Toronto-Dominion Bank: Uninterrupted Dividends Since 1857

Toronto-Dominion Bank (TD) was founded in 1855 and is one of North America's largest banks. The firm's revenue is fairly balanced between net interest income, or lending businesses (57% of sales), and non-interest income operations (43% of revenue is from non-lending businesses such as insurance policies, card services, service charges, asset management, credit fees, brokerage services, etc.).

Toronto-Dominion organizes its operations into three segments:

- Canadian Retail (58% of net income): provides a full range of financial products and services (checking and savings accounts, personal loans, credit cards, car loans, mortgages, investments) to over 15 million customers in the Canadian personal and commercial banking, wealth, and insurance businesses.

- U.S. Retail (34% of net income): provides personal banking, credit cards, auto finance, business banking, and wealth management services. This segment also includes Toronto-Dominion's 42% stake in brokerage firm TD Ameritrade, which represents about 6% of company-wide earnings.

- Wholesale Banking (8% of net income): provides capital markets, investment banking, and corporate banking products and services to large companies. Services include underwriting and distribution of new debt and equity issues, providing advice on strategic acquisitions and divestitures, and trading, funding, and investment services.

Unlike many big banks, TD has little exposure to investment banking and trading operations, which tend to be more cyclical and riskier businesses. Instead, the retail bank focuses on simple lending activities (mortgages, auto loans, commercial financing, etc.) and fee income.

Toronto-Dominion Bank boasts one of the most impressive dividend track records of any company, with a history of uninterrupted payouts dating back to 1857.

Toronto-Dominion Bank boasts one of the most impressive dividend track records of any company, with a history of uninterrupted payouts dating back to 1857.

Business Analysis

Banking is largely a commodity product, with consumers and businesses seeking access to dependable financing at the lowest interest rate possible. Banks with the largest low-cost deposit bases (i.e. cheap sources of funding to use for lending), most efficient operations, and conservative risk management practices tend to be best off.

TD checks all of these boxes but also benefits from generating about 60% of its net income in Canada, where the banking sector is especially favorable. Canada's banks are known for their stability, even sailing through the global financial crisis with relative ease (no Canadian banks failed or required government bailouts).

In fact, Canada hasn't had a banking crisis since 1840, largely due to strict regulations that cement the largest banks as an effective oligopoly. According to Department of Finance Canada, the country's six largest banks command more than 90% of market share, resulting in substantial pricing power and a more rational competitive environment.

TD checks all of these boxes but also benefits from generating about 60% of its net income in Canada, where the banking sector is especially favorable. Canada's banks are known for their stability, even sailing through the global financial crisis with relative ease (no Canadian banks failed or required government bailouts).

In fact, Canada hasn't had a banking crisis since 1840, largely due to strict regulations that cement the largest banks as an effective oligopoly. According to Department of Finance Canada, the country's six largest banks command more than 90% of market share, resulting in substantial pricing power and a more rational competitive environment.

This concentration of power is partly driven by Canadian regulators who have set strict underwriting and credit standards, while also forcing banks to eat more of their own cooking. For example, Canadian banks are required by law to hold more loans (including mortgages) on their own books, rather than securitize (i.e. sell) them to third parties. As a result, lending practices tend to be more conservative.

Home mortgages, which account for about 33% of TD's total loans, also require a minimum downpayment of 5%, and any mortgage without at least 20% down payment requires default insurance. Mortgage interest is also not tax deductible in Canada, reducing the incentive for consumers to borrow and delay repayments.

Besides mortgage rules, stricter credit score lending standards are also in place because the Canadian government requires mortgage loan insurance when a home buyer has less than a 20% downpayment. These conservative practices are one reason why Canadian banks suffered far less than many other financial institutions in 2008-2009.

Besides mortgage rules, stricter credit score lending standards are also in place because the Canadian government requires mortgage loan insurance when a home buyer has less than a 20% downpayment. These conservative practices are one reason why Canadian banks suffered far less than many other financial institutions in 2008-2009.

When combined with their impressive scale and geographic diversification across the country, Canada's largest banks enjoy durable competitive advantages, despite offering similar products and prices.

These behemoths enjoy some of the lowest cost sources of funding (massive deposit bases paying little interest), have thousands of retail locations across the country to cheaply acquire new customers, and have expanded their operations into hundreds of different product lines to continue growing. Smaller rivals struggle to compete with the giants' prices, services breadth, and reputation.

