Leggett & Platt's Dividend Could Be Pressured as Leverage Rises

Leggett & Platt (LEG) has weathered many challenges over its 137-year existence while managing to increase its dividend for nearly 50 consecutive years.

But the coronavirus pandemic could be a perfect storm for the dividend.

After digesting the company's earnings call on Tuesday, we believe there is elevated risk that management could cut the dividend, potentially as soon as this month.

Based on our analysis below, we are downgrading Leggett & Platt's Dividend Safety Score to Unsafe.

Leggett & Platt's revenue reached a low point in the first week of April, down 60% versus the weekly average. Trends have been recovering since then, but sales in the third week of April were still down 45% compared to the weekly average.

For context, Leggett & Platt's sales never fell more than 30% any given quarter during the 2007-09 financial crisis.

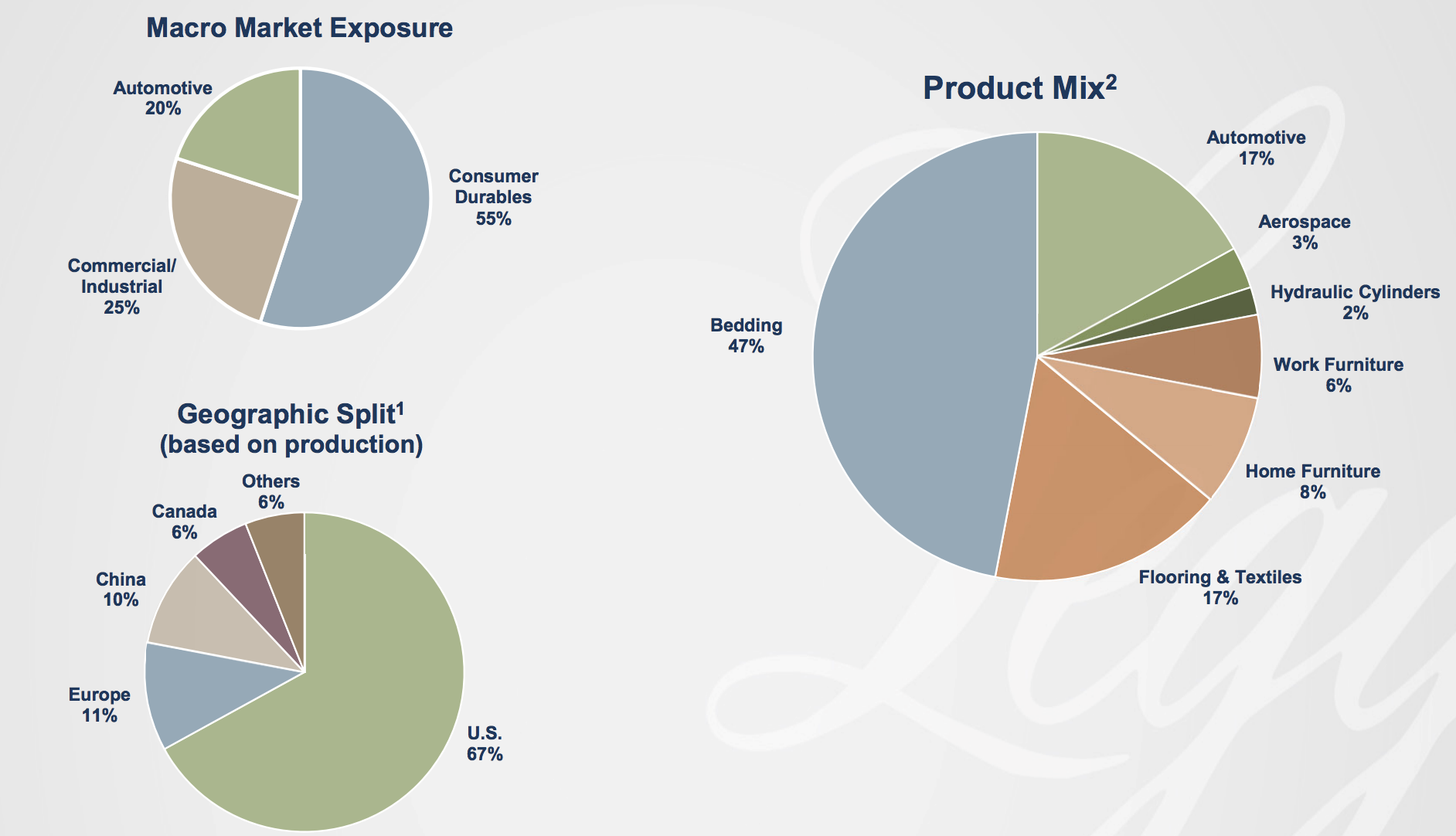

Bedding, the company's largest product category (47% of revenue), suffered the most rapid and steep decline in demand last month.

