ET to Maintain Distribution Following Acquisition of Enable Midstream; Deleveraging on Track to Accelerate

Energy Transfer on Wednesday announced plans to acquire Enable Midstream in a $7 billion all-equity transaction.

This deal will increase Energy Transfer's units outstanding by about 14%, but management plans to maintain the firm's current $0.61 per unit distribution.

We estimate the combined company's distributable cash flow (DCF) payout ratio will remain practically unchanged from Energy Transfer's current projected level near 30%.

Similarly, our analysis suggests that Energy Transfer's net debt-to-forward adjusted EBITDA leverage ratio will remain near 4.9x, ticking down less than 0.1x compared to Energy Transfer's standalone metrics.

Management previously targeted a leverage range of 4.0x to 4.5x, so this acquisition does not immediately push Energy Transfer much closer to its goal.

However, the combined company will retain more DCF after paying distributions thanks to its larger scale and potential to realize some cost synergies.

We estimate Energy Transfer and Enable Midstream could retain more than $2.5 billion of DCF this year and as much as $3.5 billion annually in 2022 and 2023. These funds will be used to chip away at their combined net debt load of about $55 billion.

With cost synergies expected to nudge EBITDA higher as well, we believe Energy Transfer's leverage ratio could decline by 0.3x in the year ahead, somewhat faster than the firm's previous deleveraging pace of about 0.2x.

Recognizing that Energy Transfer's leverage concerns have likely peaked as both firms continue to moderate their growth spending and prioritize debt reduction, we are upgrading Energy Transfer's Dividend Safety Score to Borderline Safe.

Enable Midstream was formed in 2013 by its utility sponsors OGE Energy and CenterPoint Energy, which were interested in divesting the business to focus on their core regulated utility operations.

Enable will account for close to 10% of the combined company's EBITDA. The firm owns natural gas and crude oil infrastructure assets engaged in gathering, processing, transportation, and storage activities.

About 40% of Enable's gross margin is volume dependent and another 10% is from sales of commodities such as natural gas. The firm's results can be more volatile as a result, but Energy Transfer expects to maintain a predominantly fee-based cash flow profile (95% of EBITDA).

