Why Annaly Cut Its Dividend

Last week Annaly Capital Management (NLY) announced plans to cut its dividend by 17%, beginning with its second-quarter payout. The timing of this announcement likely came as a surprise to some income investors.

After all, Annaly's earnings about matched its dividend payment in recent quarters, the firm's portfolio was growing at a double-digit pace, shares traded at a premium to book value, and its leverage was kept nearly 20% lower than Annaly's agency mortgage REIT (mREIT) peers.

As the largest and oldest mREIT in the country, Annaly was also the only company in its industry not to have reduced its payout since 2014, and its core EPS were also 90% more stable than the industry average over that period, according to management.

Despite these qualities, Annaly's dividend has looked "unsafe" under our Dividend Safety Score system for several years. In our June 2018 thesis on the firm, which you can read here for a detailed overview of Annaly's business model, we concluded that despite being "the largest and arguably best run mREIT," Annaly faced challenges:

After all, Annaly's earnings about matched its dividend payment in recent quarters, the firm's portfolio was growing at a double-digit pace, shares traded at a premium to book value, and its leverage was kept nearly 20% lower than Annaly's agency mortgage REIT (mREIT) peers.

As the largest and oldest mREIT in the country, Annaly was also the only company in its industry not to have reduced its payout since 2014, and its core EPS were also 90% more stable than the industry average over that period, according to management.

Despite these qualities, Annaly's dividend has looked "unsafe" under our Dividend Safety Score system for several years. In our June 2018 thesis on the firm, which you can read here for a detailed overview of Annaly's business model, we concluded that despite being "the largest and arguably best run mREIT," Annaly faced challenges:

"At the end of the day Annaly is merely one of the better houses in a dangerous neighborhood. The underlying business model makes it virtually impossible to sustain dividends over a full economic cycle, much less grow them consistently.

Therefore, Annaly, like virtually all mREITs, is a high-risk dividend stock that is unsuitable for most dividend investors, especially those in need of highly consistent income."

So what exactly caused Annaly to reduce its dividend for the first time in over five years, could more cuts be in the future, and what should existing shareholders consider now? Let's take a closer look.

Why Annaly Cut Its Dividend

As a mortgage REIT, Annaly generates income by borrowing money at short-term (lower) interest rates and buying longer-term residential and commercial assets (mostly mortgage-backed securities) that have higher yields.

The difference between short-term borrowing rates and the yields Annaly earns on its investments is the net interest margin, or “spread,” which is how the company makes money.

Combined with a high amount of leverage, this strategy creates around a 10% levered return that generates the company’s profits and funds the stock's double-digit dividend yield.

The use of substantial leverage might make this strategy sound dangerous. After all, last weekend Warren Buffett made a great statement about debt at Berkshire Hathaway's annual meeting:

“Both Charlie [Munger] and I have seen high IQ people, really extraordinarily high IQ people, destroyed by leverage."

While Annaly employs very high leverage of 7:1 (borrows $7 for every $1 of equity), approximately 76% of the firm's portfolio is allocated to agency mortgage-backed securities, or MBS, issued by government-sponsored entities Freddie Mac and Fannie Mae.

The payment of principal and interest on these securities is guaranteed by those agencies. Per Annaly's latest quarterly filing, "substantially all of the company's agency mortgage-backed securities have an actual or implied AAA rating."

In other words, these residential mortgages have minimal credit risk, so management's use of leverage to magnify returns isn't necessarily alarming. The firm does have to stay mindful of prepayment risk, however. Lower rates can cause more homeowners to refinance by taking out a new mortgage to pay off an existing one, cancelling it out. Since Annaly pays a slight premium for its MBS, it can incur losses on these investments in such an environment.

The remainder of Annaly's portfolio uses much less leverage (about 1:1) as it is invested in relatively riskier areas like non-agency residential mortgage assets, commercial assets, and middle market (subprime) commercial loans.

