Sysco's Dividend Likely to Remain Safe But Frozen Until at Least Late 2021 as Restaurant Volumes Recover

Sysco remains challenged by the pandemic as restaurants (more than 60% of revenue), schools, hotels, and other foodservice customers continue operating at relatively low capacity levels.

The food distributor's revenue has gradually recovered following a 60% decline in late March last year, but sales were still off 23% last quarter.

While the operating environment will remain difficult for the next quarter or two, the vaccine rollout is expected to significantly ease restaurant restrictions.

This should deliver an immediate pop for Sysco's business as existing customers order more food and supplies. The company has already seen this play out in states such as Florida and Texas where dine-in restrictions are already limited.

Management is particularly optimistic about Sysco's rebound prospects in light of the firm's market share gains, which will become more evident as volumes recover.

Sysco won more new customers at the local level last quarter than at any point in time over the last five years. Since the crisis started, the firm has added $1.5 billion of net new contracted business, representing about 2.5% of its pre-pandemic revenue.

Sysco's scale and financial strength have helped it outmaneuver smaller rivals by allowing the company to waive order minimums, not cut back on delivery frequency, provide products needed for outdoor dining, and continue to invest in its inventory.

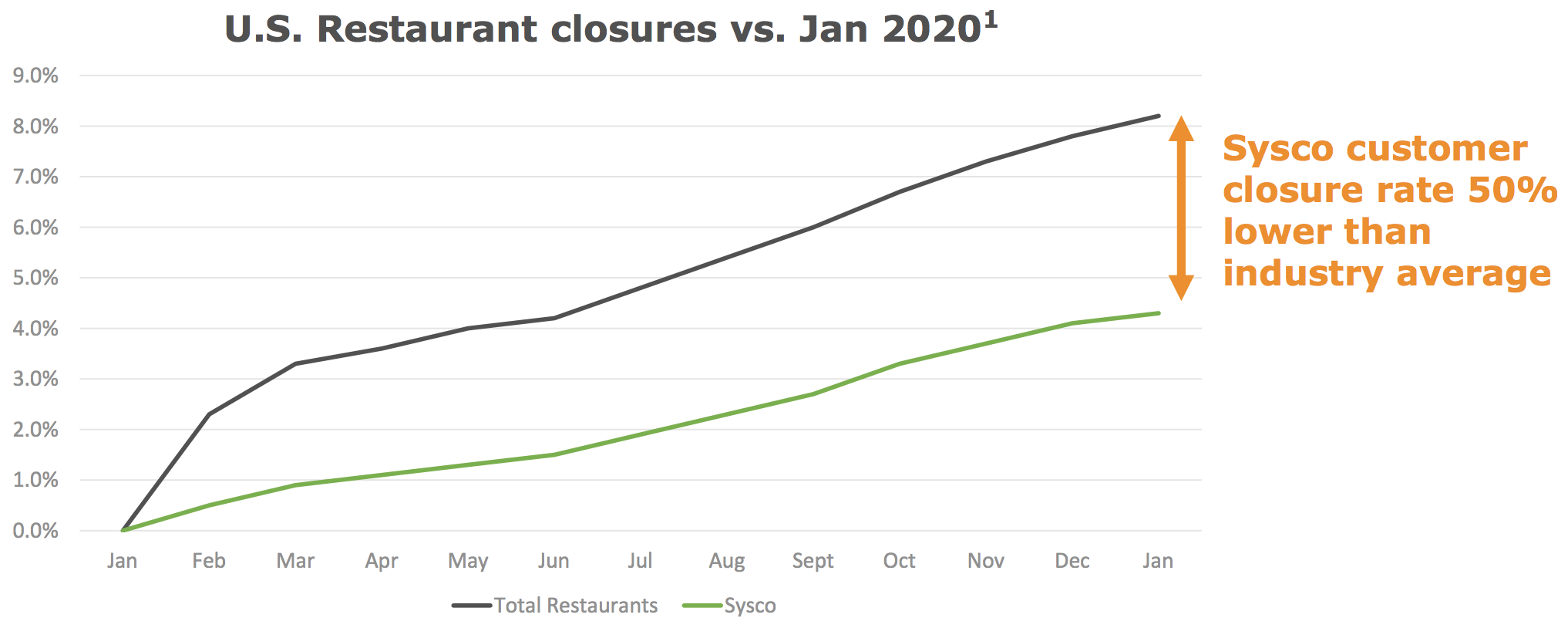

Perhaps aided in part by Sysco's efforts, its customers have experienced a much lower closure rate compared to the industry average.

