Target: Paying Higher Dividends for 46 Consecutive Years

Target (TGT) opened its first discount store in 1962 and is now one of America's largest retailers with annual sales of $70 billion and more than 1,800 stores across the U.S.

Target’s stores focus on convenient one-stop shopping and competitive discount prices, offering a broad range of products including beauty & household essentials (24% of sales), food & beverage (20%), apparel & accessories (20%), home furnishings & decor (19%), and hardlines (furniture, appliances, etc. — 17% of sales).

Target’s stores focus on convenient one-stop shopping and competitive discount prices, offering a broad range of products including beauty & household essentials (24% of sales), food & beverage (20%), apparel & accessories (20%), home furnishings & decor (19%), and hardlines (furniture, appliances, etc. — 17% of sales).

The company has increased its dividend for 46 consecutive years, making Target a dividend aristocrat and setting it up to be crowned a dividend king in 2022.

Business Analysis

Target has succeeded in retail by offering a wide selection of quality merchandise at affordable prices. Customers also enjoy a convenient and predictable shopping experience thanks to the company's nationwide reach of stores and well-known brand.

As one of the largest retailers in the country, Target can negotiate favorable contracts with suppliers to keep prices low. Smaller rivals are unable to match Target’s pricing, merchandise quality, and breadth of inventory. Consumers are price conscious and have few reasons to shop at more expensive retailers offering similar merchandise.

Rivals and new entrants also have to compete with the massive distribution network and supply chain that Target has built over the years. The company has long-lasting relationships with suppliers that often span decades and has invested heavily in logistics to keep its shelves stocked in a timely manner with relevant products.

Rivals and new entrants also have to compete with the massive distribution network and supply chain that Target has built over the years. The company has long-lasting relationships with suppliers that often span decades and has invested heavily in logistics to keep its shelves stocked in a timely manner with relevant products.

Simply put, Target is not going away anytime soon. Its stores are in good condition, it sells needed merchandise across nearly every product category imaginable, and the company is investing to stay relevant in e-commerce.

Nevertheless, retail is a highly competitive industry that's undergoing a major transformation, and Target is hardly immune to the changes taking place.

In 2017 management outlined a three-year, $7 billion plan to make Target more competitive in the wake of e-commerce. The most important part of management's strategy is its "omnichannel" initiatives that integrate online and in-store shopping to maximize convenience and keep shoppers from choosing Amazon or Walmart.

For example, by utilizing its 1,800 locations as pickup centers, Target is able to offer same-day fulfillment on many orders placed online. The company has also partnered with Shipt to offer home delivery on thousands of grocery and other items. In a few clicks, busy people can have way they need without spending time in the checkout line.

At the same time, Target is continuing to invest it its in-store shopping experience by remodeling over 1,200 of its stores. Between 2015 and 2018, the firm's spending on store improvements nearly tripled from $550 million to over $1.6 billion. These projects create a more modern, upscale look at stores that drives incremental traffic and sales growth.

Essentially, Target has shifted from a strategy based on expanding its store count quickly to one that seeks to maximize same-store sales growth created by a more efficient and premium shopping experience both online and in its brick-and-mortar locations.

All said, Target has been around for more than a century and has proven itself highly adaptable to changing consumer tastes and industry challenges. The company's most recent investments have shown promise in restoring Target to sustainable growth.

However, while management is busy making moves to stay relevant, there are big challenges ahead for Target in the increasingly competitive world of retail.

Key Risks

Arguably the greatest risk facing Target is whether the company can generate sustainable earnings growth over the long term.

Traditionally, retailers have grown by opening new stores and increasing sales at existing stores. But in the age of Amazon, it's hard to argue that America needs more big-box retailers, especially as suburbs are already filled with Walmarts, Targets, and the like.

It's no surprise then that Target is opening fewer stores than ever before. And those that Target is opening are smaller urban stores with less revenue potential.

In other words, Target's growth going forward will need to be driven by an increase in sales at existing locations, which management says will be led by its omnichannel investments integrating online and in-store shopping.

However, at this point, Target's investments into e-commerce are simply table stakes to compete in a world where Amazon can deliver millions of items in as short as an hour. Target is merely doing what all retailers must do to survive, so it's hard to say whether these investments will ultimately earn a satisfactory return.

Moreover, due to the high costs of building distribution centers and the ease of comparing prices online, internet retail is a notoriously low-margin business made profitable only through sheer volume. Yet Target is far from a market leader with just $5 billion in online sales, well behind Amazon ($60 billion) and Walmart ($20 billion).

