Assessing Walmart's Appeal as a Dividend Growth Stock After Earnings Beat

Shares of Walmart (WMT) surged 10% following the release of the company’s second-quarter earnings report.

The big headline is that Walmart’s sales growth was its best in more than a decade.

Specifically, Walmart reported 4.5% growth across its U.S. stores that have been open for at least a year, driven by strength in its grocery business.

The company's 2.2% customer traffic gain was also its strongest in more than six years, indicating that brick-and-mortar retail continues to have a pull even in the age of Amazon.

The company's 2.2% customer traffic gain was also its strongest in more than six years, indicating that brick-and-mortar retail continues to have a pull even in the age of Amazon.

Importantly, e-commerce sales increased 40%, in line with management’s expectations and up from 33% growth reported in the first quarter.

Simply put, Walmart’s top line growth gave investors increased hope that the company is competing more effectively with Amazon and other rivals in our increasingly digital shopping world.

With that said, I remain cautious on Walmart’s long-term outlook for profitable growth and don’t view this quarter as a fundamental turning point.

For one thing, the overall consumer spending environment is very strong. Fueled by tax cuts and a strong labor market, U.S. retail sales are up 5.5% through the first seven months of 2018, including 6.4% year-over-year growth in July.

A rising tide lifts most boats, and Walmart has certainly been a beneficiary of this development.

From a dividend growth perspective, I believe Walmart continues to look underwhelming. Despite rising sales, Walmart continues experiencing a contraction in margins (gross margin is down 30 basis points versus prior year), profits (operating income fell 3.7%), and free cash flow (down 1.8% year-to-date versus prior year).

Walmart’s sales growth is requiring meaningful price cuts and investments in its e-commerce operations. While these actions are necessary to help the firm’s long-term competitiveness, they continue weighing on Walmart's ability to meaningfully grow its dividend.