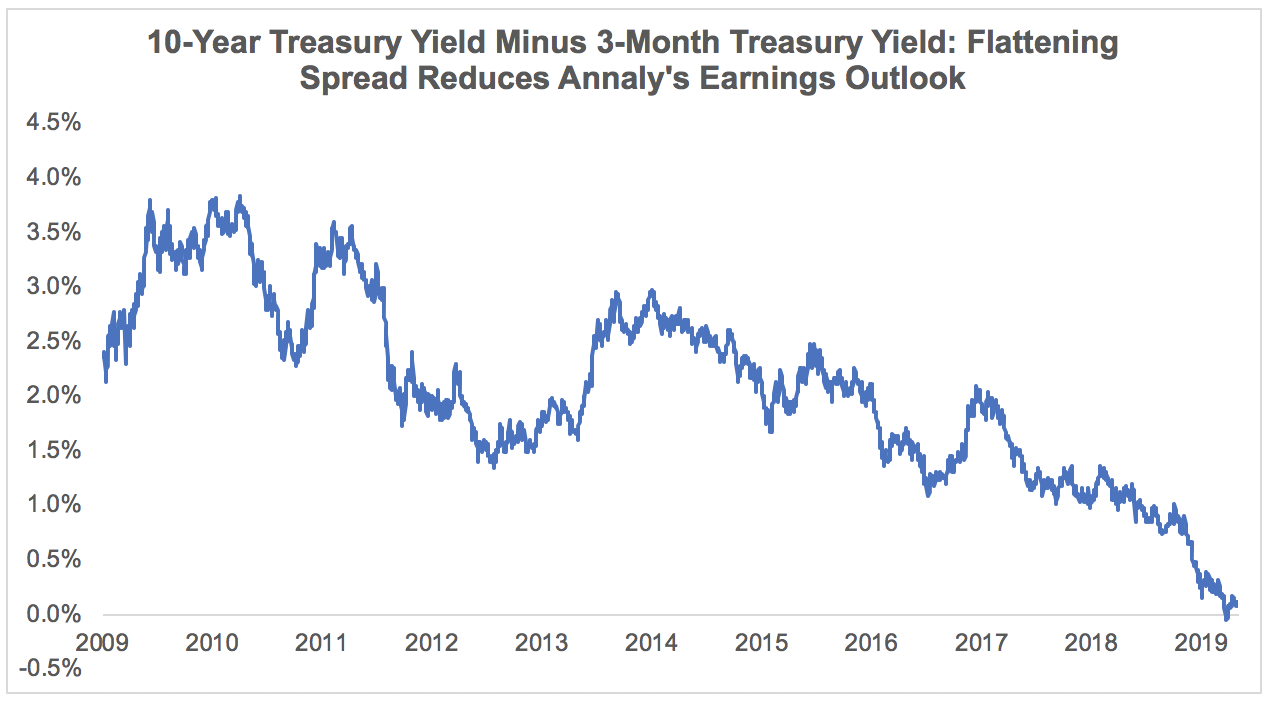

What ultimately hurt Annaly's earnings outlook and led management to cut the dividend were higher funding costs and a flat yield curve. As you can see below, the difference between the 10-year Treasury yield and the 3-month Treasury yield shrunk significantly in recent years, including a plunge to zero in late 2018.

The yield curve flattened as the Fed began hiking short-term rates, while concerns around economic growth drove down long-term rates in late 2018.