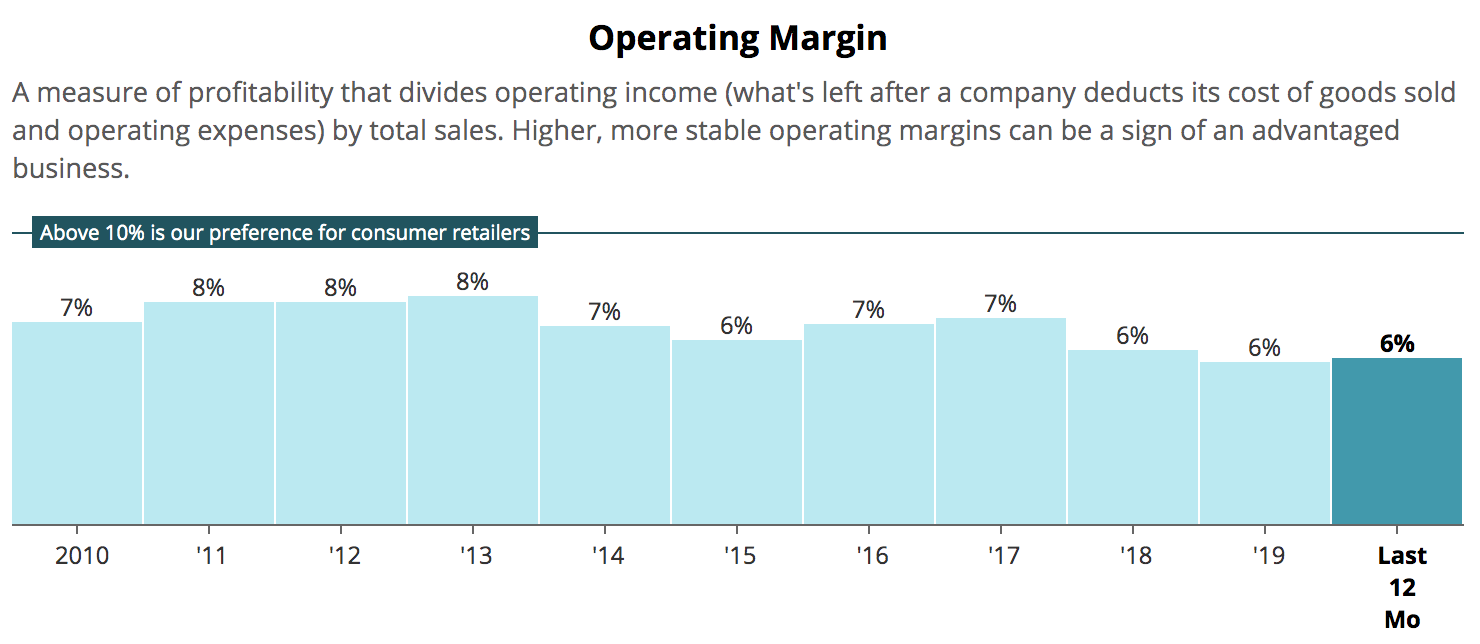

In fact, Target's operating margin, which measures how much profit the company earns for each dollar of sales, has taken a hit since the company began investing in digital:

It's also worth mentioning that Target's sales are somewhat cyclical. While Target stores do sell grocery items that are mostly non-discretionary in nature, groceries make up only 20% of sales. Walmart, for comparison, generates more than half of sales from groceries.

As a result, Target's sales slid 5.5% during the last recession, while Walmart same-store sales actually grew 1.6% and 2.5% in 2008 and 2009, respectively.

The bottom line is that Target's earnings, and therefore its dividend, are likely to grow more slowly than in the past. While Target has historically grown its dividend more than 10% per year on average, management's most recent dividend hike came in at just 3%, reflecting the company's slower growth prospects and need to invest heavily.

While Target has an excellent track record of adapting over the course of its long history, the company has a lot to prove going forward as profitable growth potentially becomes more difficult to achieve.

Closing Thoughts on Target

Target has paid uninterrupted dividends every year since it went public in late 1967, and the company's impressive dividend growth streak seems unlikely to end anytime soon.

With that said, consumer retail is one of the most challenging industries to do well in. Low margins, fierce competition, and periodic technological disruption mean that investors need to be very selective in this space. There is a reason why we have chosen to avoid investing in almost all of the retail sector – the rapidly-changing consumer landscape is just too hard to get in front of.

Target's online sales-focused turnaround plan is certainly showing some traction. However, it will keep some pressure on short-term dividend growth as the company invests more cash flow back into these initiatives.

More importantly, it will likely take years to assess whether or not management's actions will help Target find sustainable earnings growth in a saturated retail market, especially as it battles against e-commerce giants that benefit from lower operating costs and even larger economies of scale.

Mass merchandise stores seem likely to always be relevant for many people, but it’s hard to imagine that their slow bleeding and struggle to find sustainable sources of profitable growth will cease any time soon.

We prefer to invest in companies that seem likely to become larger and more profitable over the next 5 to 10 years. Despite its secure dividend and rich history, Target doesn't seem to fit that mold. Investors considering Target should maintain a high bar given these long-term uncertainties and the stock's decelerating dividend growth rate.