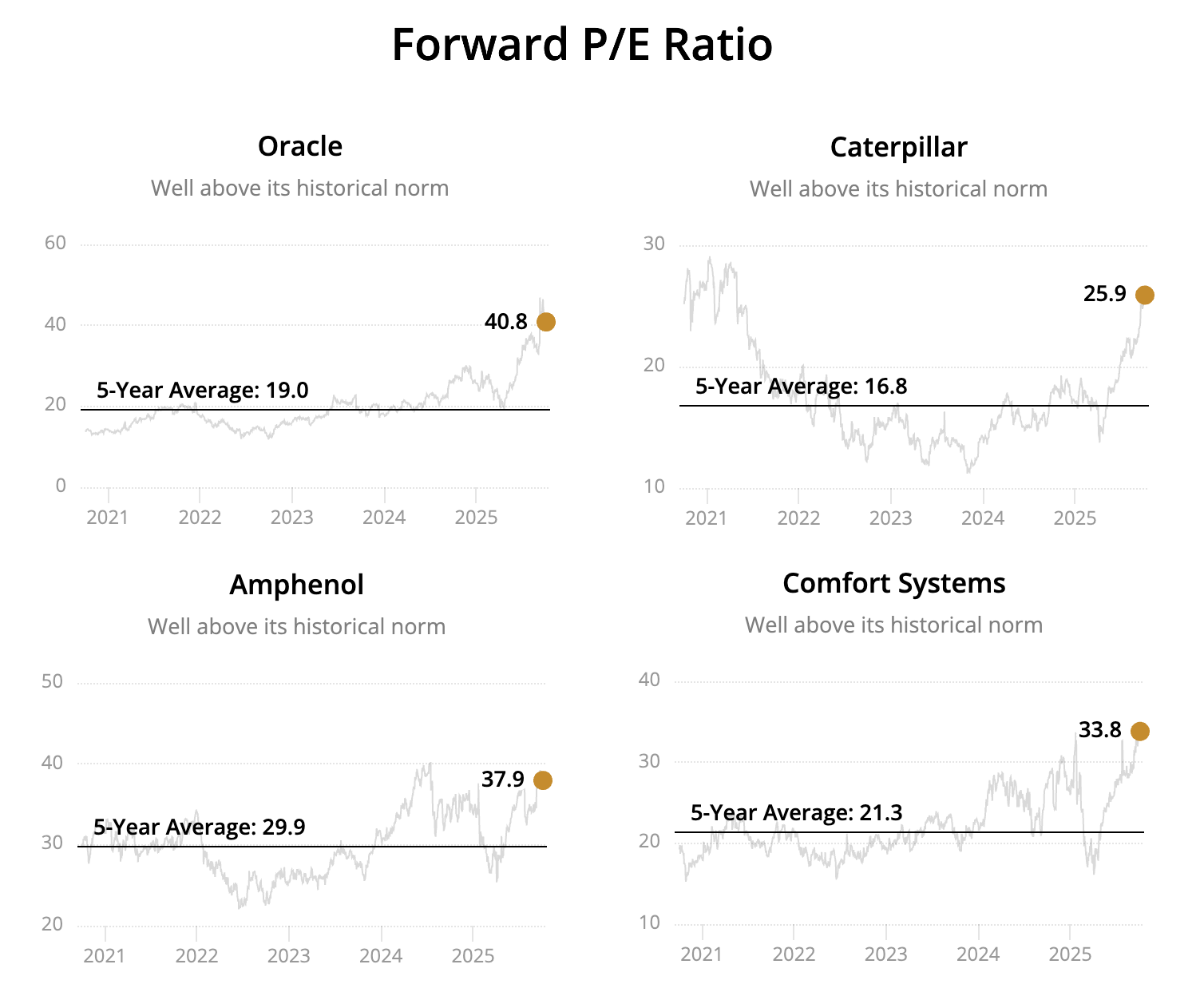

I'm no AI expert, but the current environment makes me uneasy. From cloud giant Oracle to companies supplying the picks and shovels of data center expansion like Caterpillar, Amphenol, and Comfort Systems, stock valuations have raced well ahead of their historical norms. Capital spending is surging, driven more by a fear of missing out than by clear evidence of durable returns. This is a trend that may prove unsustainable in the years ahead.

My preference is to avoid chasing the latest craze, even when the underlying technology may prove as transformative as AI. I do not doubt its potential, but the trade itself feels harder and harder to square with fundamentals.

I would rather stick with businesses that have predictable economics, reasonable valuation multiples, and a proven record of generating and returning cash to shareholders in all kinds of environments.

Rather than trying to predict which industries AI will transform, we focus on companies resilient to disruption, those whose value often rests on physical assets, regulation, or essential services rather than digital models alone. Utilities, pipelines, telecom infrastructure, real estate, consumer staples, and healthcare all fit this mold.

These firms may use AI to improve efficiency if the technology delivers on its promise. But they will continue selling power, energy, bandwidth, food, and medicine, needs that will not vanish with the next technological shift. That is the kind of foundation we want underpinning a retirement portfolio, supported by dividends that keep growing regardless of how the AI race plays out.

If AI enthusiasm proves to be a bubble, the fallout will be significant. In the past two quarters, capital spending on AI has contributed more to U.S. GDP growth than all consumer spending. As a share of the economy, AI infrastructure investment has now surpassed the telecom and internet build-out of the dot-com era. Few areas of the market have ever consumed capital this quickly without eventually running into trouble.

Meanwhile, the outlook for the rest of the economy is more subdued. Earnings expectations for the S&P 493 (companies outside of the Magnificent Seven) have been flat since April. The labor market has softened enough for the Fed to resume cutting rates, manufacturing remains in contraction, the housing market is weak, and lower-income consumers continue to feel the pinch of inflation.

With record concentration in the tech-heavy S&P 500 and valuation multiples near or above historic highs, the risks of disappointment are elevated. None of this is a reason to try timing the market, but in this environment we prefer to stay anchored in companies with dependable cash flow, solid balance sheets, and valuations that leave some room for error rather than chase what may prove to be another boom-and-bust cycle.

Dividends may not capture headlines like AI, but they remain one of the most dependable sources of long-term wealth creation. And unlike hype cycles, their payouts compound steadily over time.

We will continue working to help you keep your portfolio within the guardrails and stay focused on safe, growing dividends through whatever comes next.

Thank you for your support of Simply Safe Dividends, and please reach out with any questions or ideas for how we can keep improving the service for you.

Thank you for your support of Simply Safe Dividends, and please reach out with any questions or ideas for how we can keep improving the service for you.