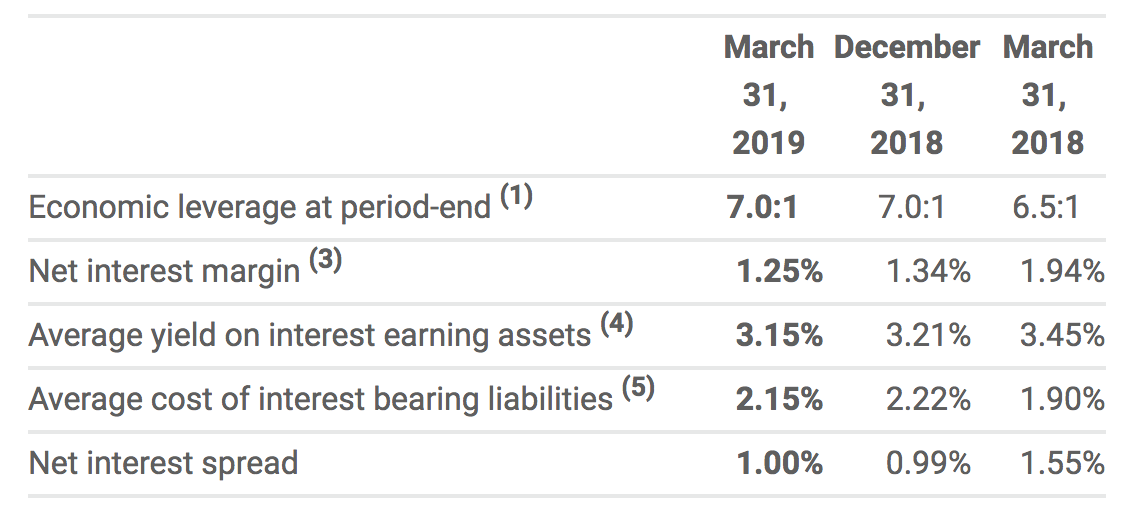

As a result, Annaly's net interest margin, or the spread it earns between the yield on its assets and the cost of its borrowings and hedging activities, narrowed substantially, falling from 1.94% in the first quarter of March 2018 to just 1.25% last quarter.

Management anticipates the firm's overall cost of funds will rise in the quarters ahead, which combined with the flat yield curve is expected to keep downward pressure on Annaly's net interest margin.

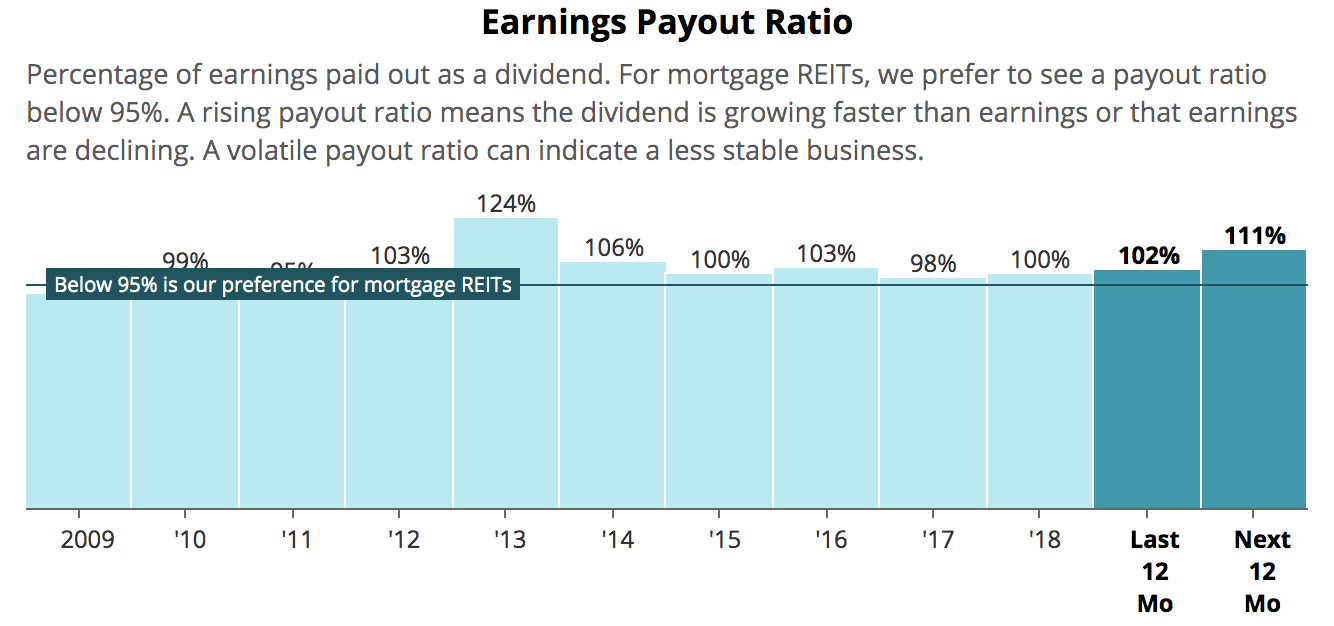

This tightening caused Annaly's earnings to decline 2% in 2018, and analysts expect another 8% fall over the year ahead. Had the dividend been maintained, the firm's payout ratio would have increased above 110%, reaching its highest level since 2013.

