Federal Realty Maintains Dividend Despite Expected Cash Flow Deficit Through Mid-2022

Federal Realty on Thursday reported fourth-quarter earnings and maintained its dividend as rent collections continued improving.

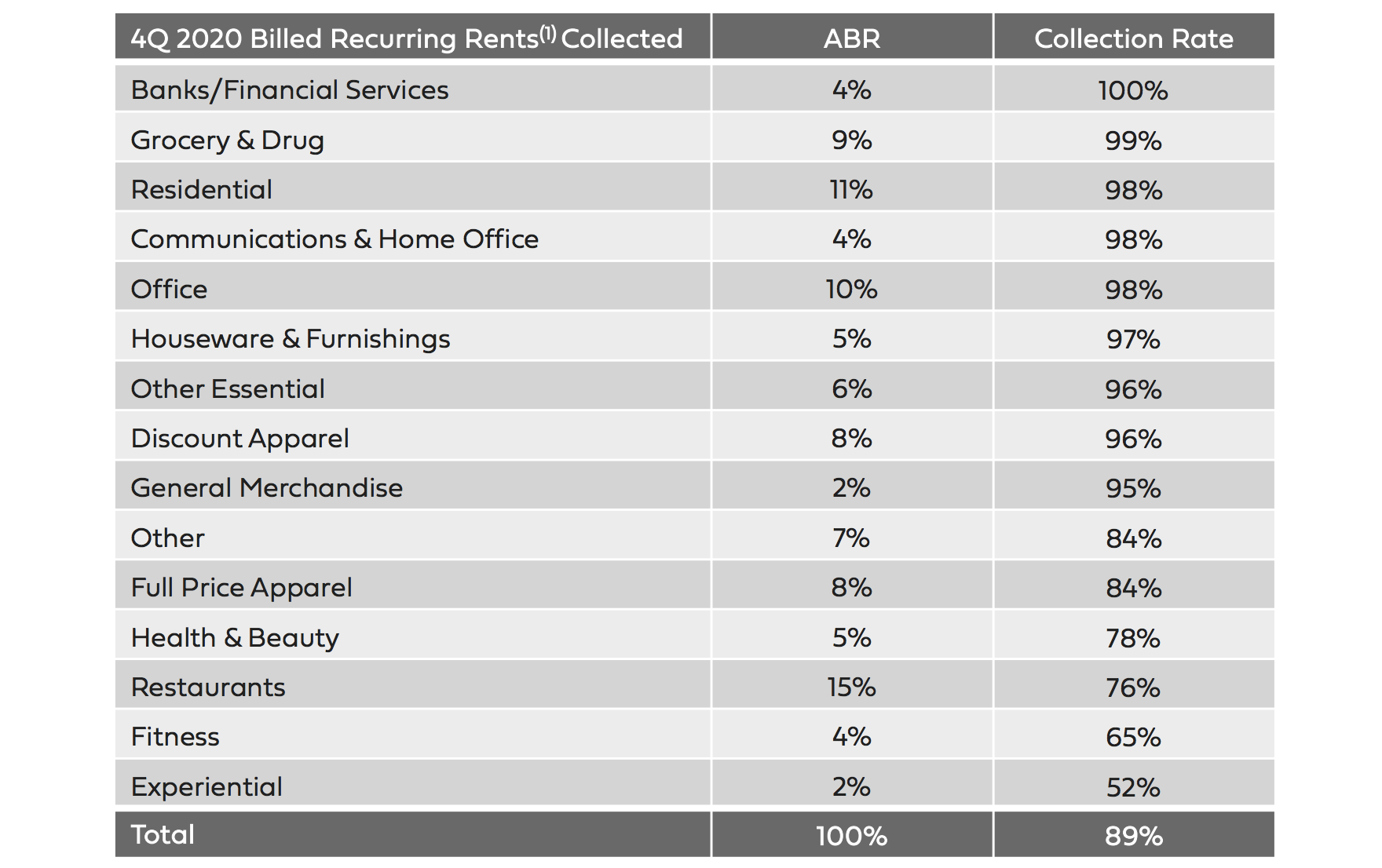

The shopping center REIT collected 89% of the rent it billed during the fourth quarter, up from 85% in the third quarter and 72% in the second quarter.