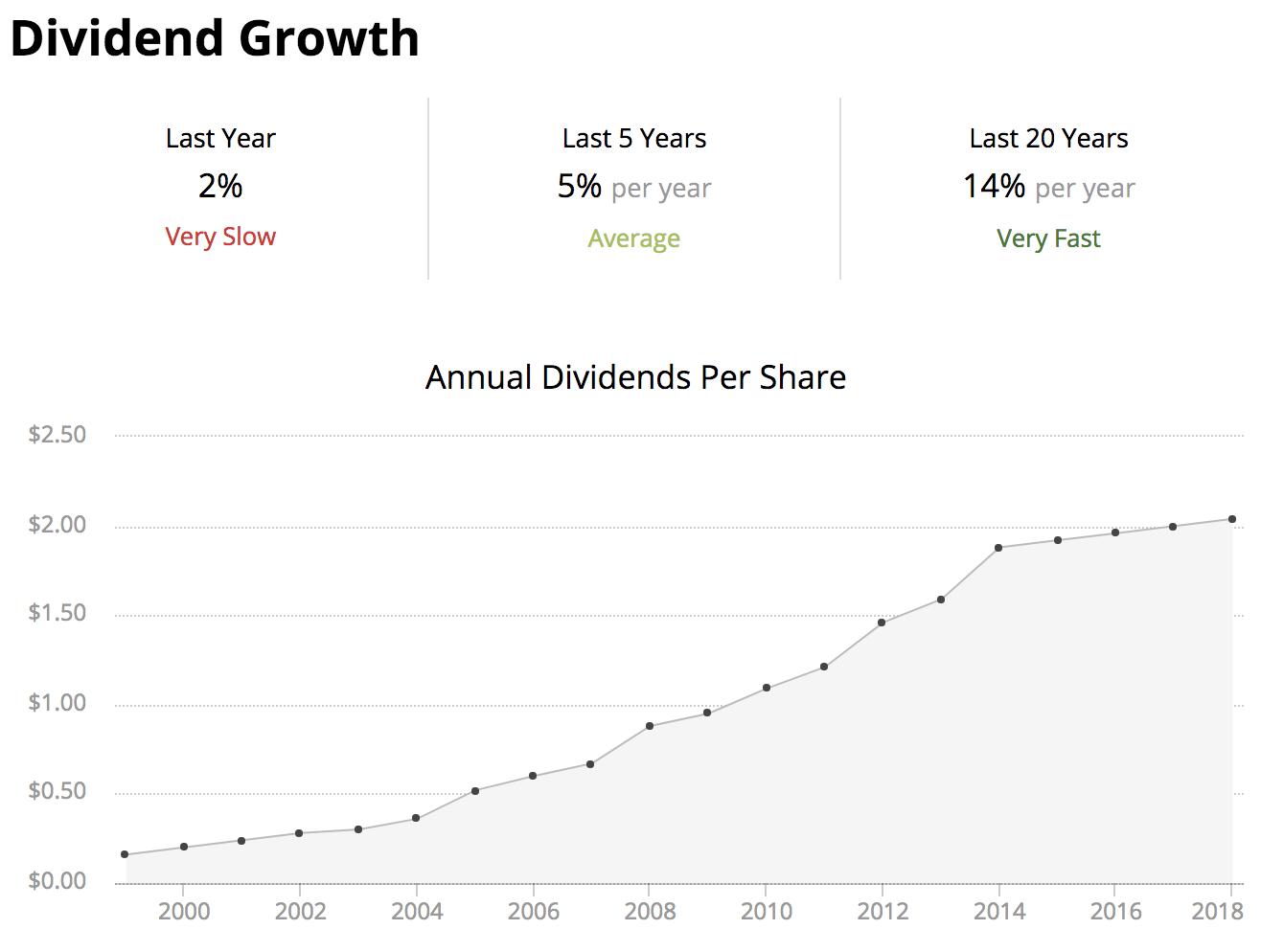

As you can see, Walmart’s dividend growth rate has decelerated from 14% per year over the last two decades to just 2% last year.

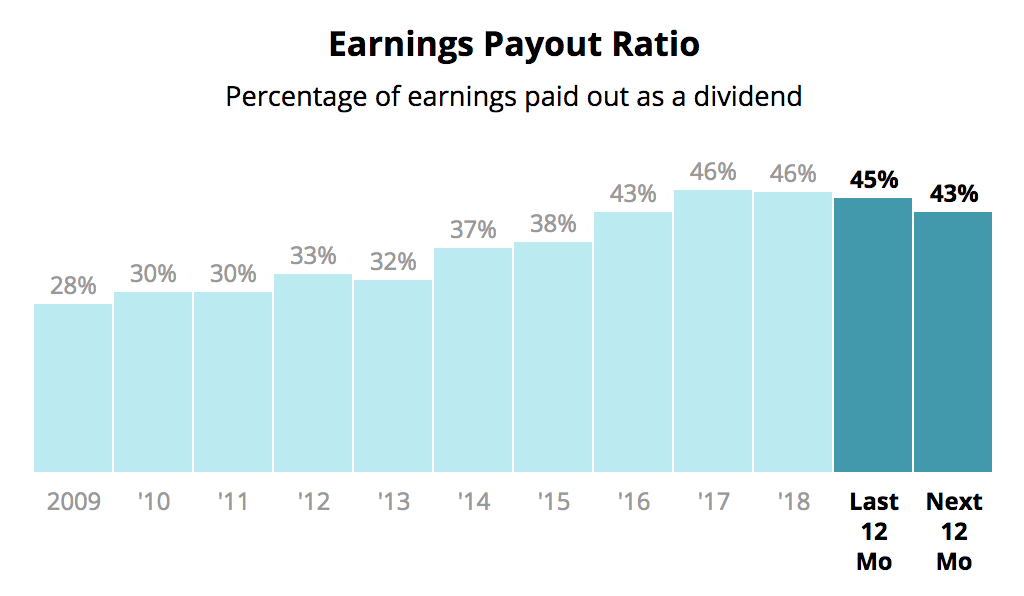

The firm’s payout ratio is expected to hover above 40% over the next year, which is about in line with its five-year average. It seems unlikely that management is willing or able to push the payout ratio much higher given the firm’s investment needs, so the pace of dividend growth is likely to remain slow.

That’s especially true given Walmart’s planned $16 billion acquisition of a 77% stake in Flipkart, the biggest e-commerce company in India.

Not only will Walmart need to take on significant debt to fund this deal, but Flipkart is very unprofitable as well; the company lost over $1 billion in fiscal year 2017 and is expected to continue burning through cash in the pursuit of sales growth.

Overall, Walmart’s relatively high payout ratio compared to its history, increasing debt load, and ramping e-commerce investments all put a damper on the firm’s short to medium-term profitability and dividend growth prospects.

For a stock yielding close to 2%, Walmart does not offer a very appealing combination of current income and long-term growth for most dividend investors.

Sure, the company is still a cash cow, has defensive qualities, and pays a safe dividend. However, if I owned shares of Walmart, I would feel more tempted to move on to other dividend growth ideas after today’s relief rally in the stock price.

With a forward P/E multiple of 20, shares of Walmart aren’t exactly looking cheap for a business that seems unlikely to grow its earnings by more than a low single-digit pace over time.

In my opinion, the brick-and-mortar giant remains a "show me" story as it works to profitably adapt to today's e-commerce world. One quarter does not make a trend, particularly as profit margins continue compressing and the broader retail environment is very healthy (perhaps more luck than skill).

In my opinion, the brick-and-mortar giant remains a "show me" story as it works to profitably adapt to today's e-commerce world. One quarter does not make a trend, particularly as profit margins continue compressing and the broader retail environment is very healthy (perhaps more luck than skill).