Is Southern Company's Dividend Still Safe?

Southern Company’s (SO) stock has slumped 8% since August 7, a large decline over such a short period of time for any business, much less a regulated utility that's supposed to be a defensive holding.

The stock’s 5.4% dividend yield now sits near its highest level since 2010, causing some investors to wonder if Southern Company’s impressive streak of paying uninterrupted dividends for more than 70 consecutive years could be coming to an end.

Let’s take a look at why Southern Company’s stock has slumped and whether or not the utility’s dividend remains on solid ground.

Nuclear Plant Construction Issues Resurface

Southern Company last reported earnings on August 8. While the firm’s core utilities are performing well, driving adjusted earnings per share growth of about 10%, investors were disappointed by yet another cost increase in the nuclear project it is leading.

As you might recall, since 2008 Southern Company has been working on Plant Vogtle Units 3 and 4, the nation’s first new nuclear reactors in 30 years that are expected to provide electricity to 500,000 homes and businesses for up to 80 years. The project was initial expected to be completed in 2016 at a maximum cost of $14.5 billion.

Due to a number of major complexities and operational setbacks, the project’s cost had ballooned to $25 billion and the in-service date was pushed back to 2021, five years later than initial expectations.

In March 2017 the nuclear project's future was especially in question after Westinghouse Electric, Toshiba's nuclear services business and the leading contractor on Vogtle, declared bankruptcy due to rising costs.

In December 2017 Georgia’s public utility commission voted to decide if the troubled project should continue. Southern Company received the greenlight to continue building its nuclear reactors, and management’s revised capital cost forecast and delivery schedule was deemed to be reasonable.

A bullet was dodged, and investors believed the worst was likely behind the company. That’s why anxiety resurfaced earlier this month when Southern Company announced the estimated costs to complete the Vogtle project increased once again by over $2 billion to reach $27.5 billion.

