Cullen/Frost's Dividend Looks Safe For Now Despite Unprecedented Plunge in Interest Rates, Oil

The unprecedented crash in oil prices, fall in interest rates, and continued slowdown in the global economy due to the novel coronavirus outbreak have rattled the confidence of many bank investors.

Depending on their magnitude and duration, these issues have potential to increase pressure on banks to conserve capital, making it a more difficult task to evaluate the safety of dividends in this complex industry.

Cullen/Frost (CFR) has an impeccable track record of paying higher dividends for more than 25 consecutive years and running its business conservatively.

However, the energy industry accounts for 11.2% of the firm's total loans. While that's down from the bank's 16% exposure during the 2014-16 oil crash, it's still one of the highest energy concentrations in the industry.

This isn't necessarily a problem if oil prices recover within the next year (or if management used extremely conservative underwriting standards), but the oil market shock is unprecedented and could persist.

While we still expect Cullen/Frost's payout to remain secure based on what we know today, the bank's elevated energy exposure coupled with some of the industry's growing headwinds result in a downgrade of the company's Dividend Safety Score from Very Safe to Safe.

Let's take a closer look at the factors that guide a bank's dividend policy in light of today's unusual environment.

Depending on their magnitude and duration, these issues have potential to increase pressure on banks to conserve capital, making it a more difficult task to evaluate the safety of dividends in this complex industry.

Cullen/Frost (CFR) has an impeccable track record of paying higher dividends for more than 25 consecutive years and running its business conservatively.

However, the energy industry accounts for 11.2% of the firm's total loans. While that's down from the bank's 16% exposure during the 2014-16 oil crash, it's still one of the highest energy concentrations in the industry.

This isn't necessarily a problem if oil prices recover within the next year (or if management used extremely conservative underwriting standards), but the oil market shock is unprecedented and could persist.

While we still expect Cullen/Frost's payout to remain secure based on what we know today, the bank's elevated energy exposure coupled with some of the industry's growing headwinds result in a downgrade of the company's Dividend Safety Score from Very Safe to Safe.

Let's take a closer look at the factors that guide a bank's dividend policy in light of today's unusual environment.

Following the 2007-09 financial crisis, global regulators implemented new standards requiring banks to hold more capital with hopes of building a more stable financial system that can withstand future shocks without requiring bailouts.

The Fed measures a bank's capital against its risk-weighted assets (a bank's loans, investments, and other assets are assigned values based on how risky they are) and requires a bank to maintain minimum required capital adequacy ratios.

Common equity tier 1 capital (CET1) is the most loss-absorbing form of capital since it primarily consists of the bank's common stock and retained earnings.

Regional banks such as Cullen/Frost are required to maintain a CET1 to risk-weighted assets ratio of at least 4.5%, plus a 2.5% “capital conservation buffer” (resulting in a minimum ratio of CET1 to risk-weighted assets of 7.0%).

In 2019, Cullen/Frost's CET1 capital totaled $2.9 billion compared to risk-weighted assets (RWA) of about $23 billion. Dividing the firm's CET1 by its RWA yielded a CET1 ratio of approximately 12.4%, well above the 7% minimum requirement.

That's important because if a bank's capital conservation buffer falls below 2.5% (i.e. a total CET1 capital ratio below 7%), then its ability to return capital to shareholders in the form of dividends and buybacks becomes increasingly limited.

As you can see, a bank would only be able to return 60% of its retained income to shareholders if its CET1 ratio fell below 7%, and no buybacks or dividends would be allowed for ratios below 4.625% (a capital buffer less than or equal to 0.625%).

No bank wants the headline risk of going close to or certainly below the regulatory minimum required capital levels.

With the coronavirus causing unprecedented economic uncertainty and perhaps serving as a trigger for a future rise in problem loans, banks can pull several levers if they need to raise their capital levels.

One option is for a bank to reduce its pace of asset growth (i.e. loan issuance) to reduce its risk-weighted assets and allow its capital levels to grow faster as some of its loans and investments wind down.

However, this would not be a good look in today's environment. Many consumers and businesses are facing a potential cash crunch with the economy coming to a virtual standstill for an indefinite period of time until the virus appears contained.

A more politically acceptable option is for a bank to increase its CET1 capital levels by either issuing equity or retaining more of its earnings. However, selling shares seems unlikely today as it would result in more dilution with many banks' stock prices in the dumps and not trading far from their book values.

That leaves reductions to buybacks and dividends as perhaps the most likely lever to pull, if economic and political conditions warrant it.

In fact, earlier this week America's biggest banks announced they were suspending share buybacks in order to have more capital available for lending during this uncertain time. Their dividend policies remained unchanged for now.

The Wall Street Journal summarized today's dynamic environment best: "The novel coronavirus outbreak is the biggest test of banks’ stability since the financial crisis."

Unprecedented interest rate pressure and the potential for a spike in non-performing loans are two primary issues.

