Meredith: 70-plus Years of Uninterrupted Dividends But Facing Dynamic Media Industry

Meredith (MDP) is one of the nation's oldest media and publishing companies, having been founded in 1902 as an agricultural publisher. At its core, Meredith provides consumers with content by leveraging print, digital, mobile, video, and broadcast TV media platforms. Nationally, the firm reaches over 180 million American consumers.

Advertising accounts for a little over half of Meredith's revenue and is driven by selling print ads (22% of firm-wide sales), spot ads on broadcast TV stations (13%), and digital ads across the company's websites (12%).

The rest of Meredith's revenue is primarily derived from consumer related activities such as magazine and book subscriptions (22% of firm-wide sales), retransmission fees from pay-TV providers to access its stations (10%), single copy magazine sales (5%), and licensing deals related to its brands (3%).

Meredith organizes its various media businesses into two segments:

Advertising accounts for a little over half of Meredith's revenue and is driven by selling print ads (22% of firm-wide sales), spot ads on broadcast TV stations (13%), and digital ads across the company's websites (12%).

The rest of Meredith's revenue is primarily derived from consumer related activities such as magazine and book subscriptions (22% of firm-wide sales), retransmission fees from pay-TV providers to access its stations (10%), single copy magazine sales (5%), and licensing deals related to its brands (3%).

Meredith organizes its various media businesses into two segments:

- Local Media (27% of sales, 41% of adjusted EBITDA): owns 17 local TV stations, mostly affiliates of CBS, FOX, NBC and ABC. Lucrative retransmission fees generate substantial profits for these stations, which reach 11% of U.S. households. This segment also includes several dozen websites and applications focused on news, sports, and weather-related information.

