Altria's Dividend Continues to Look Safe Despite Recent Cigarette Declines, Regulatory Fears

Longtime tobacco investors know a thing or two about the challenges this industry can face. From regulatory pressures to costly settlement agreements, over the years income investors have had to stomach bouts of severe volatility.

In fact, Altria's (MO) share price was nearly cut in half in the early 1990s when the Supreme Court ruled that smokers could seek damages against the cigarette industry. The country's major tobacco makers ultimately faced the largest class action lawsuit in U.S. history.

Despite these periodic ups and downs, for decades Altria delivered double-digit annualized total returns and has increased its dividend 53 times in the last 49 years.

Many income investors fell in love, and Altria is not surprisingly one of the most popular holdings in retirement-focused dividend portfolios today.

However, in recent years Altria's stock has once again come under pressure. Shares currently trade about 35% below their June 2017 peak and sport an unusually high dividend yield near 6.5%.

Some investors are worried that this time could be different. Perhaps big tobacco has finally met its maker, with its core products increasingly falling out of favor as consumers and regulators alike seek out reduced-risk alternatives to cigarettes.

In fact, Altria's (MO) share price was nearly cut in half in the early 1990s when the Supreme Court ruled that smokers could seek damages against the cigarette industry. The country's major tobacco makers ultimately faced the largest class action lawsuit in U.S. history.

Despite these periodic ups and downs, for decades Altria delivered double-digit annualized total returns and has increased its dividend 53 times in the last 49 years.

Many income investors fell in love, and Altria is not surprisingly one of the most popular holdings in retirement-focused dividend portfolios today.

However, in recent years Altria's stock has once again come under pressure. Shares currently trade about 35% below their June 2017 peak and sport an unusually high dividend yield near 6.5%.

Some investors are worried that this time could be different. Perhaps big tobacco has finally met its maker, with its core products increasingly falling out of favor as consumers and regulators alike seek out reduced-risk alternatives to cigarettes.

"Adult smokers are more willing than ever to switch to non-combustible tobacco products." – Altria CEO Howard Willard, Q1 2019 Earnings Call