Management had few reasonable options left to protect the dividend and fight the reality of tight asset spreads in a persistently flat yield curve environment. Annaly could have upped its leverage even higher to magnify its smaller profits until the spread improved again, but that's risky.

The firm also could have looked to be more aggressive in growing its smaller businesses outside of agency MBS, but management cited concerns about asset valuations and credit risk profiles in those markets, opting to remain disciplined instead.

Here's what the company said in its earnings press release:

"Over the last five years we delivered unmatched stability with our dividend and through our efficient operating structure and diversified investment platform, while providing transparency about realistic returns achievable in the market.

In the current environment, one characterized by a flattening yield curve and compressed spreads, we remain committed to delivering high quality earnings and a stable yield without assuming excessive risk or sacrificing liquidity.

Accordingly, we have pre-announced an expected quarterly dividend of $0.25 for the second quarter and for the remainder of 2019. Although we could maintain elevated earnings and dividend payouts by increasing leverage, we are focused on optimal liquidity thresholds and managing the portfolio within conservative risk parameters."

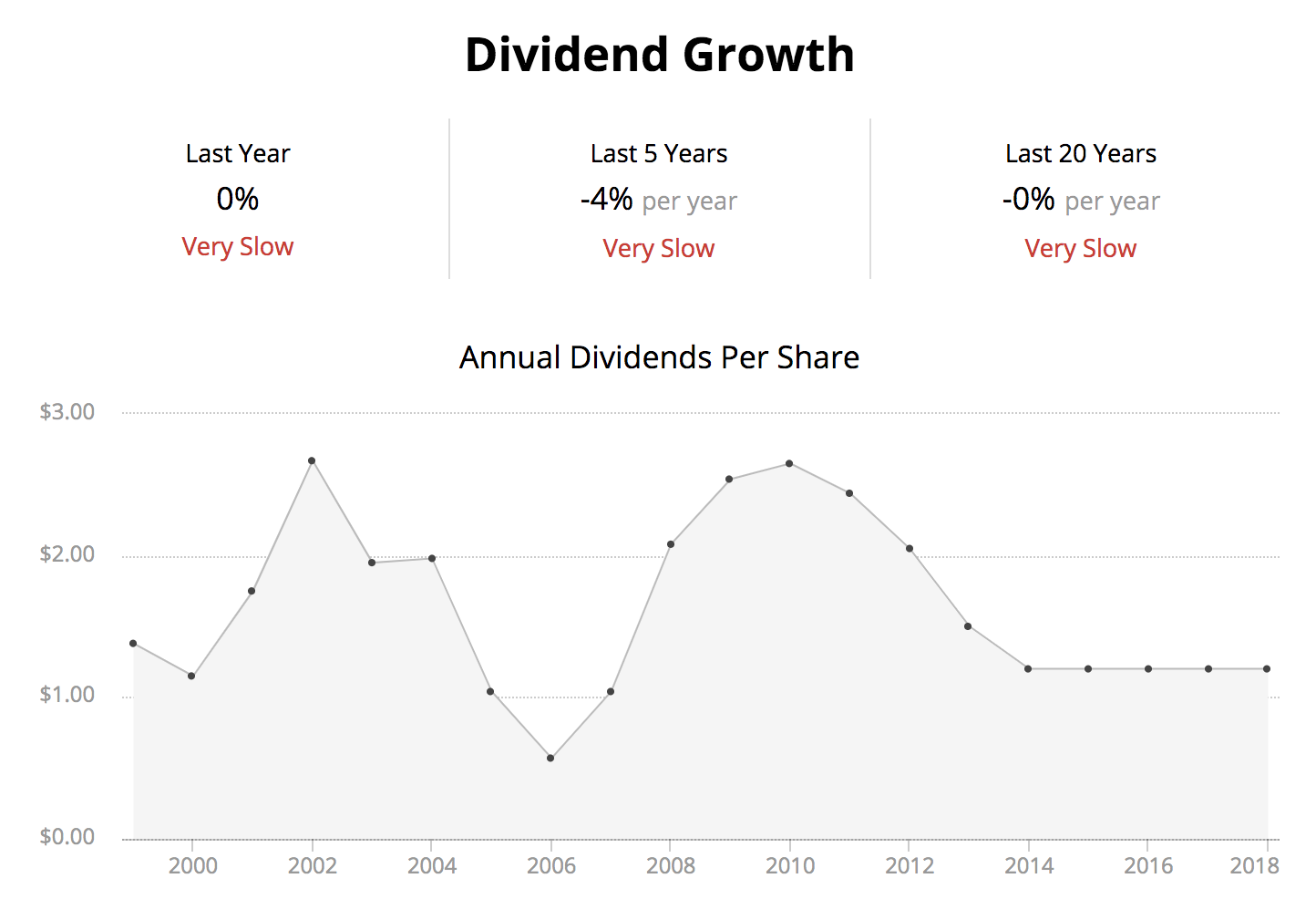

Annaly has cut its dividend in the past in response to volatile interest rates, so this latest reduction shouldn't come as a big surprise. However, it is disappointing to see the firm's new annual payout ($1.00 per share) fall to its lowest level since 2006, and below where it stood 20 years ago.

If you own this stock or are thinking of owning it, you have to be comfortable with the long-term, fixed-variable nature of Annaly's dividend. Payouts will likely continue to ebb and flow over the years, despite management's best efforts to create a more stable dividend. And sustained dividend growth will likely be non-existent.

Fortunately, additional cuts to Annaly's payout seem unlikely over the short to medium term. The firm's projected payout ratio over the year ahead will fall to around 93%, its lowest level in more than a decade. Management also commented that stability is the goal:

"We don't want to have a dividend that bounces all over the place like most other companies. We want to have a portfolio and a posture and a disposition that is overly conservative and you can rely upon it."

While disappointing, Annaly's intended conservatism should be appreciated in this environment. The flattening yield curve seems likely to claim more mREIT victims throughout 2019, and their cuts will likely be much more severe than Annaly's.