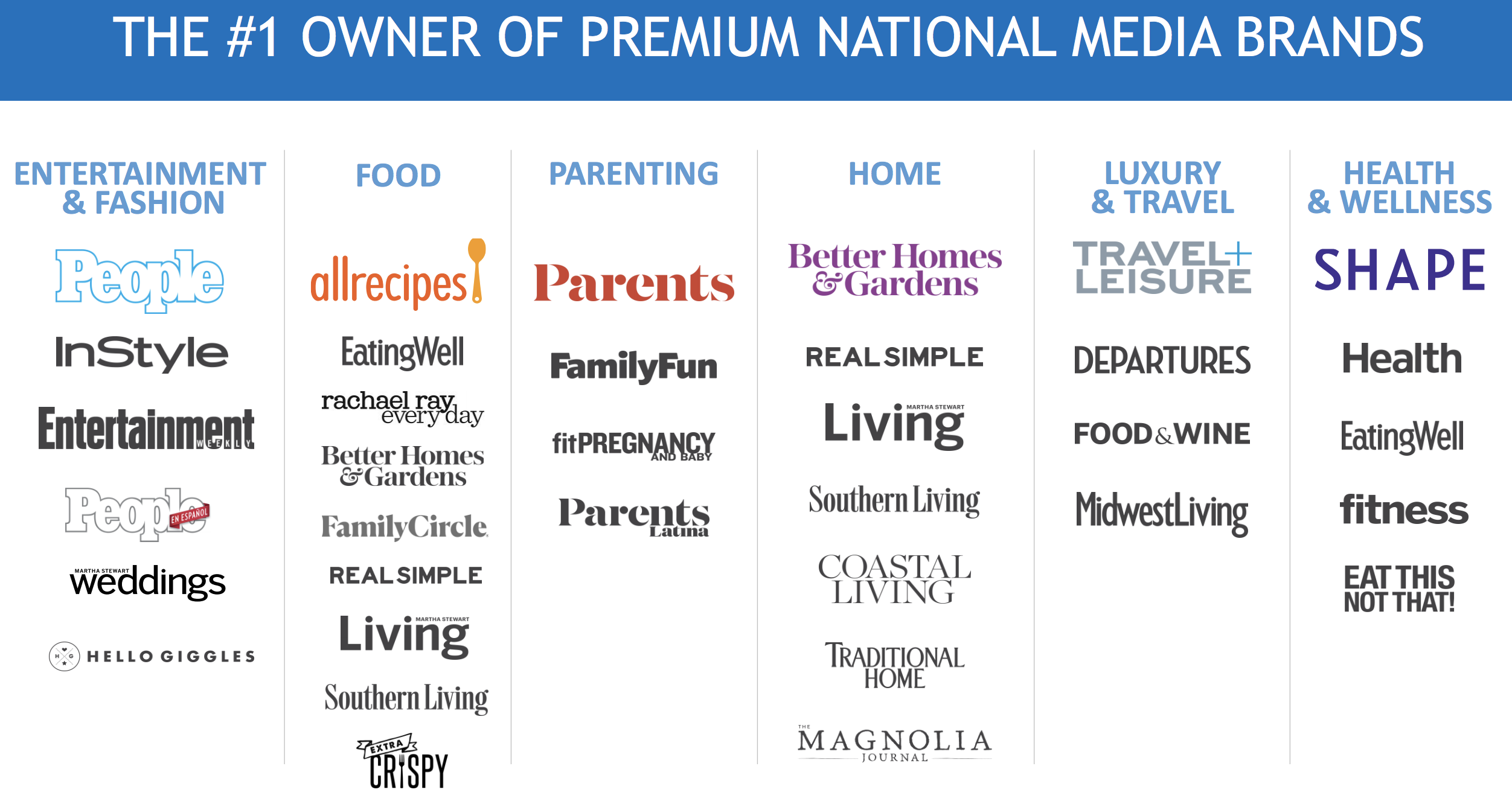

- National Media (73% of sales, 59% of adjusted EBITDA): publishes magazines targeted to women, including titles such as: People, Better Homes & Gardens, Allrecipes, Shape, Southern Living, and Martha Stewart Living. This segment also runs more than 60 websites and over a dozen smartphone applications hosting special interest publications.

Meredith has paid a dividend for 72 consecutive years and increased its dividend for 26 years straight.

Business Analysis

Meredith's wide range of media assets makes the business somewhat difficult to analyze. From print advertising and magazine circulation to and broadcast TV and digital marketing trends, there are many moving parts shaping the firm's future.

Historically, Meredith has adapted to the shifting media landscape by actively managing its content portfolio to keep its offerings relevant for its core audience of women.

On the publishing side of the business, Meredith has developed or acquired many leading magazine brands that have built impressive subscriber bases over time. Many of the firm's top magazines were founded decades ago: Better Homes & Gardens (1922), FamilyCircle (1932), People (1974), Southern Living (1966), Health(1981), Travel + Leisure (1937).

These brands existed well before cable TV and the internet went mainstream. (Less than 60% of U.S. households had cable TV in 1990, and only 600 websites existed in 1993.) With consumers facing limited options to receive content, Meredith's magazine circulation thrived.

As the company's readership grew, Meredith could stay on top of trends and evolve its mix of publishing assets accordingly (usually through acquisitions). The firm also developed an extensive database containing many attributes on its customers, allowing it to target consumers more precisely.

This helped Meredith cross-sell its various magazines across its swelling base of female readers. More eyeballs and data insights also resulted in more interest and higher rates from advertisers, which also had fewer channels to use to reach consumers before the digital age took off.

Today Meredith is the No. 1 U.S. magazine operator and boasts a paid subscriber base of more than 40 million, which generates about 20% of company-wide revenue. Impressively, the company reaches 90% of all women in the U.S., including more than 80% of all Millennial women and three-quarters of all Latinas, according to management.

Historically, Meredith has adapted to the shifting media landscape by actively managing its content portfolio to keep its offerings relevant for its core audience of women.

On the publishing side of the business, Meredith has developed or acquired many leading magazine brands that have built impressive subscriber bases over time. Many of the firm's top magazines were founded decades ago: Better Homes & Gardens (1922), FamilyCircle (1932), People (1974), Southern Living (1966), Health(1981), Travel + Leisure (1937).