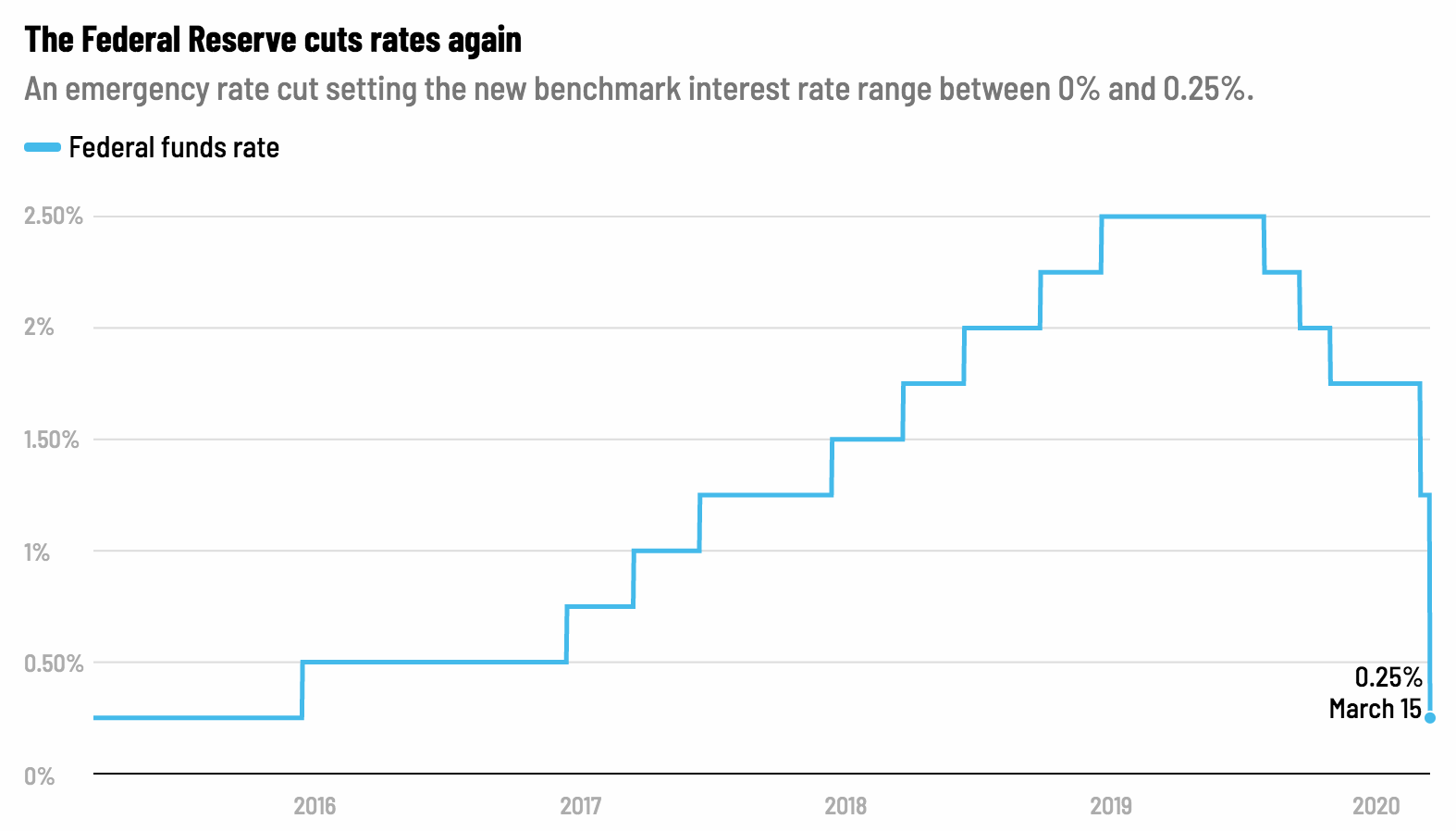

The Fed surprised investors on Sunday by announcing its second rate cut in less than two weeks with hopes of giving the economy a boost. As you can see, the Federal funds rate has plunged by 150 basis points since the start of the year.

Falling interest rates are bad news for most banks, which typically generate about two-thirds of their revenue from interest earned on loans. Cullen/Frost discloses that a decline in interest rates of 175 basis points is expected to reduce its net interest income by 6.4%.

Assuming that reduction falls straight to the bottom line, Cullen/Frost's pretax income would be projected to decline about 13% if such an environment persisted. The bank's payout ratio has hovered around 40% to 50% historically and would sit just north of 50% this year in such a scenario.

In other words, the latest rate cut seems unlikely to materially impair Cullen/Frost's dividend coverage and financial flexibility, but it's a situation worth monitoring if long-term rates continue sliding.

A bigger issue for the bank is the economic standstill taking shape as many businesses close temporarily and activity pauses with hopes of slowing down COVID-19's spread.

Workers are without paychecks, and many consumer-facing businesses are without customers. This creates a major need for liquidity and produces uncertainty over their ability to pay back their loans in the short term.

It's simply too soon to say whether or not this could lead to a big enough spike in problem loans or a rise in the assessed value of risk-weighted assets to put pressure on certain banks to raise their capital levels.

At of the end of 2019, the banking sector was in solid shape. Cullen/Frost's regional bank peers maintained an average CET1 capital ratio of 11%, well above the 7% regulatory minimum. Non-performing loans and charge-offs were at relatively low levels.

Cullen/Frost's CET1 capital was also about $1.2 billion above the minimum amount required by regulators. For its capital to fall to the minimum adequate level, the value of its loan portfolio would need to fall by about 8.5%, all else equal.

For context, during the financial crisis Cullen/Frost's bad loan net charge-offs represented less than 0.8% of its total loans each year, suggesting that it will likely remain well capitalized even as the coronavirus effects are felt.

Cullen/Frost's energy exposure (11.2% of loans) is arguably its biggest source of uncertainty. Depressed oil prices could also indirectly impact other industries the bank serves around Texas (the firm's headquarters and primary market).

In both energy markets and the broader U.S. economy, the big questions are how bad the current economic situation will get and how long it will last. We will hopefully know more in the coming weeks.

For now, Cullen/Frost appears to be adequately positioned to maintain its dividend. However, between oil's plunge, the coronavirus outbreak, sinking interest rates, and governments launching major stimulus packages, banks face an unprecedented and extremely fluid financial and political environment.

We will continue monitoring these developments. Investing in any bank stock requires a good deal of trust in management given how opaque their loan books and balance sheets are. Given the number of headwinds hitting the industry at once today, that's especially true.