Altria Faces Long-term Growth Uncertainties But Says Dividend Remains a Top Priority

Altria (MO) shares have slumped over 20% since December 2018 when management announced plans to pay $12.8 billion for a 35% stake in e-vapor leader Juul.

During that period, international cigarette manufacturer Philip Morris has seen its stock price appreciate about 7%, and the S&P 500 has gained 22%.

Put simply, Altria's untimely investment in Juul has created nothing but headaches for the business and its shareholders (more on that later).

Some investors now question if the Marlboro maker's dividend is safe given the stock's unusually high yield near 9%.

Altria has had a Borderline Safe Dividend Safety Score since September 2019, and we expect the dividend to remain safe for now.

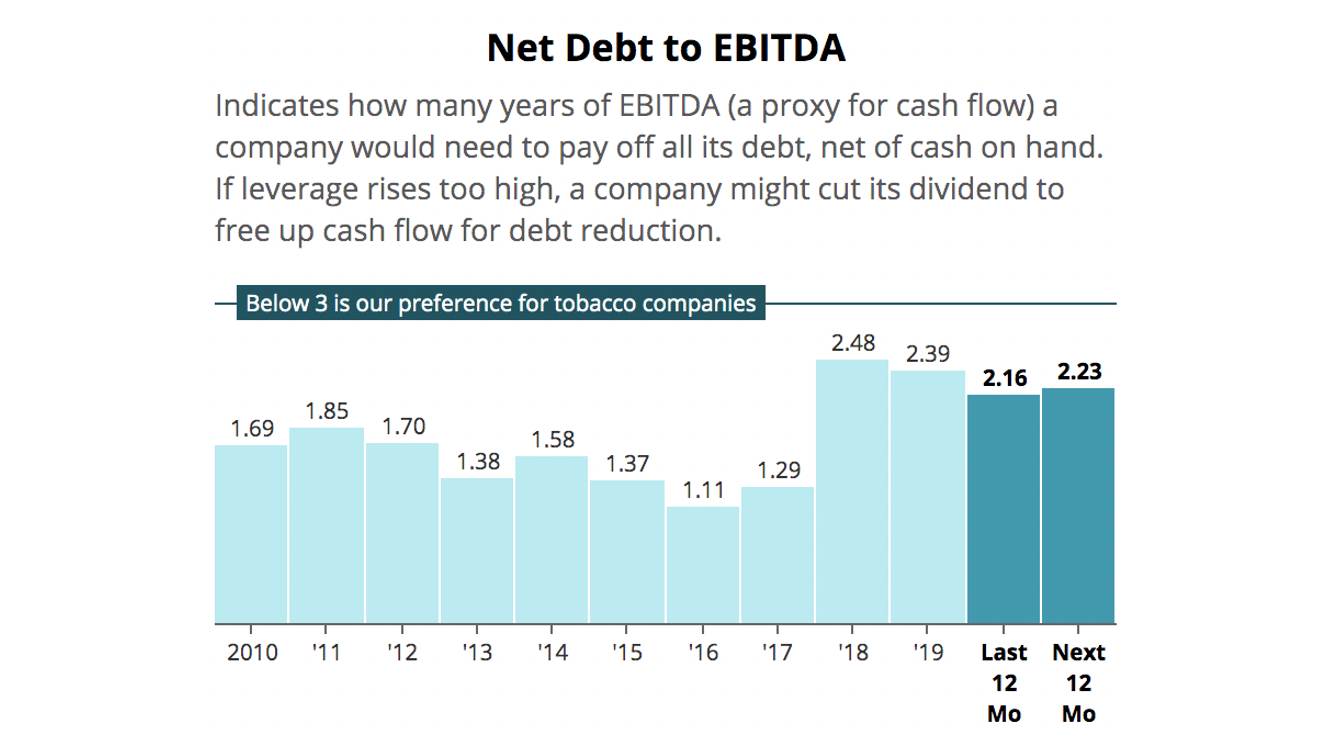

Altria should continue covering its dividend with free cash flow this year (even despite the pandemic), liquidity is solid ($5.6 billion in cash, more than enough to cover debt maturities through 2022), leverage appears reasonable, and management continues backing the dividend.

At Altria's annual shareholders meeting on May 14, new CEO Billy Gifford emphasized the dividend's importance (and declared the next regular quarterly dividend payable in July):

During that period, international cigarette manufacturer Philip Morris has seen its stock price appreciate about 7%, and the S&P 500 has gained 22%.

Put simply, Altria's untimely investment in Juul has created nothing but headaches for the business and its shareholders (more on that later).

Some investors now question if the Marlboro maker's dividend is safe given the stock's unusually high yield near 9%.

Altria has had a Borderline Safe Dividend Safety Score since September 2019, and we expect the dividend to remain safe for now.

Altria should continue covering its dividend with free cash flow this year (even despite the pandemic), liquidity is solid ($5.6 billion in cash, more than enough to cover debt maturities through 2022), leverage appears reasonable, and management continues backing the dividend.

At Altria's annual shareholders meeting on May 14, new CEO Billy Gifford emphasized the dividend's importance (and declared the next regular quarterly dividend payable in July):

We are committed to the dividend. We know it's important to our shareholders. They greatly value it, and it's a top priority for us.