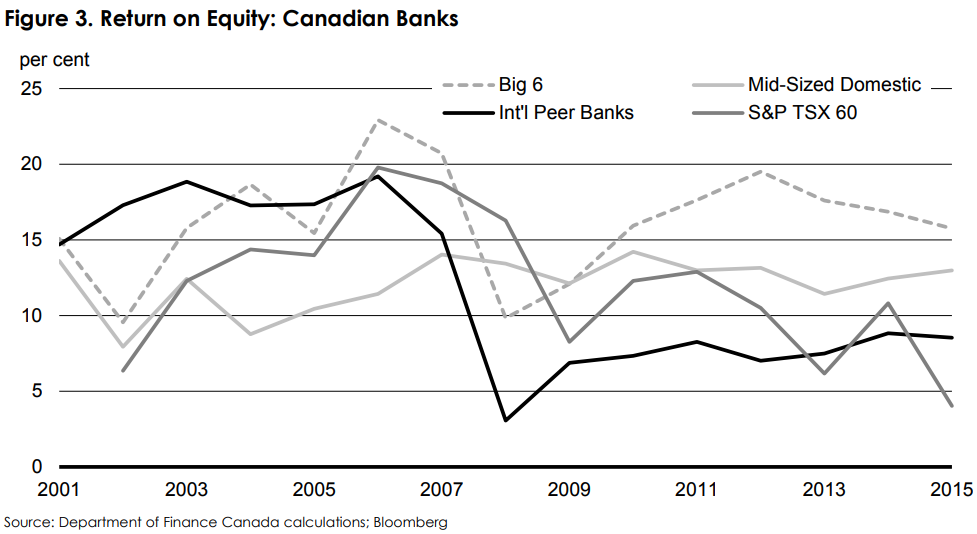

As you can see below, Canada's big six banks (the dashed line) have generated solid profitability throughout all types of economic environments for many years. They have also earned a superior return on equity compared to smaller Canadian banks, international peers, and the corporate sector overall.

Outside of Canada, TD's expansion efforts are focused in the U.S. where the company is already one of the 10 largest retail banks. Thanks in part to several acquisitions over the last decade, Toronto-Dominion now operates in seven of America's 10 wealthiest states, and four of its largest metropolitan areas.

The bank's growing U.S. footprint means that it has access to nearly 110 million people, although TD only serves around 9 million customers in its service territories today. In other words, TD has plenty of growth runway in the states, especially since the U.S. population is nearly nine times the size of Canada's. Management hopes the bank can achieve 7% to 10% annual adjusted EPS growth over the medium term, driven by its U.S. retail operations.

TD's U.S. expansion plans center around investing in digital technology, opening and acquiring more branches, and building up the firm's smaller businesses such as wealth management. These efforts are backed by the bank's extreme focus on customer service, which in Canada has helped TD establish itself as the No. 1 or No. 2 player in nearly all retail banking product lines.

Thanks to its scale and breadth of sticky services, TD enjoys one of the largest low-cost deposit bases in Canada. In fact, personal and commercial deposits, which are paid a very low rate of interest, account for nearly 70% of the bank's funding mix, ensuring TD's lending operations enjoy a healthy spread even if long-term loan rates remain stubbornly low.

Besides its focus on stable retail businesses and growing a base of low-cost deposits, TD's balance sheet is managed conservatively, too. The bank's capital levels are maintained well above minimum regulatory requirements to ensure the firm can weather any economic storm and remain solvent (i.e. not need a bailout). TD also earns an industry-leading A credit rating from Standard & Poor's.

Overall, as one of Canada's largest banks, Toronto-Dominion enjoys an entrenched and profitable market position created by a favorable regulatory environment. The bank has developed numerous competitive advantages over its many years in operation, including industry-leading economies of scale, one of the lowest cost structures in the world, massive distribution channels, and conservative risk management practices.

However, Toronto-Dominion is still a bank and has several risk factors that investors need to understand before investing.

Key Risks

First, note that as a Canadian company, TD pays its dividend in Canadian dollars. This creates some currency risk in that a stronger U.S. dollar might decrease the effective dividend amount for American shareholders, at least in the short term (each quarterly dividend is converted from Canadian dollars to U.S. dollars when it is paid, based on prevailing exchange rates).

In addition, like all Canadian stocks, U.S. TD investors face a 15% foreign dividend tax withholding. Tax treaties between the U.S. and Canada allow U.S. investors to potentially recoup this withholding, but it can be a complicated and lengthy amount of paperwork at tax time.

As for risks to the bank itself, there are several to consider. First, like all banks, the company's profits can be cyclical and largely tied to the Canadian and U.S. economies.

For example, in 2009 Toronto-Dominion experienced a 19% drop in revenue and a 30% decline in earnings. However, the bank remained profitable (with a healthy return on equity of 14%), and the dividend was easily maintained, though frozen for one year.

TD's strong balance sheet, culture of conservatism, low-cost deposit base, and diversified mix of retail banking businesses suggest the firm is prepared to ride out the next downturn, whenever it happens. However, investors considering owing any bank must be comfortable with their sensitivity to economic cycles and interest rates. These can be volatile stocks.

The other major risk all banks face is regulatory in nature. Canadian and U.S. regulators can raise banks' capital requirements, potentially lowering their profitability in an effort to reduce systemic risk. While such actions could slow the bank's earnings growth, it would likely further improve its fundamental risk profile.

Closing Thoughts on Toronto-Dominion Bank

Banking is a complex and cyclical industry for dividend investors to navigate. The global banking crisis proved that even large blue-chip banks weren't safe dividend stocks, so many U.S. income investors prefer to shy away from the sector.

However, banking is done differently in Canada, where conservative balance sheets and disciplined underwriting is followed with near-religious zeal. Among Canadian banks, Toronto-Dominion is a standout business thanks to its entrenched market position, substantial low-cost deposit base, and financial conservatism.

Although Toronto-Dominion may have its eyes set on strong growth into the U.S. banking sector, the firm's disciplined corporate culture is likely to persist in America. In other words, TD seems likely to remain a source of safe and growing income for many years to come.