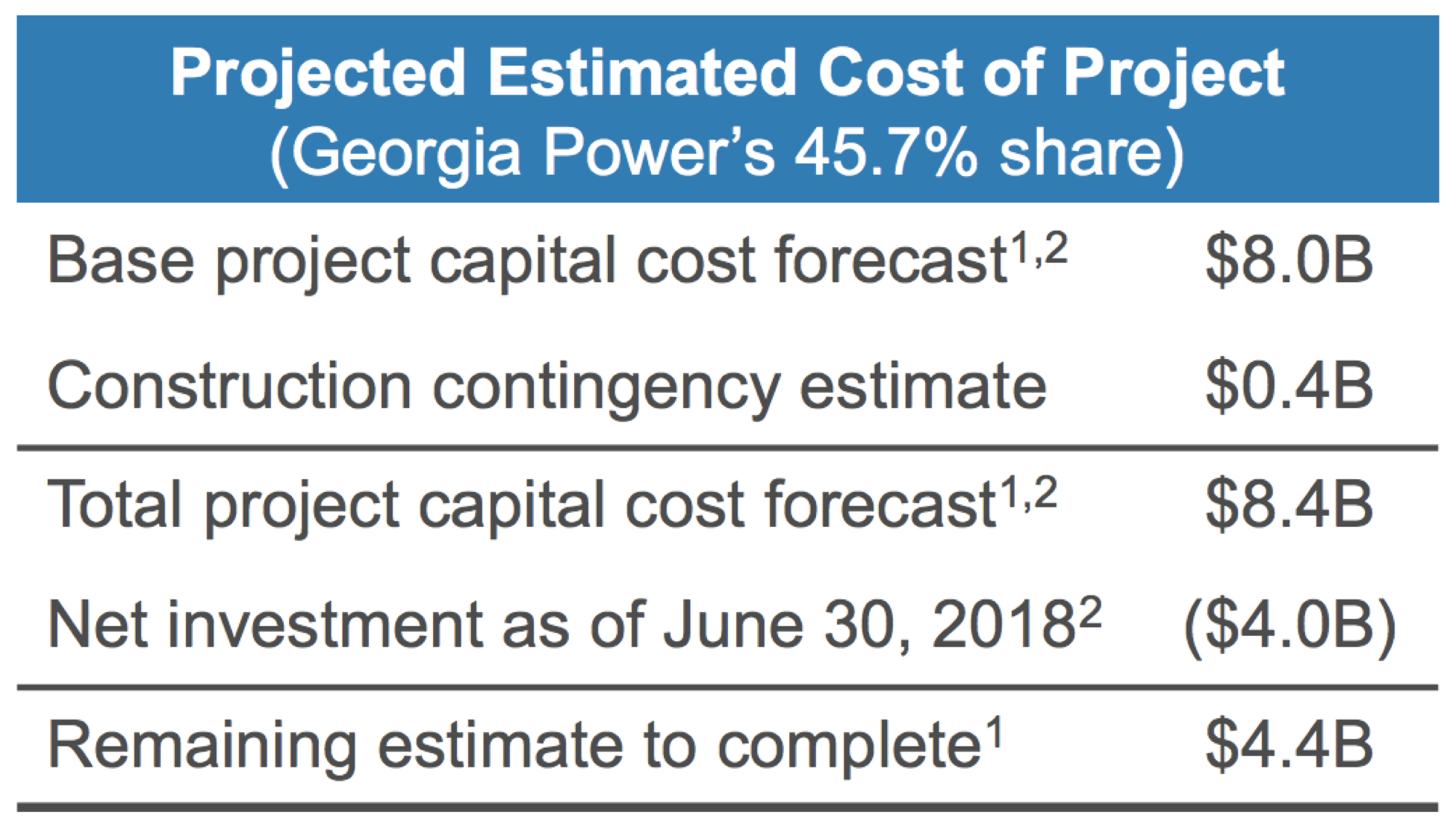

Southern Company has a 45.7% stake in the project, so its estimated costs rose by $1.1 billion to $8.4 billion. Its other partners who will share the increased cost are Oglethorpe Power (30%), Municipal Electric Authority of Georgia, or MEAG (22.7%), and Dalton (1.6%).

Given the sensitivity of this project with Georgia’s regulators, who have thus far been very reasonable with accepting news of delays and cost overruns, Southern Company decided not to seek recovery of these incremental costs from ratepayers to keep the relationship on solid ground.

Instead, shareholders will absorb $700 million of the higher costs (the remaining $400 million is a contingency which the firm could try to recover if it gets used).

Fortunately, Southern Company has the financial strength to stomach this hit. The company plans to issue an incremental $800 million of equity this year and reaffirmed its long-term guidance calling for 4% to 6% annual EPS growth. Management also reaffirmed the Vogtle project’s expected in-service dates.

But here’s the rub. While Southern Company wants to proceed with the project, the increased cost estimate triggered a clause in its agreement with the other partners that they all must vote on whether to continue the project.

At least 90% of votes must be in favor of the project continuing or it technically gets canceled.

Southern Company’s “yes” vote gets the total halfway there. Oglethorpe Power which has a 30% ownership stake in the project has stated that its budget can cover the majority of its share of the recently announced cost increases, suggesting the firm is also in favor of continuing.

However, Southern Company and Oglethorpe Power need MEAG and its 22.7% ownership stake to agree with them to hit the 90% threshold to continue.

Unfortunately, MEAG is under the most pressure to discontinue its participation in the Vogtle project.

In 2008 a utility JEA signed a 20-year power purchase agreement with MEAG in which it shares some of the capital and operating costs of the Vogtle project.

Not surprisingly, JEA is furious about the latest cost overruns. JEA’s management wanted the project canceled last year and is threatening MEAG with legal action if it votes to proceed with construction on the two nuclear units.

JEA’s consultants believe the utility’s customers could save between $345 million and $727 million if the Vogtle project is canceled.

Market conditions and the nuclear project’s economics have obviously changed quite significantly since the initial agreement was signed with MEAG, so some of the firm’s beef about the agreement it signed is understandable.

You can read the scathing letter JEA’s CEO sent to MEAG on August 17 here.

The partners’ vote on whether to continue the Vogtle project is expected to take place in late September.

So what happens if MEAG is unable to move forward with the Vogtle project, technically canceling the massive undertaking partway through after billions of dollars have already been spent?

Can Southern Company’s Dividend Survive a Worst-Case Outcome?

Before getting into the numbers, it’s worth noting that this scenario seems unlikely to play out.

With that said, if MEAG ultimately pulls out of the Vogtle project, preventing it from achieving the 90% of votes needed to continue construction, work on the nuclear units will technically be canceled.