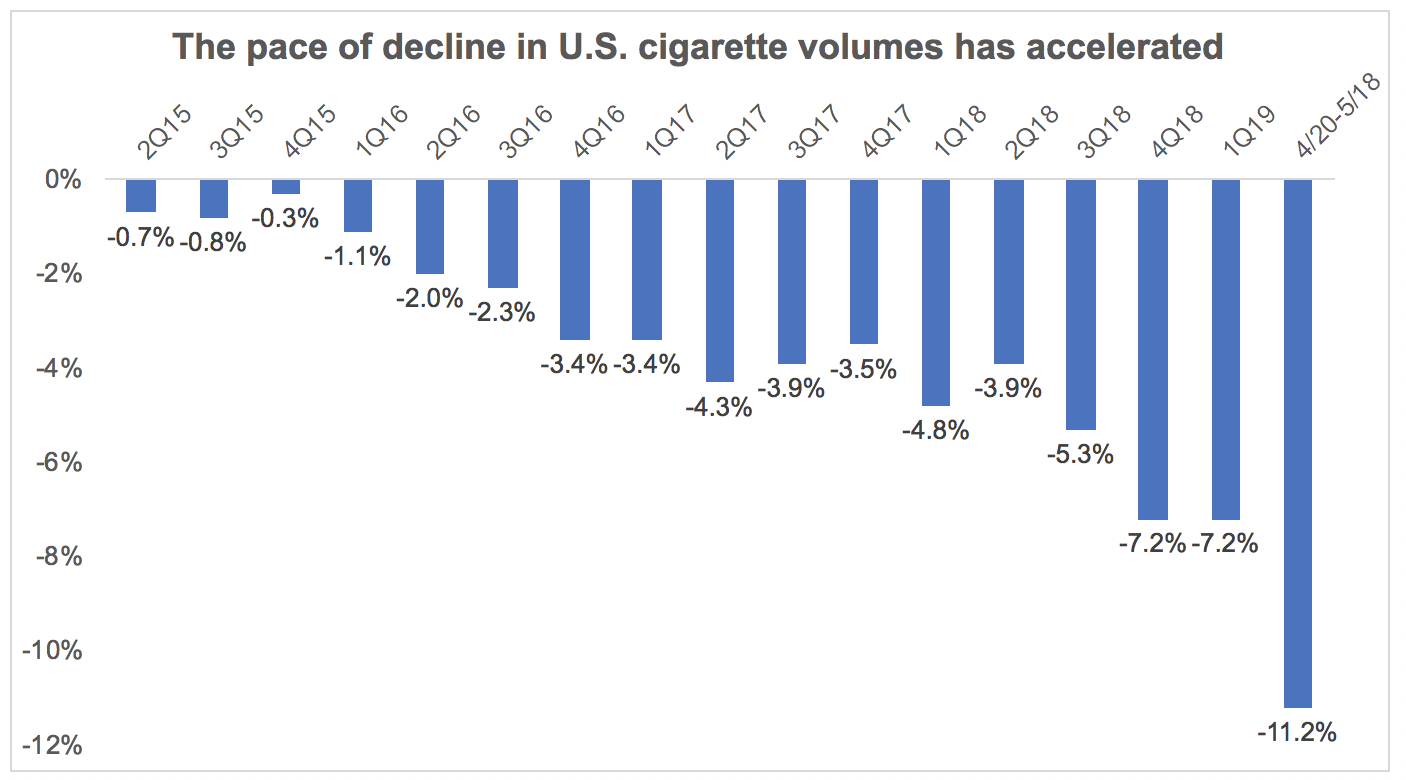

As you can see below, demand for U.S. cigarette packs is falling faster than it has in years. On Tuesday tobacco stocks were hit with more bad news from Nielsen showing that cigarette sales volume fell an estimated 11.2% in the four-week period ended May 18, the industry's worst decline in years.