In fact, over the last five years we've already seen over 60 dividend cuts in the mREIT sector, according to management, and the average cut was about 30%. In the agency mREIT space the average cut was approximately 44%.

Annaly's risk profile benefits from the company's large scale, more diversified sources of cash flow, and relatively low leverage. Smaller mREITs typically do not share those benefits and often only have one source of cash flow. As a result, increasing leverage is one of the few options they have to protect their earnings in a flat yield curve environment.

It's true that mREITs have a number of long-term growth opportunities in front of them, especially as banks continue shrinking their mortgage businesses. In fact, since the beginning of 2014 non-bank's share of total agency mortgage origination is up from 29% to 53% of the market, per Annaly.

However, entities that are stepping in to fill the financing void can have very different risk profiles. JPMorgan Chase CFO Marianne Lake made the following remark on the firm's first-quarter earnings call:

"Not all non-banks are situated similarly, there's some healthy, thriving, well capitalized, and responsibly run companies, and there are some others who may not be standing at the end of another downturn."

In today's environment especially, conservative investors should resist the urge to chase yield and remain focused on high-quality companies that are prudently managed.

Closing Thoughts on Annaly's Dividend Cut

Annaly's dividend cut, its first in more than five years, underscores the difficulties that mortgage REITs have in maintaining reliable payouts over time. Their high use of leverage and sensitivity to interest rates means they face many risks outside of their control, regardless of how large or diversified their businesses are.

Annaly's lower dividend, which will be officially declared next month, looks more sustainable for now since the firm's forward payout ratio will fall from 111% to around 93%. Overall, the firm arguably remains one of the better houses in a dangerous neighborhood for income investors who are comfortable with the risks this sector presents.

However, while Annaly's cut announcement is now behind it, remember that the flat yield curve seems likely to claim more mREIT victims as 2019 rolls on, especially smaller companies with higher cost structures and less diversified operations.

As a conservative income investor, my personal preference would be to invest elsewhere in stocks that have safer dividends, less volatile business models, and more within their control, regardless of yield curves or the overall economic environment. As always, understand your risk tolerance and make sure to diversify your portfolio enough so you can sleep well at night.