AT&T Reiterates Confidence in Dividend Despite Economic Uncertainty

On April 7, AT&T (T) provided a brief financial update on its business in light of the coronavirus pandemic.

Management reiterated their confidence in AT&T's dividend, issuing the following statement:

Management reiterated their confidence in AT&T's dividend, issuing the following statement:

As it has for the past 36 years, the company looks forward to continuing to pay a quarterly dividend to shareholders. On March 27, the Board of Directors declared a dividend payable on May 1, 2020, to stockholders of record of its common and preferred shares at the close of business on April 9, 2020.

AT&T also noted that it had about $12 billion in cash on hand at the end of 2019 and has a $15 billion revolver in place, though it doesn't need or plan to use it in 2020.

For context, prior to the pandemic AT&T expected to generate $28 billion of free cash flow in 2020, and its dividend costs around $15 billion annually.

Excess free cash flow after paying dividends was expected to cover the firm's debt maturities in each of the next couple of years.

Despite the company's sound liquidity, some investors worry about how AT&T's business will perform in a recession and the impact that could have on the company's deleveraging ambitions.

After all, the company's business has evolved significantly following its $67 billion acquisition of satellite TV provider DirecTV in 2015 and its $85 billion deal for media giant Time Warner in 2018.

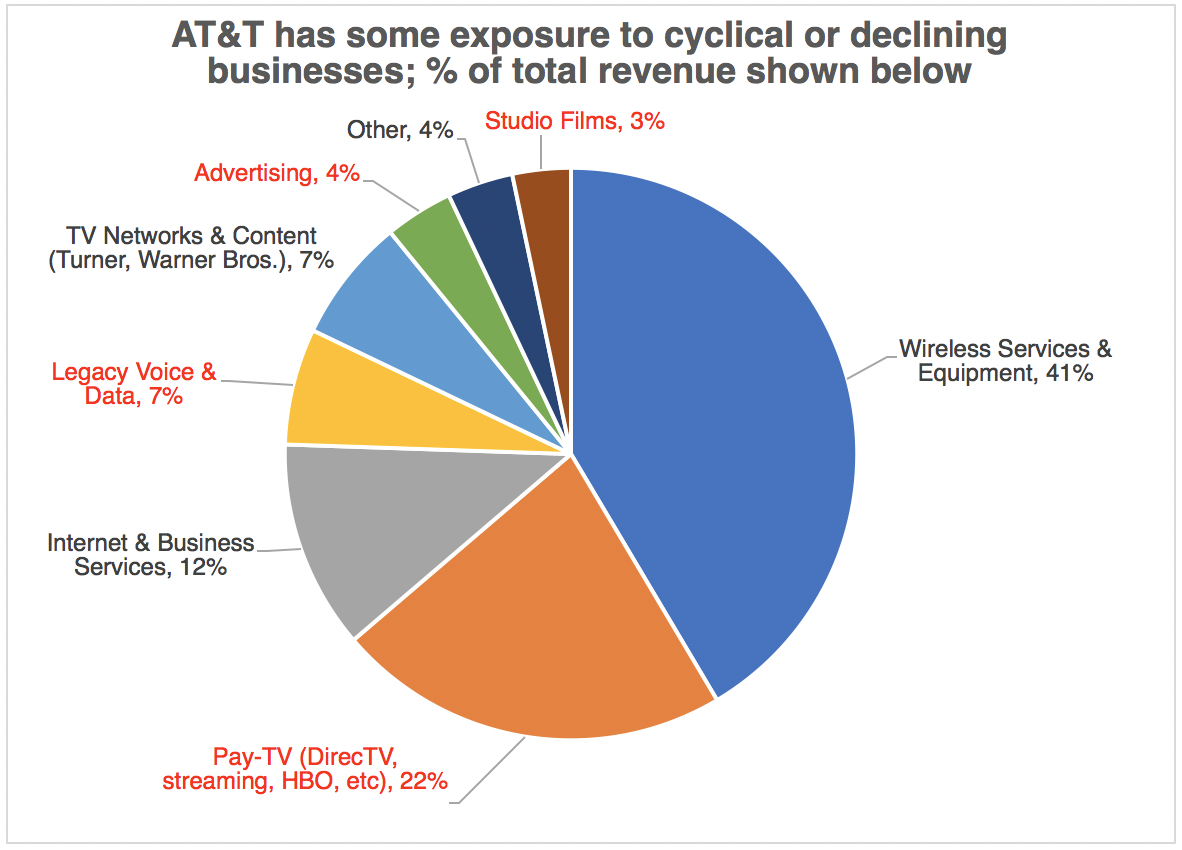

We did our best to break down AT&T's revenue mix in the chart below. Cyclical areas such as advertising (4% of sales) and studio films (3%) are feeling pressure from the pandemic and will likely seeing significant short-term declines.

AT&T also has exposure to pay-TV (22%) and legacy voice and data (7%) services. These businesses remain in secular decline as more consumers embrace streaming and stop using landline phones.

If we conservatively assume advertising and studio films decline 30% this year, legacy voice and data is down 15%, pay-TV (including streaming) falls 10%, and the other businesses remain stable, then we estimate AT&T's revenue would decline by 5%, or about $9.7 billion.

Even if that entire revenue loss was unable to be offset by a reduction in any of AT&T's costs, the company's free cash flow would fall from $28 billion to around $18 billion. That's an extremely unlikely scenario, but AT&T's $15 billion dividend would remain covered.

However, a material dip in free cash flow could still be problematic since AT&T could not pay down debt as quickly as it had planned.

AT&T ended 2019 with $151 billion of net debt, which worked out to a 2.5x net debt to EBITDA leverage ratio. The company hoped to reduce its leverage closer to 2.0x by the end of 2022, paying down all of the debt it had taken on to fund its acquisitions.

Prior to the coronavirus outbreak, AT&T saw a path to increase its free cash flow from $28 billion this year to between $30 billion and $32 billion in 2022.

If all went well, AT&T would retain around $13 billion to $16 billion of free cash flow after paying dividends each year, which it could use to continue reducing debt and repurchasing shares.

It's too soon to say how disruptive the coronavirus will be to some of AT&T's businesses. In aggregate, we expect the company's operations to continue generating solid cash flow that keeps the dividend well covered.

After all, essential wireless services and equipment still account for a little over half of the company's operating income, and areas such as high-speed internet and TV network programming seem very likely to remain cash cows.

AT&T is also progressing on its goal to divest at least $5 billion of non-core assets (representing only about 1% of the assets on its balance sheet) and has suspended its share repurchases. These actions increase the firm's financial flexibility and can help offset a temporary dip in free cash flow, should that occur.

AT&T has also had success recently in issuing preferred stock, providing an additional financing option it can consider to continue managing its balance sheet.

Based on what management knows today, they expect AT&T's subscription businesses and initiatives to generate enough cash flow to continue supporting necessary investments (nationwide 5G coverage expected this quarter), dividends, and debt reduction:

The strength and relevance of our core subscription businesses, our continued execution on our business transformation initiatives, and sizing our operations to economic activity will provide cash from operations that will support network investments, dividend payments and debt retirement, as well as the ability to invest in business opportunities that arise as the economies recover.

AT&T will provide more information on COVID-19 impacts to its results when it reports earnings on April 22.

We plan to continue holding our shares of AT&T in our Conservative Retirees portfolio and will keep monitoring the situation.

We plan to continue holding our shares of AT&T in our Conservative Retirees portfolio and will keep monitoring the situation.