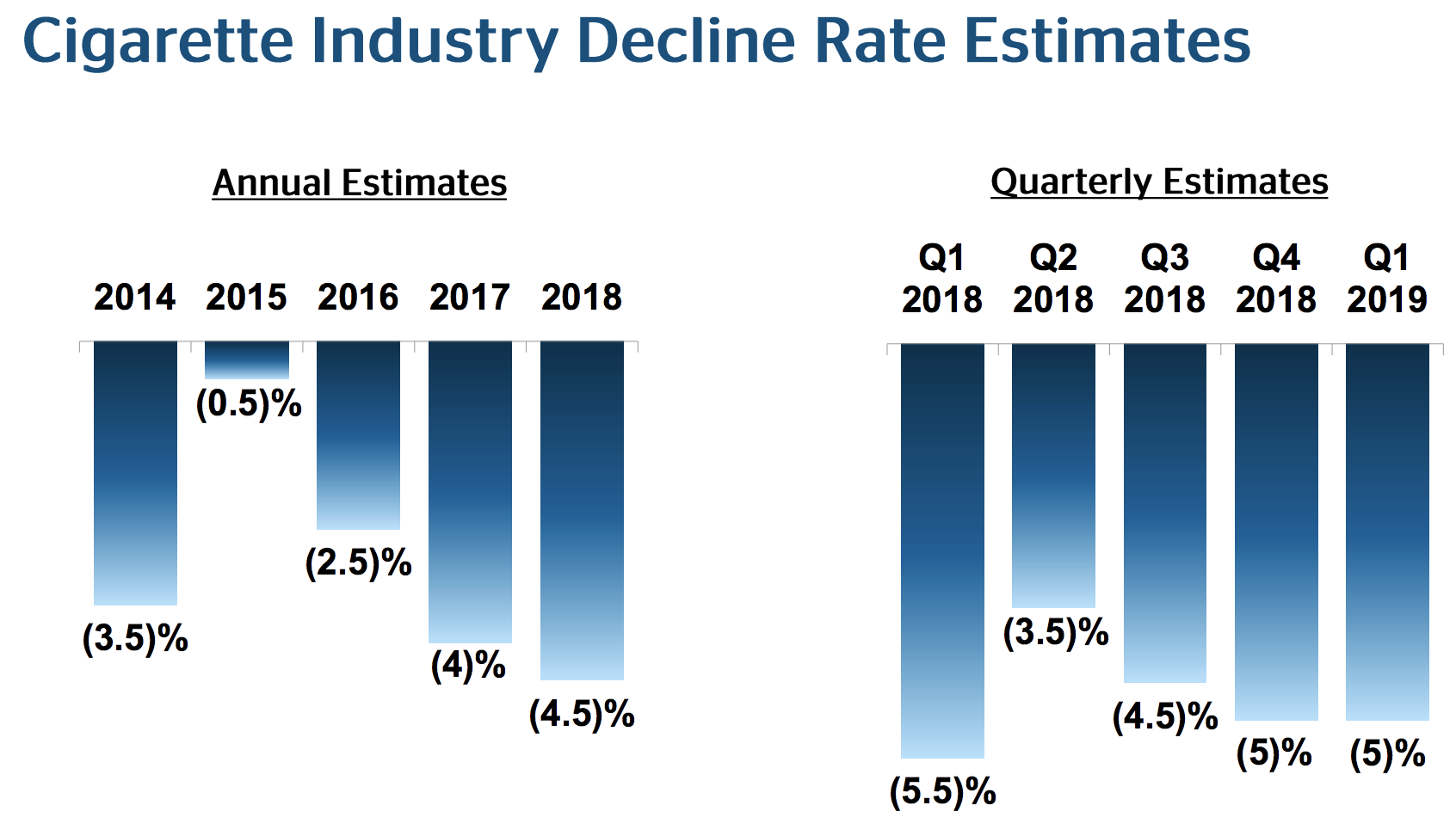

It's worth pointing out that different data collectors have reached somewhat different conclusions regarding the cigarette industry's magnitude of decline. Citing data from ALCS CMI estimates, for example, Altria pegged the industry's Q418 and Q119 volume declines at 5% each, better than the 7.2% slumps estimated by Nielsen.

Even on May 16, near the end of the four-week period Nielsen just published data on, Altria reaffirmed its 2019 guidance at its annual shareholder meeting. (Note that in April 2019 the firm lowered its expected U.S. cigarette industry volume decline rate for 2019 from 3.5% - 5% to 4% - 5% due largely to higher gas prices.)

But no matter what data set you look at, volume trends appear to be getting worse, not better, for the U.S. cigarette industry as more alternative products hit the market. Many states have also moved up the legal age to purchase tobacco products from 18 to 21, although only 2% of cigarette volume today is in that legal age to 20 segment.

Management continues to believe that average U.S. cigarette industry volumes will decline around 4% to 5% annually over the next five years, but some investors are worried that forecast could prove to be overly optimistic.

The trajectory of Altria's core cigarette business is critical to its ability to adapt to changing industry trends. While the firm has made headlines for its $14.6 billion investments in Juul (vaping) and Cronos (cannabis), these businesses are in growth mode and seem unlikely to generate and return any significant level of cash to Altria for at least the next year or two.

Instead, cigarette sales will continue driving the company's short-term results. In 2018, Altria's Smokeable segment, which houses cigarette brands such as Marlboro, generated $8.4 billion in adjusted operating income, compared to just $1.5 billion of income produced by its Smokeless division.

With the company's dividend tracking to consume close to $6 billion this year, it's clear that the profitability of Altria's Smokeable segment is critical. Not only does it support the dividend, but it provides the majority of the cash flow Altria needs to invest in non-combustible, reduced-risk products as it adapts its business model for an eventually smoke-free world.