In that event, Southern Company and its remaining partners could presumably negotiate with each other to take on MEAG’s stake and continue the project, with approval from the Georgia Public Service Commission. However, it’s not totally clear how this scenario would play out.

Here is what Southern Company’s CEO Tom Flanning said during the company’s earnings call:

“So the technical answer there is that the project would be deemed to be cancelled I believe. And then of course, you could take a variety of different paths beyond that. But the technical answer is, if you don't get the 90% vote the project is cancelled. Then you have to figure out how or whether to proceed beyond that. There is no prescription per se beyond that action. Of course, we could all negotiate whatever but that would also require Public Service Commission approval and a variety of other things.”

MEAG’s 22.7% ownership stake implies the firm is on the hook for about $6.2 billion of Vogtle’s total costs ($27.5 billion). With the project roughly halfway finished, MEAG’s remaining obligations are likely around $3.1 billion which would presumably need to be absorbed by Southern Company and its other two partners if MEAG pulled out and work was ultimately continued.

However, the worst-case scenario would seem to be that the Vogtle project is completely abandoned, raising the question of whether shareholders or ratepayers should cover the billions of dollars already spent.

Earlier this year SCANA (SCG) provided an example of just how dangerous this game can be. The utility was the primary own of a multibillion-dollar nuclear project in South Carolina that was ultimately canceled due to growing construction costs and delays.

SCANA wanted ratepayers to cover its construction expenses of $4.7 billion and had increased rates by 18% since 2007, per The Wall Street Journal. However, South Carolina officials decided to slash the utility’s rates by 15%, stopping most of SCANA’s charges for its failed nuclear project.

As a result, SCANA cut its dividend (by 80%) for the first time in close to 20 years to preserve cash as it tried seeking a resolution with regulators to recover costs for its failed nuclear construction project.

Like SCANA, Southern Company has already incurred some very large construction expenditures.

As you can see, the utility’s net investment through the second quarter of 2018 totaled $4 billion, and the Voglte project is only about halfway finished. Canceling the project now would certainly be painful.

Who would be left on the hook for the $4 billion of expenditures Southern Company has incurred? Not to mention any cleanup costs.

Well, it would appear that at least half of the cost would be recoverable under the current law. Based on its 45.7% ownership stake Southern Company’s share of the project’s total cost was $7.3 billion prior to the recent $1.1 billion increase.

Since shareholders will absorb that future increase, reimbursement is not an issue there. Looking at the remaining $7.3 billion of estimated costs that could be recovered, CEO Tom Fanning commented that $4 billion have been found prudent (and thus are recoverable by law) and another $1.7 billion are presumed to be prudent:

“We have law in place that basically says any prudently incurred cost is recoverable. And recall there are at least three segments of costs that have been ruled on over time up to – I hope I get these numbers right… up to about $4 billion have been found prudent, up to about $5.7 billion or so have been presumed to be prudent. And then up to the $7.3 billion, they are deemed to be reasonable, but the burden is still on us to prove prudence.”

In other words, about 55% of the $7.3 billion budget is recoverable ($4 billion / $7.3 billion), and 81% ($5.7 billion / $7.3 billion) is likely recoverable.

So of the $4 billion net investment Southern Company has already made, it’s hard to imagine the company’s shareholders being forced to shoulder more than $2 billion of the cost, assuming an equal proportion of recoverable costs have been incurred thus far.

Yes, public backlash would be strong if the Vogtle project is discontinued. However, Georgia regulation has historically been very constructive (especially towards nuclear power), and the Georgia Public Service Commission granted unanimous approval to continue the Vogtle project in December 2017. Changing direction so significantly to create a SCANA-like situation seems unlikely.

Furthermore, Georgia ratepayers have not felt as big of a pinch as South Carolinians experienced with SCANA. The projected peak rate impact to Southern Company’s Georgia retail customers is 10% (compared to an 18% increase from SCANA), with 5% related to the project already in rates as of December 2017.

In other words, there doesn’t seem to be as much of a pressing need by lawmakers to substantially reduce rates in a worst-case legal outcome like we saw with SCANA, reducing some of the financial blowback Southern Company could face.

Regardless, does Southern Company’s dividend have the ability to survive if the company needs to acquire MEAG’s ownership stake in the project or eat most of the cost it has already incurred if the project is canceled?