These brands existed well before cable TV and the internet went mainstream. (Less than 60% of U.S. households had cable TV in 1990, and only 600 websites existed in 1993.) With consumers facing limited options to receive content, Meredith's magazine circulation thrived.

As the company's readership grew, Meredith could stay on top of trends and evolve its mix of publishing assets accordingly (usually through acquisitions). The firm also developed an extensive database containing many attributes on its customers, allowing it to target consumers more precisely.

This helped Meredith cross-sell its various magazines across its swelling base of female readers. More eyeballs and data insights also resulted in more interest and higher rates from advertisers, which also had fewer channels to use to reach consumers before the digital age took off.

Today Meredith is the No. 1 U.S. magazine operator and boasts a paid subscriber base of more than 40 million, which generates about 20% of company-wide revenue. Impressively, the company reaches 90% of all women in the U.S., including more than 80% of all Millennial women and three-quarters of all Latinas, according to management.

However, print magazine circulation likely faces secular decline as the world goes digital, making content consumption more convenient and affordable. Print advertising, which accounts for about another 20% of Meredith's revenue, follows circulation trends and has experienced double-digit declines in recent years.

Meredith is responding to these challenges by bolstering its internet presence, focusing more on contractual paid subscriptions rather than advertising, and increasing its productivity via further industry consolidation.

Much of the company's magazine content has already moved online, helping Meredith become a top 10 digital company with 150 million monthly unique visitors to its 50-plus websites. However, digital advertising, while growing, still accounts for less than 15% of Meredith's total revenue.

To combat the sluggish pace of growth in publishing, Meredith has turned to industry consolidation to help lift its profitability, including the firm's $3.2 billion acquisition of struggling publication giant Time in January 2018.

That purchase added magazines and brands such as People, InStyle, Real Simple, Southern Living, and Travel + Leisure. Management believes Meredith can extract $565 million in cost savings from this purchase within several years by eliminating duplicate overhead expenses, gaining more leverage over vendors, and squeezing out other efficiencies.

For context, $565 million represents nearly 20% of Meredith's total revenue, providing significant opportunity to lift the firm's cash flow generation. Meredith also hopes to leverage its data and know-how to improve the advertising performance of Time's properties. However, the success of the deal also hinges on the future growth trajectory of magazine subscriptions.

Outside of magazines and publishing, nearly half of Meredith's cash flow is driven by the success of its TV broadcasting business, which the firm started in 1948 to expand its advertising business.

Meredith's 17 TV stations are concentrated mostly in attractive areas, with 13 in the nation's top 50 markets. Five of its stations also operate in duopoly markets, and 10 of them have No. 1 or No. 2 market share positions in morning or late night news.

Strong ratings support the advertising revenue these stations generate, but a significant amount of their profits is derived from retransmission fees paid by cable and satellite TV operators such as AT&T and Comcast.

Broadcasters including Meredith have benefited from a 1990s provision in federal copyright law requiring pay-TV providers to negotiate retransmission-consent fees to carry their stations, according to the New York Times. With online ads taking share from TV ads, broadcasters have increasingly relied on these high-margin fees for growth.

Overall, Meredith seems likely to remain a cash cow by focusing on core local TV markets, national magazine brands, recurring subscriptions, cross selling products (multiple revenue streams), and cost-cutting synergies from the Time acquisition.

However, the fast-moving media landscape, coupled with the Time acquisition, create several meaningful risks that could get the firm into trouble.

Key Risks

First, Meredith's purchase of Time added a massive amount of debt to the firm's balance sheet. In fact, the company's leverage ratio tripled, which is why today Meredith has a B+ junk credit rating from Standard & Poor's.

While management has a good track record of integrating acquisitions, Time is a large and complex business facing various growth challenges. There's risk that the environment continues changing faster than management expects, jeopardizing the firm's ability to quickly deleverage and hit its cost synergy target.

The company already delivered disappointing cash flow guidance for fiscal 2020 due to the poor performance of Time's legacy assets, straining its financial health. Management needs to demonstrate that Meredith can return to profitable growth.

