Vodafone's Outlook Remains Cloudy

Vodafone's (VOD) dividend has scored at the absolute bottom rung (41) of our "Borderline Safe" Dividend Safety Score category throughout all of 2018.

Companies on this part of our scale often find themselves in a murky area, and Vodafone is no exception.

In fact, a number of analysts have been speculating about a potential dividend cut at Vodafone. With the stock's dividend yield sitting near 10%, the market seems to be pricing in that possibility as well.

Let's take a closer look at the key issues clouding Vodafone's dividend safety to better understand the firm's risk profile.

From what I can tell, investors' have three primary concerns:

1) Intensifying competition in certain European countries

2) Increased skepticism about Vodafone's planned acquisition of Liberty Global

Companies on this part of our scale often find themselves in a murky area, and Vodafone is no exception.

In fact, a number of analysts have been speculating about a potential dividend cut at Vodafone. With the stock's dividend yield sitting near 10%, the market seems to be pricing in that possibility as well.

Let's take a closer look at the key issues clouding Vodafone's dividend safety to better understand the firm's risk profile.

From what I can tell, investors' have three primary concerns:

1) Intensifying competition in certain European countries

2) Increased skepticism about Vodafone's planned acquisition of Liberty Global

3) Vodafone's expected jump in leverage following its Liberty Global purchase

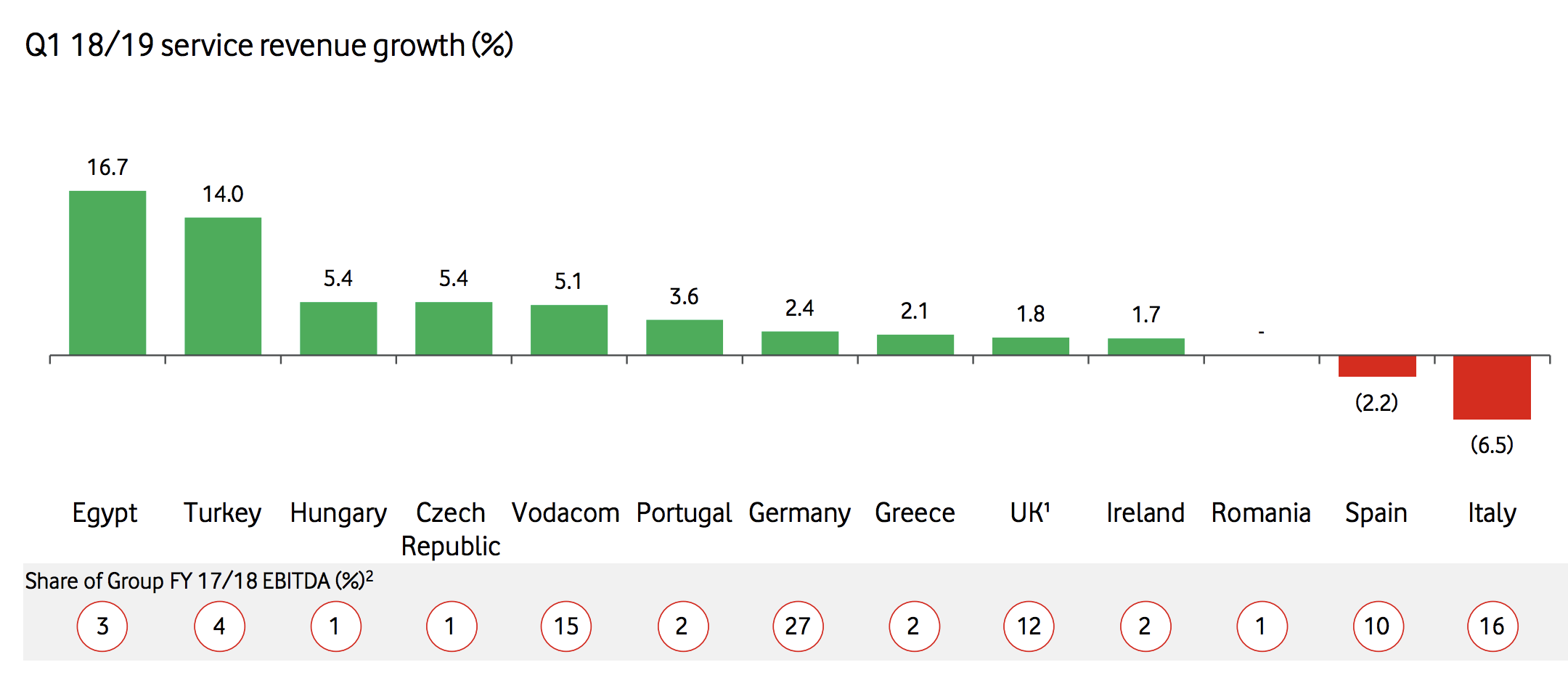

Starting with the first point, Spain and Italy combine to account for around 25% of Vodafone's EBITDA. Unlike the U.S. wireless market, which is an oligopoly, European regulators want to maintain a more fragmented marketplace to drive greater price competition.