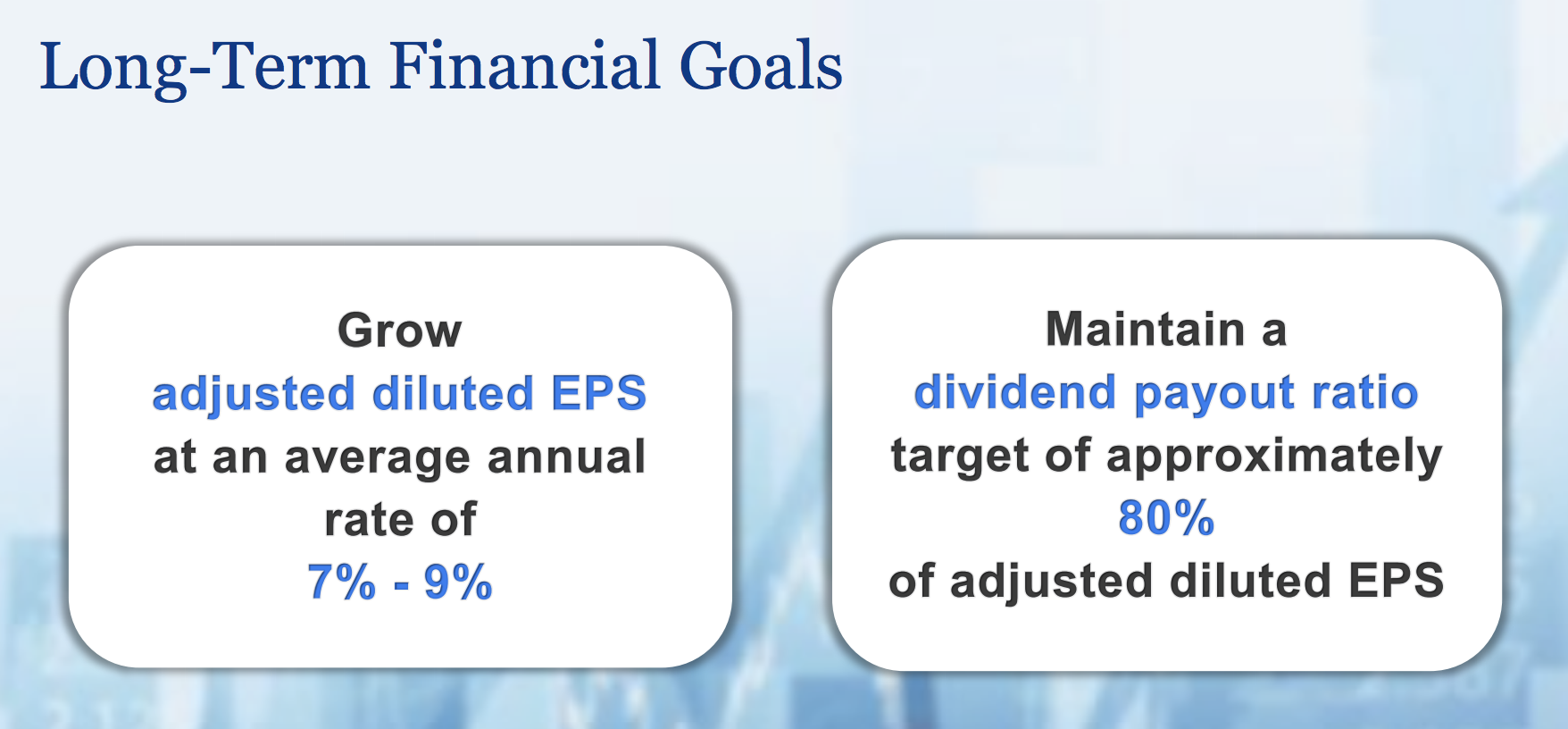

Management targets an 80% adjusted EPS payout ratio, which already doesn't leave much wiggle room if cash flow were to unexpectedly fall. This isn't necessarily a problem so long as industry volume declines remain manageable, tobacco's historical pricing power remains intact, and reduced-risk products (Juul, Cronos) grow to become meaningful contributors to Altria's bottom line.

Of course, none of those critical drivers are guaranteed to work in Altria's favor. Consumer preferences could shift faster than management expects, and regulators could clamp down on the vaping and cannabis markets, hurting their long-term outlooks.

For now, the good news is that Altria appears to be holding its ground in the cigarette market. While the firm's adjusted cigarette volumes fell 7% during the first quarter of 2019, Altria realized a net price increase of more than 8%, which was much higher than the 4% to 6% average annual price increases the company has recorded over the last five years.

As a result, the firm's Smokeable segment expanded its margin by more than three percentage points to 53.3% and managed to hold its adjusted operating income flat. The big question is whether or not Altria can continue pulling the price lever to fully offset cigarette volume declines if the erosion accelerates from here.