The food distributor's revenue has gradually recovered following a 60% decline in late March last year, but sales were still off 23% last quarter.

While the operating environment will remain difficult for the next quarter or two, the vaccine rollout is expected to significantly ease restaurant restrictions.

This should deliver an immediate pop for Sysco's business as existing customers order more food and supplies. The company has already seen this play out in states such as Florida and Texas where dine-in restrictions are already limited.

Management is particularly optimistic about Sysco's rebound prospects in light of the firm's market share gains, which will become more evident as volumes recover.

Sysco won more new customers at the local level last quarter than at any point in time over the last five years. Since the crisis started, the firm has added $1.5 billion of net new contracted business, representing about 2.5% of its pre-pandemic revenue.

Sysco's scale and financial strength have helped it outmaneuver smaller rivals by allowing the company to waive order minimums, not cut back on delivery frequency, provide products needed for outdoor dining, and continue to invest in its inventory.

Perhaps aided in part by Sysco's efforts, its customers have experienced a much lower closure rate compared to the industry average.

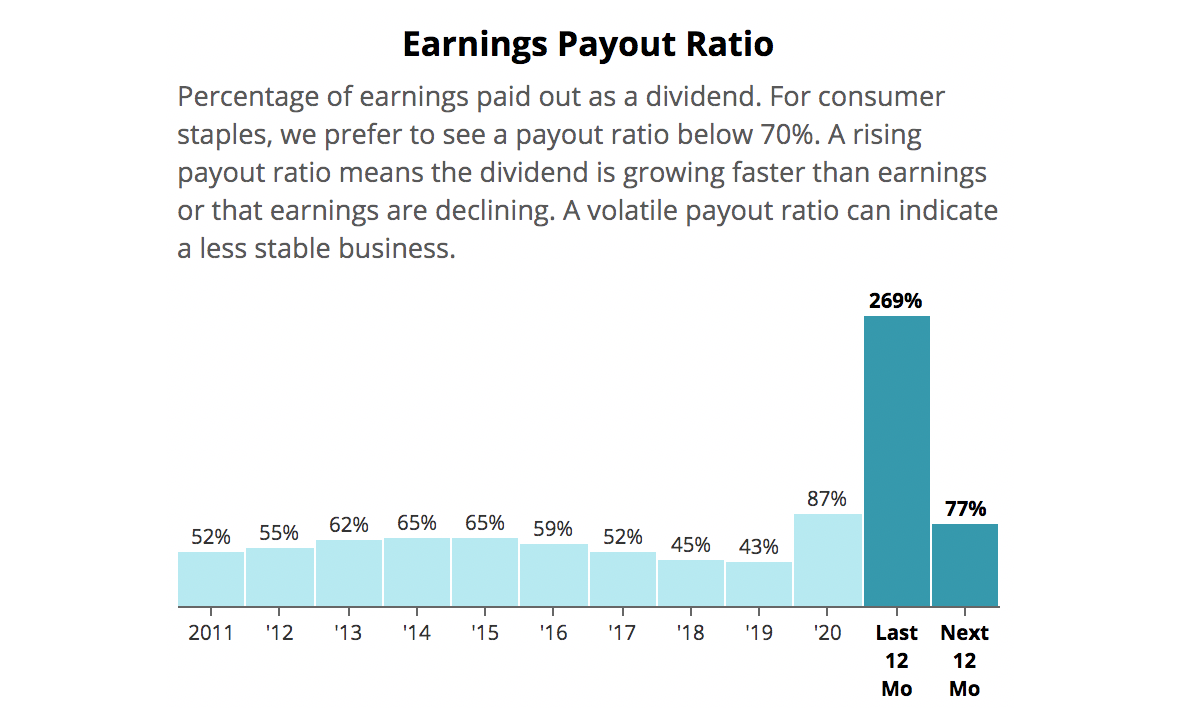

As Sysco's customers ramp their order volumes in the year ahead, analysts expect the firm's earnings to more than triple. This will allow profits to return to covering the dividend, albeit at a relatively high payout ratio compared to historical norms.