However, management expects 2021 to be another tough year. About 85% of Federal's property operating income comes from markets with some of the most restrictive government-imposed COVID laws in the country, including California, New York, and New Jersey.

This has continued to hurt non-essential retailers. As you can see, rent collection rates remain especially weak across restaurants (15% of Federal's rent), health and beauty firms (5%), gyms (4%), and experiential retailers (2%).

The shopping center REIT collected 89% of the rent it billed during the fourth quarter, up from 85% in the third quarter and 72% in the second quarter.

However, management expects 2021 to be another tough year. About 85% of Federal's property operating income comes from markets with some of the most restrictive government-imposed COVID laws in the country, including California, New York, and New Jersey.

This has continued to hurt non-essential retailers. As you can see, rent collection rates remain especially weak across restaurants (15% of Federal's rent), health and beauty firms (5%), gyms (4%), and experiential retailers (2%).

As more businesses go under or choose not to renew their leases, Federal expects continued pressure on its occupancy. Management believes occupancy over the next few quarters will dip into the upper 80s% at the trough, down from 90.1% today.

Lower rent collection rates and occupancy will keep weighing on Federal's cash flow per share, which fell nearly 30% last quarter and failed to cover the dividend after deducting maintenance expenses.

Based on management's comments during the earnings call, we estimate Federal's dividend could exceed adjusted funds from operations by around $20 million this year, resulting in a payout ratio between 105% and 110%.

But assuming the operating environment does not take another major step back, Federal appears content maintaining its dividend until conditions improve.

Management expects results to strengthen in 2022 as leasing activity improves, certain retail assets rebound, and Federal's $1.2 billion development pipeline begins contributing income.

As this plays out, Federal said it expects the dividend to return to being covered by cash flow by the second half of 2022 and beyond.

Until then, Federal has the financial flexibility to defend its payout. In addition to its A- credit rating and minimal debt maturities until 2023, the company has nearly $800 million of cash on hand and an untapped $1 billion credit facility.

These funds can be used to cover the REIT's estimated dividend deficit of around $20 million this year and the remaining $400 million of spending required by Federal's current development pipeline.

With "something of a war chest on hand," Federal could even pursue opportunistic property acquisitions over the next few years, according to management.

Overall, Federal's latest update should provide income investors with a little more confidence in the dividend, which has been raised every year since 1967.

But until the REIT's payout ratio improves, we expect to maintain Federal's Borderline Safe Dividend Safety Score.

We will continue monitoring the retail landscape as the year progresses and provide updates as necessary.

Lower rent collection rates and occupancy will keep weighing on Federal's cash flow per share, which fell nearly 30% last quarter and failed to cover the dividend after deducting maintenance expenses.

Based on management's comments during the earnings call, we estimate Federal's dividend could exceed adjusted funds from operations by around $20 million this year, resulting in a payout ratio between 105% and 110%.

But assuming the operating environment does not take another major step back, Federal appears content maintaining its dividend until conditions improve.

Management expects results to strengthen in 2022 as leasing activity improves, certain retail assets rebound, and Federal's $1.2 billion development pipeline begins contributing income.

As this plays out, Federal said it expects the dividend to return to being covered by cash flow by the second half of 2022 and beyond.

Until then, Federal has the financial flexibility to defend its payout. In addition to its A- credit rating and minimal debt maturities until 2023, the company has nearly $800 million of cash on hand and an untapped $1 billion credit facility.

These funds can be used to cover the REIT's estimated dividend deficit of around $20 million this year and the remaining $400 million of spending required by Federal's current development pipeline.

With "something of a war chest on hand," Federal could even pursue opportunistic property acquisitions over the next few years, according to management.

Overall, Federal's latest update should provide income investors with a little more confidence in the dividend, which has been raised every year since 1967.

But until the REIT's payout ratio improves, we expect to maintain Federal's Borderline Safe Dividend Safety Score.

We will continue monitoring the retail landscape as the year progresses and provide updates as necessary.