Either scenario is likely to require at least a couple billion dollars of spending.

Unlike SCANA, Southern Company’s business is much larger and more diversified. SCANA’s incurred construction expenses exceeded its annual revenue and were over four times larger than its annual cash flow from operations.

While several billion dollars is no small chunk of change, you can see that Southern Company’s business is much better positioned to handle this level of unrecoverable cost overruns.

SCANA:

- $4.4 billion in 2017 revenue

- 1.7 million customers

- $1.1 billion average annual cash flow from operations the last three years

- $350 million annual dividends (prior to the 80% cut)

Southern Company:

- $22.2 billion in 2017 revenue

- 9 million customers

- $5.9 billion average annual cash flow from operations the last three years

- $2.4 billion annual dividends

With that said, Southern Company’s dividend ($2.4 billion per year) is a fairly big weight on the firm’s cash flow. With the utility’s payout ratio expected to sit near 87% next year (excluding construction charges related to Kemper and Vogtle, plus other one-time items), not much money is retained after paying dividends.

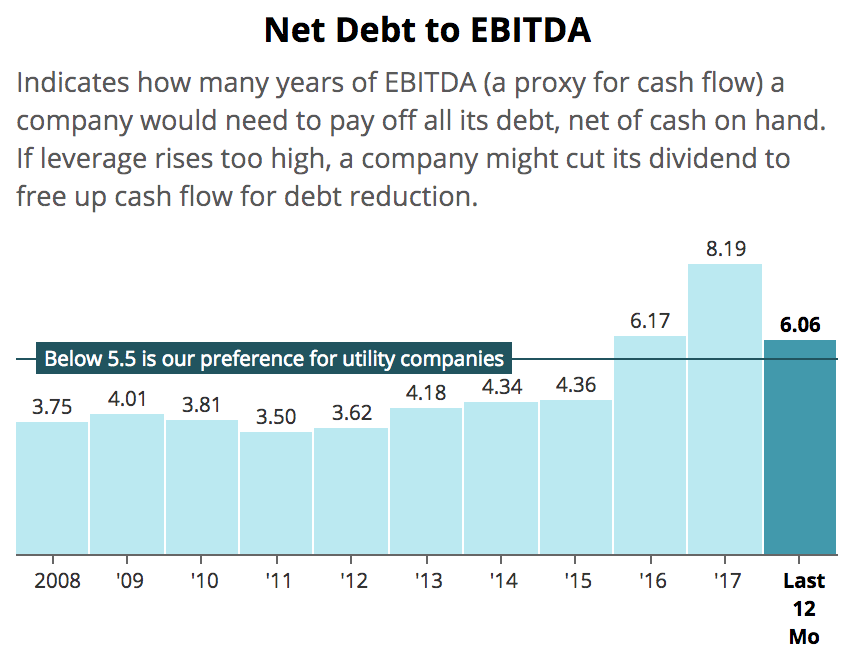

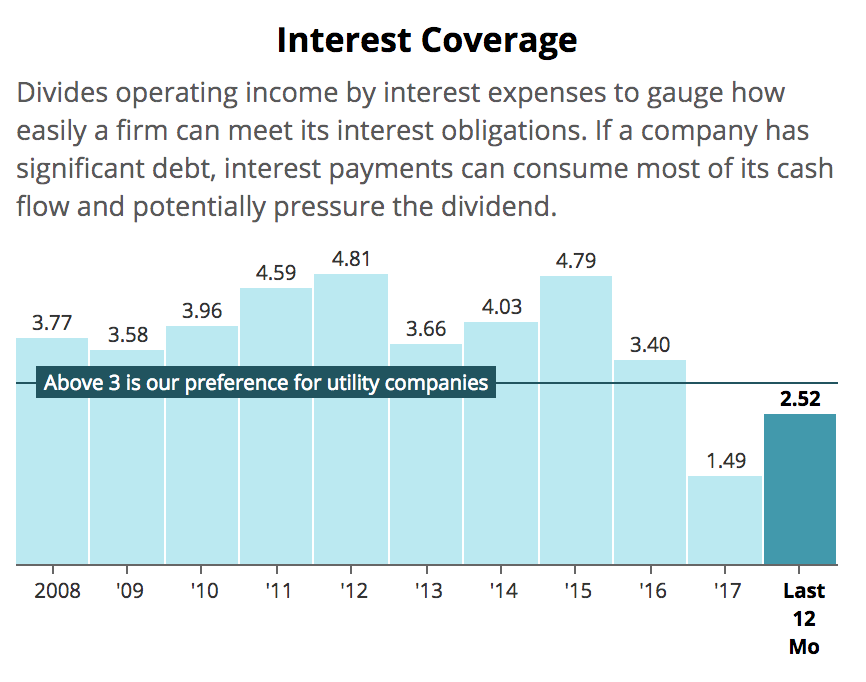

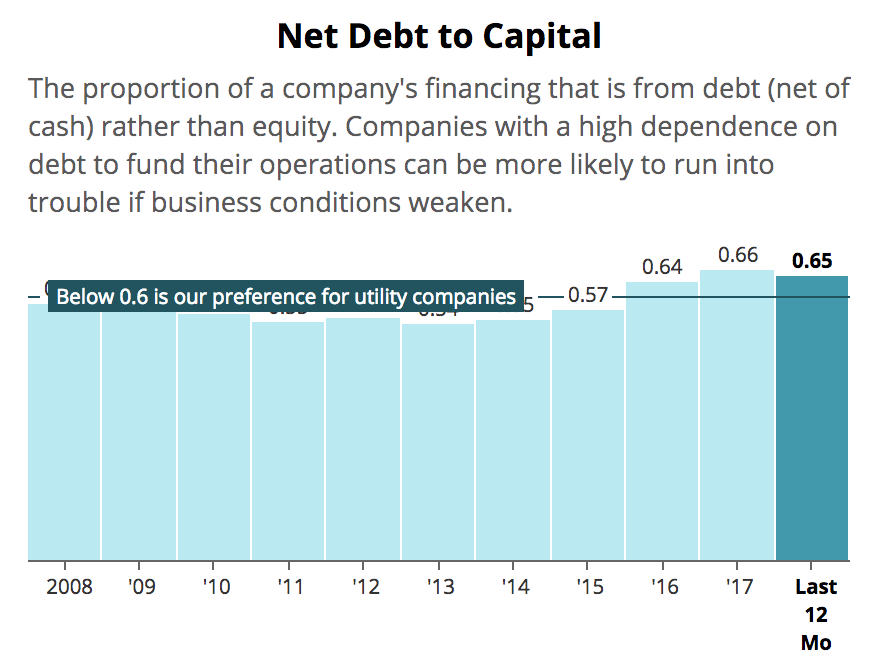

Southern Company’s debt metrics have also deteriorated in recent years following its 2016 acquisition of AGL Resources for $12 billion, construction cost overruns, and tax reform (savings passed through to customers).

The firm does not have as much financial flexibility as we would like to see, but at the end of the day, Southern Company’s dividend seems likely to remain safe.