Meanwhile, Sysco's liquidity supports the company's plan to begin investing more in labor, warehouse capacity, and inventory as it prepares for stronger demand.

At quarter end, Sysco carried $5.8 billion of cash and had access to $2 billion of available borrowing capacity. For comparison, the firm had $2 billion of cash on hand at the onset of the pandemic.

Sysco is also better positioned to defend its BBB- credit rating, which sits one notch above junk.

Ratings firm S&P on February 10 revised Sysco's outlook from negative to stable, citing expectations that industry sales will recover close to pre-coronavirus levels.

Coupled with Sysco's share gains and efforts to cut costs, S&P believes that the firm will be able to reduce its leverage to a level that better supports its investment-grade rating.

With the worst likely behind Sysco and the company's financials set to strengthen, we are upgrading Sysco's Dividend Safety Score from Borderline Safe to Safe.

However, income investors shouldn't expect much, if any, dividend growth this year.

In May last year, Sysco was forced to amend its credit facility agreement to avoid breaching a financial covenant. This amendment fortunately allowed Sysco to continue paying its dividend, but it placed a restriction on dividend growth.

Specifically, Sysco's dividend must remain frozen until either the company's EBITDA-to-interest expense ratio falls below 4.0x or the covenant modification period ends on September 30, 2022.

We estimate Sysco's EBITDA-to-interest expense ratio was around 2.9x as of the most recent quarter. Based on analysts' EBITDA forecasts, we believe this metric could rise to about 5.0x over the next four quarters.

In other words, Sysco could have a chance to drop its amended covenant by the fourth quarter of this year rather than waiting until late 2022. This would allow the company to raise its dividend (by a token amount) and maintain its status as a dividend king.

Semantics aside, Sysco looks well positioned for an eventual recovery in restaurant demand. Assuming there are no major setbacks with the vaccine rollout, the worst is behind the company.

At quarter end, Sysco carried $5.8 billion of cash and had access to $2 billion of available borrowing capacity. For comparison, the firm had $2 billion of cash on hand at the onset of the pandemic.

Sysco is also better positioned to defend its BBB- credit rating, which sits one notch above junk.

Ratings firm S&P on February 10 revised Sysco's outlook from negative to stable, citing expectations that industry sales will recover close to pre-coronavirus levels.

Coupled with Sysco's share gains and efforts to cut costs, S&P believes that the firm will be able to reduce its leverage to a level that better supports its investment-grade rating.

With the worst likely behind Sysco and the company's financials set to strengthen, we are upgrading Sysco's Dividend Safety Score from Borderline Safe to Safe.

However, income investors shouldn't expect much, if any, dividend growth this year.

In May last year, Sysco was forced to amend its credit facility agreement to avoid breaching a financial covenant. This amendment fortunately allowed Sysco to continue paying its dividend, but it placed a restriction on dividend growth.

Specifically, Sysco's dividend must remain frozen until either the company's EBITDA-to-interest expense ratio falls below 4.0x or the covenant modification period ends on September 30, 2022.

We estimate Sysco's EBITDA-to-interest expense ratio was around 2.9x as of the most recent quarter. Based on analysts' EBITDA forecasts, we believe this metric could rise to about 5.0x over the next four quarters.

In other words, Sysco could have a chance to drop its amended covenant by the fourth quarter of this year rather than waiting until late 2022. This would allow the company to raise its dividend (by a token amount) and maintain its status as a dividend king.

Semantics aside, Sysco looks well positioned for an eventual recovery in restaurant demand. Assuming there are no major setbacks with the vaccine rollout, the worst is behind the company.