Leggett & Platt Maintains Dividend

Leggett & Platt (LEG) delivered a positive surprise for income investors today: the dividend is being maintained.

As we discussed on May 6, the company's payout looked to possibly be in peril due to the coronavirus pandemic.

Mattress store closures and idled automotive manufacturing plants drove a 60% decline in Leggett & Platt's revenue in the first week of April. Sales were still down 45% in the third week of April.

For perspective, the company's sales never fell more than 30% any given quarter during the 2007-09 financial crisis.

This was especially bad timing because Leggett & Platt was in the middle of deleveraging following a large acquisition in January 2019.

As part of this deal, the firm needed to increase the size of its credit facility, which added a financial covenant limiting its leverage.

The sudden plunge in revenue had potential to cause Leggett & Platt to breach this covenant and trigger an event of default.

Management was working with its banks to amend the covenants. But as we discussed earlier this month, it was unclear if a favorable resolution would be reached that could keep the dividend in place.

As we discussed on May 6, the company's payout looked to possibly be in peril due to the coronavirus pandemic.

Mattress store closures and idled automotive manufacturing plants drove a 60% decline in Leggett & Platt's revenue in the first week of April. Sales were still down 45% in the third week of April.

For perspective, the company's sales never fell more than 30% any given quarter during the 2007-09 financial crisis.

This was especially bad timing because Leggett & Platt was in the middle of deleveraging following a large acquisition in January 2019.

As part of this deal, the firm needed to increase the size of its credit facility, which added a financial covenant limiting its leverage.

The sudden plunge in revenue had potential to cause Leggett & Platt to breach this covenant and trigger an event of default.

Management was working with its banks to amend the covenants. But as we discussed earlier this month, it was unclear if a favorable resolution would be reached that could keep the dividend in place.

If management can quickly work out a favorable amendment for the covenants and weekly sales data shows continued improvement, Leggett & Platt will be better positioned to consider keeping its dividend for now with hopes that demand will bounce back.

After all, the business should continue generating positive cash flow, and its liquidity is sound assuming the covenant situation can be worked out.

The amended covenant provides Leggett & Platt with greater financial flexibility going forward.

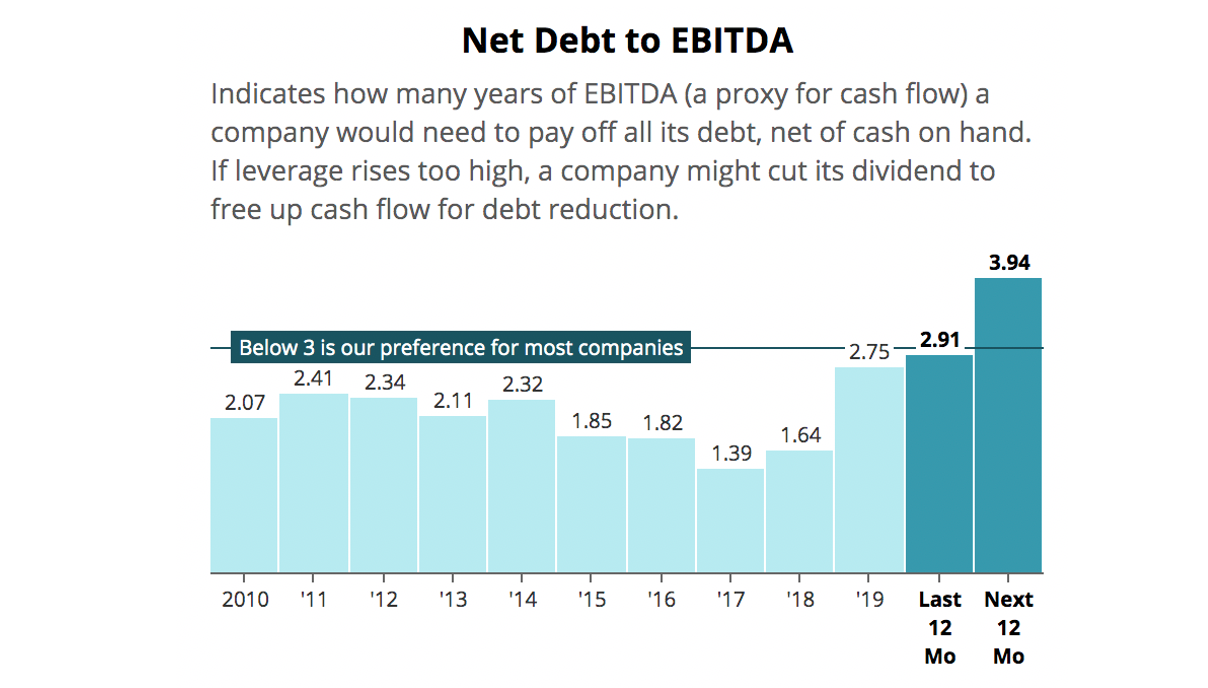

Specifically, the company's net debt to EBITDA ratio needs to remain below 4.75x through March 31, 2021. The ratio will be reduced by 0.5x every quarter through the end of 2021 until it reaches and will remain at 3.25x.

For context, the old covenant required Leggett & Platt's debt to EBITDA ratio to remain below 3.5x.

Based on our prior analysis, the company's covenant headroom under the old agreement could have been nearly eliminated if Leggett & Platt's 2019 sales fell by only 15%.

This new agreement provides much greater flexibility for the company to manage through a fairly severe downturn in the year ahead.

Management's decision to maintain the dividend also likely reflects some confidence that business trends have continued showing signs of improvement.

In light of these developments, plus the company's ability to generate solid cash flow during downturns, we are upgrading Leggett & Platt's Dividend Safety Score to Borderline Safe.

A return to a Safe rating is unlikely until the company's leverage is reduced and the pandemic's longer-term impact on consumer spending becomes clearer.

However, income investors can rest a little easier knowing that this dividend aristocrat remains committed to its payout and now has greater flexibility to continue navigating this crisis.

A return to a Safe rating is unlikely until the company's leverage is reduced and the pandemic's longer-term impact on consumer spending becomes clearer.

However, income investors can rest a little easier knowing that this dividend aristocrat remains committed to its payout and now has greater flexibility to continue navigating this crisis.