While management has a good track record of integrating acquisitions, Time is a large and complex business facing various growth challenges. There's risk that the environment continues changing faster than management expects, jeopardizing the firm's ability to quickly deleverage and hit its cost synergy target.

The company already delivered disappointing cash flow guidance for fiscal 2020 due to the poor performance of Time's legacy assets, straining its financial health. Management needs to demonstrate that Meredith can return to profitable growth.

The acquisition of Time is meant to gradually make Meredith's business less dependent on cyclical advertising revenue and more focused on high-margin consumer subscriptions, but the firm's largest source of sales is still advertising.

As a result, Meredith's earnings track the health of the U.S. economy. While this isn't a risk to the company's long-term earning power, a recession that occurs in the next few years could strain Meredith's business given its debt load and need to grow its cash flow. While that's unlikely to threaten the dividend, the stock could be more volatile than usual.

As a result, Meredith's earnings track the health of the U.S. economy. While this isn't a risk to the company's long-term earning power, a recession that occurs in the next few years could strain Meredith's business given its debt load and need to grow its cash flow. While that's unlikely to threaten the dividend, the stock could be more volatile than usual.

Looking further out, Meredith faces challenges with some of its core businesses, such as the retransmission fees generated by its local TV stations. Most of these contracts are up for renewal every few years, and fees could slow or even decline as local TV faces rising pressure from the cord-cutting trend. Parent networks such as CBS could also demand higher network fees from Meredith, squeezing profits.

Due to some of these potential challenges and management's desire to focus on its most profitable media properties, Meredith is rumored to be exploring a sale of its broadcast stations. Reuters states a sale could fetch more than $2 billion, or nearly half of the company's enterprise value.

In such a scenario, Meredith's remaining business would be completely driven by its print and digital media assets, for better or worse. The firm would probably try to maintain its current dividend given its track record and the majority voting power held by Meredith's founding family.

However, Meredith's new earning power would be much lower, creating some uncertainty. It's too soon to say what could happen, but management has strongly denied these rumors when asked about them on earnings calls.

However, Meredith's new earning power would be much lower, creating some uncertainty. It's too soon to say what could happen, but management has strongly denied these rumors when asked about them on earnings calls.

Finally, the changing nature of advertising itself will always represent a long-term risk to Meredith. Back in the 1950s magazine advertising reigned supreme, due to high subscriber penetration and a lack of a more targeted method of competition.

However, today online advertising is the fastest-growing part of the industry, a trend that seems unlikely to end anytime soon. In recent years even Meredith's top magazines have experienced meaningful declines in advertising revenue.

Management is focusing on growing Meredith's digital sales, but the continued proliferation of streaming media services, mobile video, and other forms of content and targeted advertising threaten the relationships the firm has with its audience and advertisers.

Management is focusing on growing Meredith's digital sales, but the continued proliferation of streaming media services, mobile video, and other forms of content and targeted advertising threaten the relationships the firm has with its audience and advertisers.

Conclusion

Meredith has long been one of the best-run and most adaptable traditional media companies in America. Decades of acquiring and launching premium-branded magazines, plus dominant market share in its core TV stations, have served investors well, resulting in 26 consecutive years of dividend growth.

Meredith's long-term strategy of further consolidating the traditional media industry by acquiring Time, combined with an increased focus on digital media interaction and targeted online advertising, appears reasonable. However, the media industry continues to change at an accelerating pace.

Meredith will be burdened with high debt levels for the next few years and could continue facing integration challenges with Time. That likely means slow dividend growth and higher than usual execution risk over the next year or two. And in the long term, Meredith will likely face ever greater competition from giant and well-capitalized rivals in online ad sales, including Google, Facebook, and Amazon.

While the company has opportunities to continue creating shareholder value for years to come, conservative investors may want to give management more time to stabilize the performance of Time, deleverage the balance sheet, and demonstrate that Meredith can profitably grow its digital media assets to more than offset the headwinds pressuring traditional print magazines.