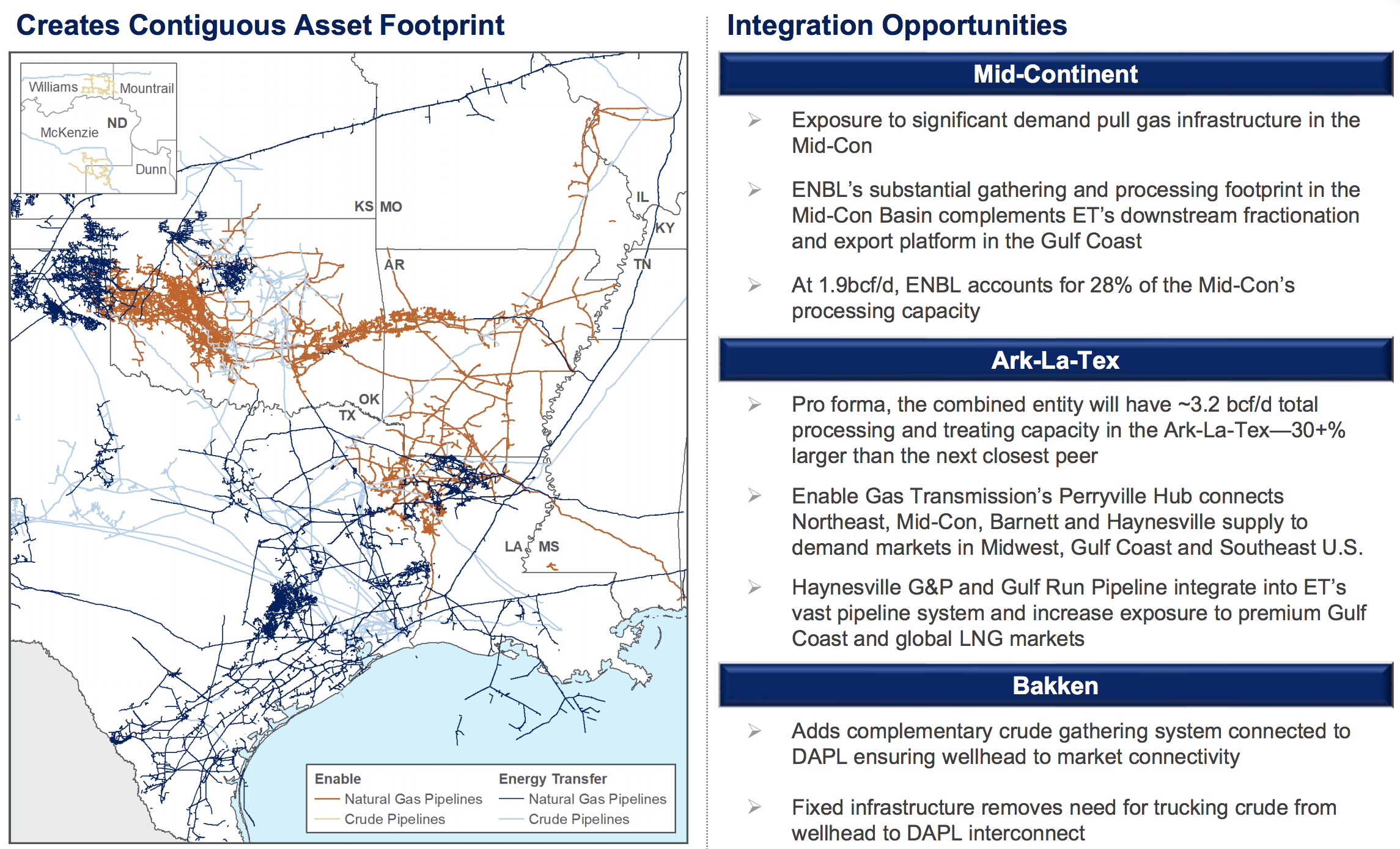

Enable didn't strike us as a very compelling midstream business given its lower mix of volume-protected contracts, but Energy Transfer touted various opportunities to integrate Enable's gathering and processing operations (orange lines below) with the firm's downstream assets along the U.S. Gulf Coast.

This deal will increase Energy Transfer's units outstanding by about 14%, but management plans to maintain the firm's current $0.61 per unit distribution.

We estimate the combined company's distributable cash flow (DCF) payout ratio will remain practically unchanged from Energy Transfer's current projected level near 30%.

Similarly, our analysis suggests that Energy Transfer's net debt-to-forward adjusted EBITDA leverage ratio will remain near 4.9x, ticking down less than 0.1x compared to Energy Transfer's standalone metrics.

Management previously targeted a leverage range of 4.0x to 4.5x, so this acquisition does not immediately push Energy Transfer much closer to its goal.

However, the combined company will retain more DCF after paying distributions thanks to its larger scale and potential to realize some cost synergies.

We estimate Energy Transfer and Enable Midstream could retain more than $2.5 billion of DCF this year and as much as $3.5 billion annually in 2022 and 2023. These funds will be used to chip away at their combined net debt load of about $55 billion.

With cost synergies expected to nudge EBITDA higher as well, we believe Energy Transfer's leverage ratio could decline by 0.3x in the year ahead, somewhat faster than the firm's previous deleveraging pace of about 0.2x.

Recognizing that Energy Transfer's leverage concerns have likely peaked as both firms continue to moderate their growth spending and prioritize debt reduction, we are upgrading Energy Transfer's Dividend Safety Score to Borderline Safe.

Enable Midstream was formed in 2013 by its utility sponsors OGE Energy and CenterPoint Energy, which were interested in divesting the business to focus on their core regulated utility operations.

Enable will account for close to 10% of the combined company's EBITDA. The firm owns natural gas and crude oil infrastructure assets engaged in gathering, processing, transportation, and storage activities.

About 40% of Enable's gross margin is volume dependent and another 10% is from sales of commodities such as natural gas. The firm's results can be more volatile as a result, but Energy Transfer expects to maintain a predominantly fee-based cash flow profile (95% of EBITDA).

Enable didn't strike us as a very compelling midstream business given its lower mix of volume-protected contracts, but Energy Transfer touted various opportunities to integrate Enable's gathering and processing operations (orange lines below) with the firm's downstream assets along the U.S. Gulf Coast.

Overall, acquiring Enable Midstream provides Energy Transfer with some slight benefits related to diversification, retained cash flow, and deleveraging potential.

The firm's move to a self-funded business model this year will not be affected by the addition of Enable, which was already covering its distribution and expansion capital program with DCF.

The distribution appears better supported as deleveraging efforts ramp in 2021, but income investors should not expect much, if any, distribution growth until Energy Transfer reaches its target leverage level within the next two years.

Looking further out, the company's fortunes will remain tied to a sustained recovery in energy prices and domestic oil and gas production. This would help ease some of today's concerns about excess midstream infrastructure capacity.

As we concluded in our October note, conservative income investors who wish to maintain exposure to the midstream space may want to consider Enterprise Products Partners, which runs its business more conservatively, has a stronger balance sheet, would also benefit from an energy recovery, and sports a similar yield near 8%.

The firm's move to a self-funded business model this year will not be affected by the addition of Enable, which was already covering its distribution and expansion capital program with DCF.

The distribution appears better supported as deleveraging efforts ramp in 2021, but income investors should not expect much, if any, distribution growth until Energy Transfer reaches its target leverage level within the next two years.

Looking further out, the company's fortunes will remain tied to a sustained recovery in energy prices and domestic oil and gas production. This would help ease some of today's concerns about excess midstream infrastructure capacity.

As we concluded in our October note, conservative income investors who wish to maintain exposure to the midstream space may want to consider Enterprise Products Partners, which runs its business more conservatively, has a stronger balance sheet, would also benefit from an energy recovery, and sports a similar yield near 8%.