Widespread closures of mattress stores due to government shutdown orders caused volumes to plunge. Sales were still down around 30% to 35% last week compared to the norm.

In automotive (17% of revenue), sales were down over 60% through the first three weeks of April as vehicle manufacturers' plants remained idle. Restarting production is expected to be a lengthy and complex process.

The aerospace market (3% of sales) faces similar headwinds which will intensify in the months ahead as weak air travel demand reduces aircraft production.

Furniture, flooring, and textiles (31% of sales) fared somewhat better, but sales were still down about 30% through the first three weeks of April.

But the coronavirus pandemic could be a perfect storm for the dividend.

After digesting the company's earnings call on Tuesday, we believe there is elevated risk that management could cut the dividend, potentially as soon as this month.

Based on our analysis below, we are downgrading Leggett & Platt's Dividend Safety Score to Unsafe.

Leggett & Platt's revenue reached a low point in the first week of April, down 60% versus the weekly average. Trends have been recovering since then, but sales in the third week of April were still down 45% compared to the weekly average.

For context, Leggett & Platt's sales never fell more than 30% any given quarter during the 2007-09 financial crisis.

Bedding, the company's largest product category (47% of revenue), suffered the most rapid and steep decline in demand last month.

Widespread closures of mattress stores due to government shutdown orders caused volumes to plunge. Sales were still down around 30% to 35% last week compared to the norm.

In automotive (17% of revenue), sales were down over 60% through the first three weeks of April as vehicle manufacturers' plants remained idle. Restarting production is expected to be a lengthy and complex process.

The aerospace market (3% of sales) faces similar headwinds which will intensify in the months ahead as weak air travel demand reduces aircraft production.

Furniture, flooring, and textiles (31% of sales) fared somewhat better, but sales were still down about 30% through the first three weeks of April.

Cyclical demand is nothing new for Leggett & Platt, but this is no normal cycle.

You'll remember in the 2008, 2009 timeframe, I was the chief operating officer. So I've been through this. And it was very different in that the decline was slow and gradual. And we didn't have the kind of instantaneous cliff. We had layoffs but not mass layoffs ... We didn't have 30 million people file for unemployment in a three week period.

So much of the demand that we experience is based on consumer confidence, and we have a consumer that doesn't know, frankly, what to think. So they're just completely different dynamics. What we don't know today is depth or duration...

It's maybe embarrassing for us not to be able to [provide guidance], but heck, we don't know if there's going to be a second wave. We just don't know. We're appreciative of the trends that we're experiencing in April. But I mean, heck, that doesn't mean that they'll continue. It always feels like we're 1 day away from bad news.

– CEO Karl Glassman

Leggett & Platt's business has historically been a great cash generator, especially during downturns.

For example, in 2009 sales fell 25% but operating cash flow increased 30%. And operating cash flow has exceeded dividends and capital spending every year for over 30 years.

Approximately 75% of the firm's costs are variable in nature, providing greater flexibility to partially offset revenue declines.

The company's working capital position also provides cash during downturns as Leggett & Platt collects receivables and works down existing inventories.

Management expects those qualities to result in "really pretty good" cash generation this quarter, but the bigger issue is the company's leverage ratio increasing as its profits fall in the months ahead.

In January 2019, Leggett & Platt's debt doubled after the company closed its $1.25 billion acquisition of Elite Comfort Systems, a leader in high-quality specialty foam used in bedding and furniture markets.

To fund this deal, in 2018 Leggett & Platt increased the size of its credit facility, which added a financial covenant limiting the firm's leverage.

Specifically, the covenant required Leggett & Platt's debt-to-EBITDA leverage ratio to remain below 4.25x, with the cap stepping down to 3.5x as of March 31, 2020.

If Leggett & Platt fails to comply with the covenants in its credit agreement, it could trigger an event of default.