The competitive landscape in Spain and Italy has especially intensified this year, resulting in Vodafone losing share in these major markets. Here were CEO Nick Read's comments on Spain:

Starting with the first point, Spain and Italy combine to account for around 25% of Vodafone's EBITDA. Unlike the U.S. wireless market, which is an oligopoly, European regulators want to maintain a more fragmented marketplace to drive greater price competition.

The competitive landscape in Spain and Italy has especially intensified this year, resulting in Vodafone losing share in these major markets. Here were CEO Nick Read's comments on Spain:

"Yeah, look the situation in Spain has really been triggered by Orange wholesaling and doing the strategic relationship with Masmovil, that basically has now created a very credible fourth player in the marketplace in the value segment. And that has shifted the market. So we said to ourselves as a management team, this isn't going to be a short-term phenomenon. We have to reposition our business."

The capital intensity of the telecom industry results in most companies using high amounts of debt to run their businesses, so maintaining steady EBITDA is critical. Should headwinds in Spain and Italy intensify, Vodafone could have a more challenging time funding its dividend while also responsibly positioning itself to service its sizable debt load.

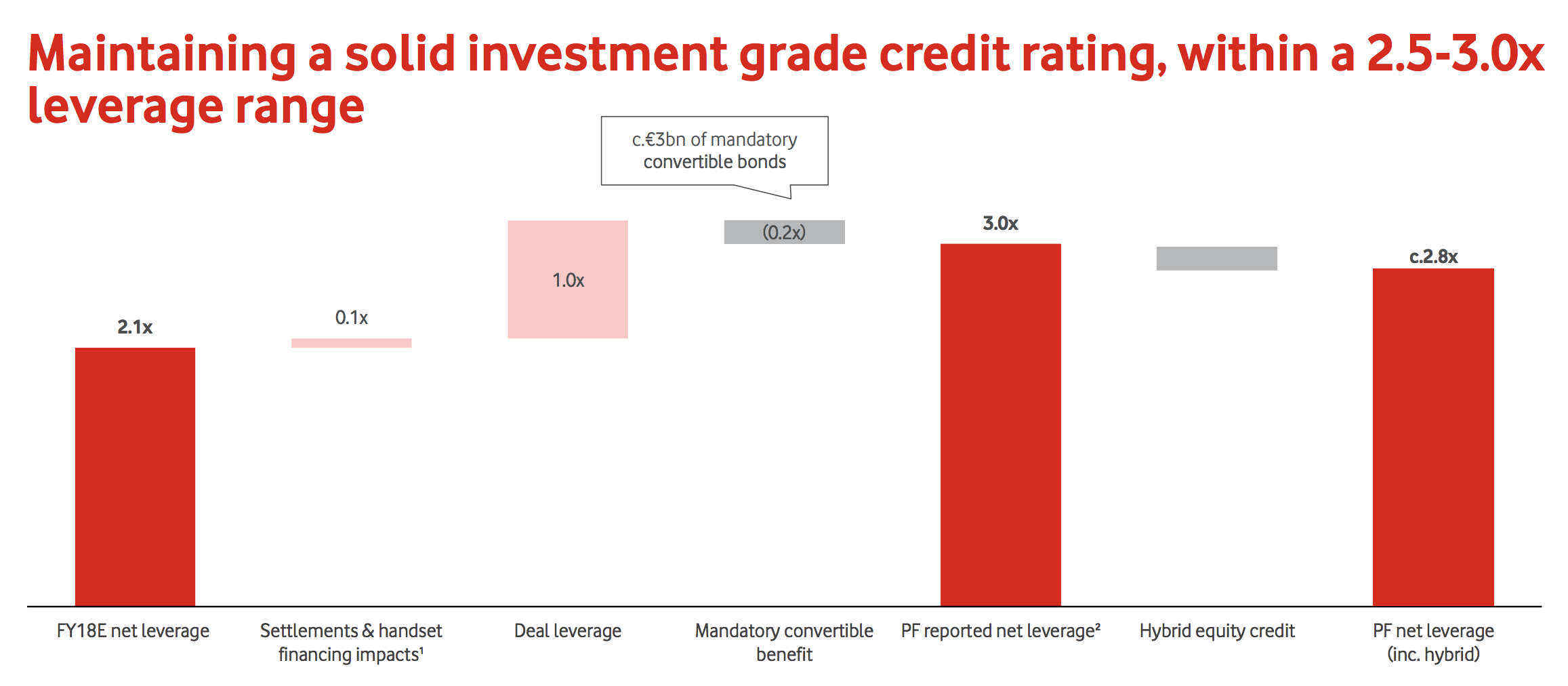

That brings us to Vodafone's planned acquisition of Liberty Global's cable TV and broadband internet businesses in Germany, the Czech Republic, Hungary and Romania. This deal, announced in May 2018, is valued at close to $21 billion, so it will meaningful increase Vodafone's leverage assuming it gains regulatory approval and closes as planned in mid-2019.

Specifically, using management's calculations, the company's net leverage will rise from 2.1x to about 3.0x. As a result, Moody's has placed the company's solid Baa1 investment grade credit rating on review for a downgrade.