But investors are looking beyond today's dividends. They want to know that Altria will remain relevant a decade from now as tobacco consumption habits evolve.

Combustible cigarettes account for around 85% of the company's revenue and profits today, with chewing tobacco generating most of the rest.

However, next-generation products (NGPs) such as heated tobacco and e-cigarettes could account for over half of the industry's nicotine-based product volumes in 10 years, according to Altria.

Management believes over half of adult smokers are already looking for alternatives.

U.S. cigarette industry volumes declined 5.5% in 2019, up from their longer-term annual decline rate of 3% to 4% as more smokers moved to alternative nicotine products such as e-vapor.

Altria's cigarette volume declined 7% last year due to minor share losses, though its brands (led by Marlboro) continue to dominate about half of the U.S. market.

The company's pricing power has continued offsetting volume declines (revenue grew 1% in 2019) while also boosting Altria's operating margin from 46% in 2015 to 55% last year.

However, it's unclear how long this can continue if cigarette volume declines accelerate.

Ratings-firm Fitch expects Altria's revenue to decline at a low single-digit pace in 2020, driven by a 6% decline in cigarette volumes and spending weakness among consumers due to the coronavirus pandemic.

Fitch forecasts revenue returning to modest growth in 2021, but cigarette volume declines are projected to be above 6% (about twice as much as the longer-term average).

Altria knows it will eventually need to generate more of its revenue from the nicotine markets of the future.

But the company has not executed well to create its own solutions. Management has had to scramble to respond to these developing trends which threaten the future of Altria's combustible cigarettes cash cow.

That's why in 2018 and 2019 management spent about $15 billion to buy exposure to e-vapor (35% stake in Juul), cannabis (45% stake in Cronos), and oral nicotine pouches (80% stake in "on!").

In April 2019, Altria was also approved by the U.S. Food and Drug Administration to begin selling IQOS, a device manufactured by Philip Morris that heats tobacco sticks. (Altria has exclusive rights to sell IQOS in America.)

While it's nice to know that Altria is covering a number of bases to hedge its bets, none of these areas have much momentum at the moment.

Juul represents the biggest disappointment. Investing in Juul was intended to expand the company's reach into international markets with a leading disruptive product.

Shortly after Altria's defensive acquisition, vaping came under attack by regulators following rampant teen use and health concerns.

With the outlook for e-cigarettes deteriorating, Altria has already written down the value of its investment from $12.8 billion in December 2018 to just $4.2 billion.

Adding insult to injury, in April 2020 the Federal Trade Commission sued Altria over antitrust concerns.

Depending on the outcome (the trial starts in January 2021), Altria could be forced to unwind its transaction with Juul or sell its stake.

Meanwhile, the coronavirus pandemic has slowed commercial progress rolling out IQOS as Altria's retail shops have closed and person-to-person marketing efforts have temporarily halted.

Longer-term, Fitch believes Altria "will need to make material investments behind IQOS as distribution ramps nationally...before realizing any positive margin contributions and growth to operating income."

Altria's $6.2 billion dividend doesn't provide much financial flexibility in the event that the company needs to invest more in NGPs.

Over the last five years, Altria has retained on average about $1 billion excess cash flow after paying dividends each year.

That makes the $12.8 billion investment in Juul especially painful as its price tag represents over 12 years of retained cash flow and nearly doubled Altria's debt.

The good news is that Juul was far from a bet-the-firm acquisition since Altria's leverage remains at a reasonable level (BBB credit rating).

But going forward there's still less financial flexibility to take another swing if nicotine markets take an unexpected turn.

Overall, Altria remains in the penalty box for its questionable capital allocation decisions in recent years (including a failed attempt to merge with Philip Morris), plus ongoing concerns about the decline in U.S. cigarette volumes.

The coronavirus pandemic could put additional pressure on the business as some cash-strapped smokers swap Marlboro for discount brands, but it doesn't seem likely to threaten coverage of the dividend.

A bigger concern could be an eventual increase in excise taxes on cigarettes.

State government budget deficits have ballooned due to lockdowns and higher expenses to contain the virus. Increasing excise taxes would help raise much-needed revenue.

We've yet to see evidence this is happening, but it's worth monitoring since excise taxes already account for 21% of Altria's revenue. Passing on higher taxes to consumers could further accelerate cigarette volume declines.

Looking ahead, it's become harder to say what Altria's business might look like in 10 years since the company remains so dependent on traditional cigarettes and the U.S. regulatory environment.

For comparison, Philip Morris already generates over 20% of its revenue from reduced-risk products (up from 0.2% in 2015) and sells its brands in over 180 countries.

Altria lacks that momentum and diversification. Investors are now left wondering how long cigarette volume declines can be offset by price increases as tobacco consumption habits evolve in the years ahead.

Expectations look low for Altria, and the dividend appears secure over at least the short- to medium-term. However, the uptick in cigarette volume declines is cause for some concern since it influences the pace at which Altria may need to adapt.

Assuming Altria's pricing power remains intact and volume declines don't accelerate further, we plan to hold our shares in our Top 20 portfolio, where MO accounts for about 2.5% of our portfolio's market value.

Should the stock's valuation improve, we would consider exiting Altria for a business that has a clearer path to long-term profitable growth.