The company’s scale, long-term track record, diversified operations, and attractive regulated cash flow should continue providing management with affordable access to debt and equity markets to support capital expenditures and the dividend.

When combined with Southern Company's ability to raise cash through selective asset divestitures and regulators' desire to keep the firm's cost of capital reasonable enough to ensure reliable and affordable service, the magnitude of unrecoverable cost overruns in discussion seems unlikely to threaten this dynamic.

And again, right now this is all a theoretical, worst-case scenario discussion. We should know a lot more about the reality management is facing by October.

When combined with Southern Company's ability to raise cash through selective asset divestitures and regulators' desire to keep the firm's cost of capital reasonable enough to ensure reliable and affordable service, the magnitude of unrecoverable cost overruns in discussion seems unlikely to threaten this dynamic.

And again, right now this is all a theoretical, worst-case scenario discussion. We should know a lot more about the reality management is facing by October.

Either way, income investors need to be prepared for Southern Company’s dividend to grow at a slower pace than earnings over the next several years. And if the Vogtle project continues but experiences additional setbacks (cost overruns, delays), then Southern Company's financial health and dividend safety would need to be reevaluated.

For now, Southern Company shareholders should make sure they feel comfortable with the size of their position as the vote on Vogtle approaches. The stock could be unusually volatile depending on the outcome.

For now, Southern Company shareholders should make sure they feel comfortable with the size of their position as the vote on Vogtle approaches. The stock could be unusually volatile depending on the outcome.