Your guess is as good as mine, but if the industry's favorable price elasticity shows signs of breaking down, shrinking Altria's core business faster than expected, then the firm's Dividend Safety Score (currently 65 – Safe) would be at risk of a downgrade to Borderline Safe.

Such a scenario could put Altria in an uncomfortable position where its earnings decline, putting upward pressure on its payout ratio while its investments in Juul and Cronos are potentially several years away from generating meaningful returns and cash flow (assuming they eventually do).

For now, more time is needed to see how the rest of 2019 plays out with cigarette volumes and the Smokeable segment's profits.

Altria continues guiding for 4% to 7% EPS growth this year, with an expected return to 7% to 9% EPS growth over the long term. Despite the market's skepticism, management has even said that "if there is further movement around the category that drives cigarettes' volume decline higher," they'd "still have confidence" that they can deliver against their long-term EPS growth target.

However, the firm's confidence is largely due to expected growth from Juul, which management believes has potential to deliver substantial incremental income over the next few years to offset any impact from unfavorable variation in cigarette volumes.

Investors have a right to feel uncomfortable about this growing dependency on Juul's success. Altria does not have a controlling interest in Juul (only a 35% stake), and the firm's $12.8 billion investment was ultimately the result of management failing to capitalize on the vaping trend, which is applying more pressure to its core cigarette business.

Altria's stock performance will likely remain very sensitive to cigarette volume trends and new developments in the e-cigarette market, which remains under regulatory pressure.

Most recently, in mid-May a federal judged sided with public health groups in a lawsuit against the U.S. Food and Drug Administration (FDA) calling for a review of e-cigarettes on the market. Since 2016, the FDA has had authority to regulate vaping products, such as those sold by Juul.

However, the agency had postponed its review of these products by several years to better prepare for their regulation. In the meantime, vaping goods were allowed to continue being sold with minimal rules and standards, despite their unknown long-term health effects.

Public health groups worry the FDA's failure to regulate vaping products in a timely manner has resulted in increased usage among teens. It will likely take time for this legal matter to be resolved, and it's hard to say what a worst-case scenario could be.

Perhaps the FDA would take e-cigarettes off the market until they each work through the regulatory approval process, dealing a costly blow to Juul, at least in the short term.

Such an event could actually provide some stabilization for cigarette volumes as the number of alternative products temporarily shrinks, but it would certainly make Altria's investment in Juul look questionable.

Overall, not much has really changed with Altria's story over the last six months. The company's long-term thesis is just continuing to evolve from a story of predictable price increases on high-margin cigarette packs to one focused more on smoking alternatives such as e-cigarettes and cannabis.

As this transition plays out, investors will remain especially tuned in to the trajectory of U.S. cigarette volumes, which could begin declining at an even faster pace as more smokers seek out alternative products.

If Altria cannot continue offsetting these declines in its core business with higher prices, at least until Juul and Cronos become major contributors to the bottom line, then the firm's cash flow outlook and growth prospects could weaken.

The firm has thus far continued to show that its pricing power remains strong enough to deliver steady profits in its cigarette business. However, Altria's Dividend Safety profile would need to be reviewed for a downgrade to our Borderline Safe category if this trend reverses.

Perhaps the bigger challenge is sizing up the long-term potential of Juul and Cronos, which are expected to become increasingly important drivers of Altria's business. Vaping and cannabis are emerging markets that hold great potential, but their competitive environments, regulatory landscapes, and ability to eventually become predictable cash cows like cigarettes are less certain.

Ultimately, our concluding thoughts from our January 2019 note hold true today:

Despite its impressive long-term track record, Altria increasingly looks like an income investment that needs to be more closely monitored over the next few years. While there is no imminent threat to its business or dividend, some clouds are forming on the horizon.

In these situations – a financially healthy business dealing with hard-to-quantify risks and growth uncertainties – I prefer to simply hold my shares (no buying or selling), waiting for more information to emerge to take some emotion out of the decision-making process.

We will continue monitoring the latest regulatory developments and trends in Altria's core tobacco business, providing updates as necessary. In these more complex situations, the importance of maintaining a well-diversified dividend portfolio to reduce company-specific risk can't be overstated.