This would allow its lenders to terminate their commitment to provide additional loans and declare all borrowings outstanding to be immediately due. The firm's senior debt notes could also be accelerated.

In its last annual report filed in February 2020, the company noted that it was "comfortably in compliance" with its covenants.

Even as of March 31, the company's leverage ratio, as defined in its revolving credit facility, equated to a maximum borrowing capacity of $650 million, according to management.

But the pandemic could quickly threaten that status if it causes a severe, prolonged slump in demand in Leggett & Platt's key end markets.

Management said that the company's decremental margin is around 25% to 35%, meaning that for every $1 drop in revenue, operating profits are expected to fall around $0.25 to $0.35.

It's not out of the question that Leggett & Platt's revenue could decline at least 10% to 20% this year based on recent sales trends.

If annual revenue fell by 15% (about $710 million), then perhaps EBITDA would fall around $180 million (25% decremental margin).

All else equal, that would reduce Leggett & Platt's borrowing capacity by $630 million ($180 million EBITDA decline multiplied by 3.5x max leverage ratio), nearly eliminating all of its covenant headroom.

Leggett & Platt is working with its banks to amend the covenants in its revolving credit facility because it doesn't know how long the significant demand decreases across its markets will continue.

It's hard to say what concessions or additional commitments banks will want from Leggett & Platt to change the covenants, especially as they feel more pressure to be conservative with their own lending books due to the pandemic.

The outcome of these discussions could determine the dividend's fate when the board meets on May 15 to make a decision on the payout:

Even as of March 31, the company's leverage ratio, as defined in its revolving credit facility, equated to a maximum borrowing capacity of $650 million, according to management.

But the pandemic could quickly threaten that status if it causes a severe, prolonged slump in demand in Leggett & Platt's key end markets.

Management said that the company's decremental margin is around 25% to 35%, meaning that for every $1 drop in revenue, operating profits are expected to fall around $0.25 to $0.35.

It's not out of the question that Leggett & Platt's revenue could decline at least 10% to 20% this year based on recent sales trends.

If annual revenue fell by 15% (about $710 million), then perhaps EBITDA would fall around $180 million (25% decremental margin).

All else equal, that would reduce Leggett & Platt's borrowing capacity by $630 million ($180 million EBITDA decline multiplied by 3.5x max leverage ratio), nearly eliminating all of its covenant headroom.

Leggett & Platt is working with its banks to amend the covenants in its revolving credit facility because it doesn't know how long the significant demand decreases across its markets will continue.

It's hard to say what concessions or additional commitments banks will want from Leggett & Platt to change the covenants, especially as they feel more pressure to be conservative with their own lending books due to the pandemic.

The outcome of these discussions could determine the dividend's fate when the board meets on May 15 to make a decision on the payout:

"[The board] will make a decision based on the evolving economic conditions. As Jeff said in his prepared remarks, we're working with the banks on some covenant relief and all of those things will be considered. Contemporary sales trends. Every week of data is helpful." – CEO Karl Glassman

If management can quickly work out a favorable amendment for the covenants and weekly sales data shows continued improvement, Leggett & Platt will be better positioned to consider keeping its dividend for now with hopes that demand will bounce back.

After all, the business should continue generating positive cash flow, and its liquidity is sound assuming the covenant situation can be worked out.

As of March 31, the company had $506 million in cash on hand and $228 million in available capacity under its revolver. No significant debt matures until 2022.

Leggett & Platt's only essential cash outlays this year are $60 million for capital expenditures and $37.5 million of scheduled debt repayments. Both of these obligations should be easily covered.

The $220 million dividend is the biggest commitment. Maintaining the dividend this quarter would result in more than $50 million leaving the company.

It's worth noting that management is taking actions to reduce fixed costs this year by $130 million to $150 million, including an expected benefit in the second quarter of nearly $50 million. That could pay for the next dividend and keep Leggett & Platt's hopes alive to become a dividend king.

But given the amount of uncertainty facing the business, the unprecedented pace of decline in revenue, and the ongoing need to deleverage, management may desire to be extra conservative with liquidity.

This is a very difficult call to make. Few companies have demonstrated a commitment to their dividend like Leggett & Platt has over the years, but between the covenant issues and total lack of demand visibility caused by the virus, the dividend may no longer be safe.

Current shareholders should decide if they are comfortable with these risks and their position sizes. We will continue monitoring the situation.