Higher leverage, especially from a large acquisition, is not an uncommon path to an eventual dividend cut. There is simply less margin for error if anything goes wrong, including deal synergies, capital market access, and the performance of legacy businesses.

On that note, I believe investors are also viewing the company's acquisition of Liberty Global with an increasingly critical eye. Liberty Global's operations consisted primarily of broadband internet and cable TV, whereas Vodafone focuses mostly on wireless services today.

Assuming the deal closes by mid-2019, Vodafone's mix of internet and TV services will represent 35% of European pro-forma revenues, up from 29% prior to the transaction.

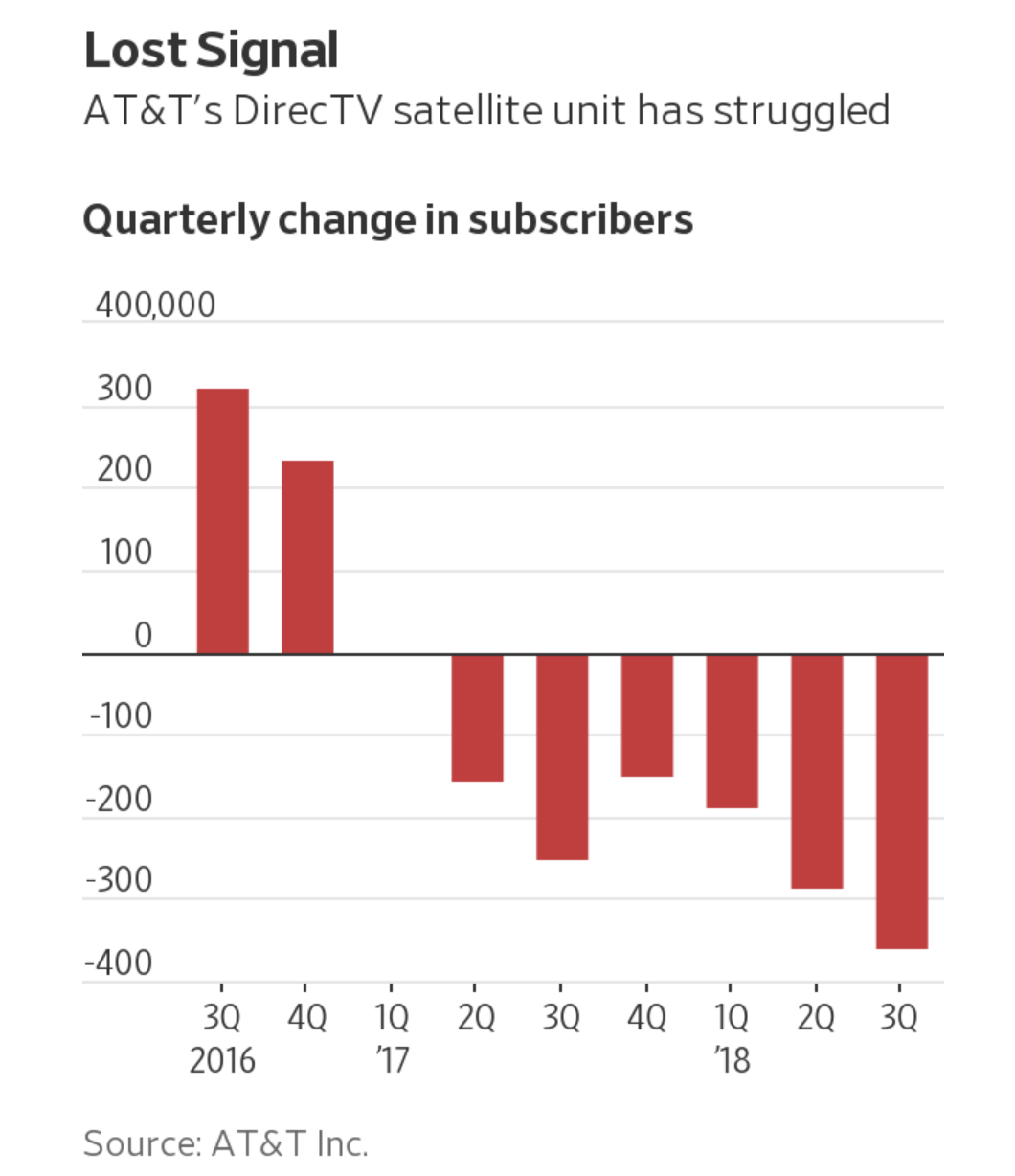

In addition to major cost synergies, Vodafone hopes it will be able to cross-sell Liberty Global's fixed broadband, telephony, and TV offerings to its existing customers, while also cross-selling its mobile services to Liberty Globals' customers. In some ways, this sounds like the bundling strategy AT&T envisioned when it acquired DirecTV in 2014.

And that's likely part of the pressure on Vodafone's stock. Traditional TV is losing share to streaming services, so there's risk that Vodafone is buying an asset at its peak. As you can see below, AT&T's DirecTV business has seen subscriber losses accelerate in recent quarters. Liberty Global's TV business seems unlikely to be immune from this trend.

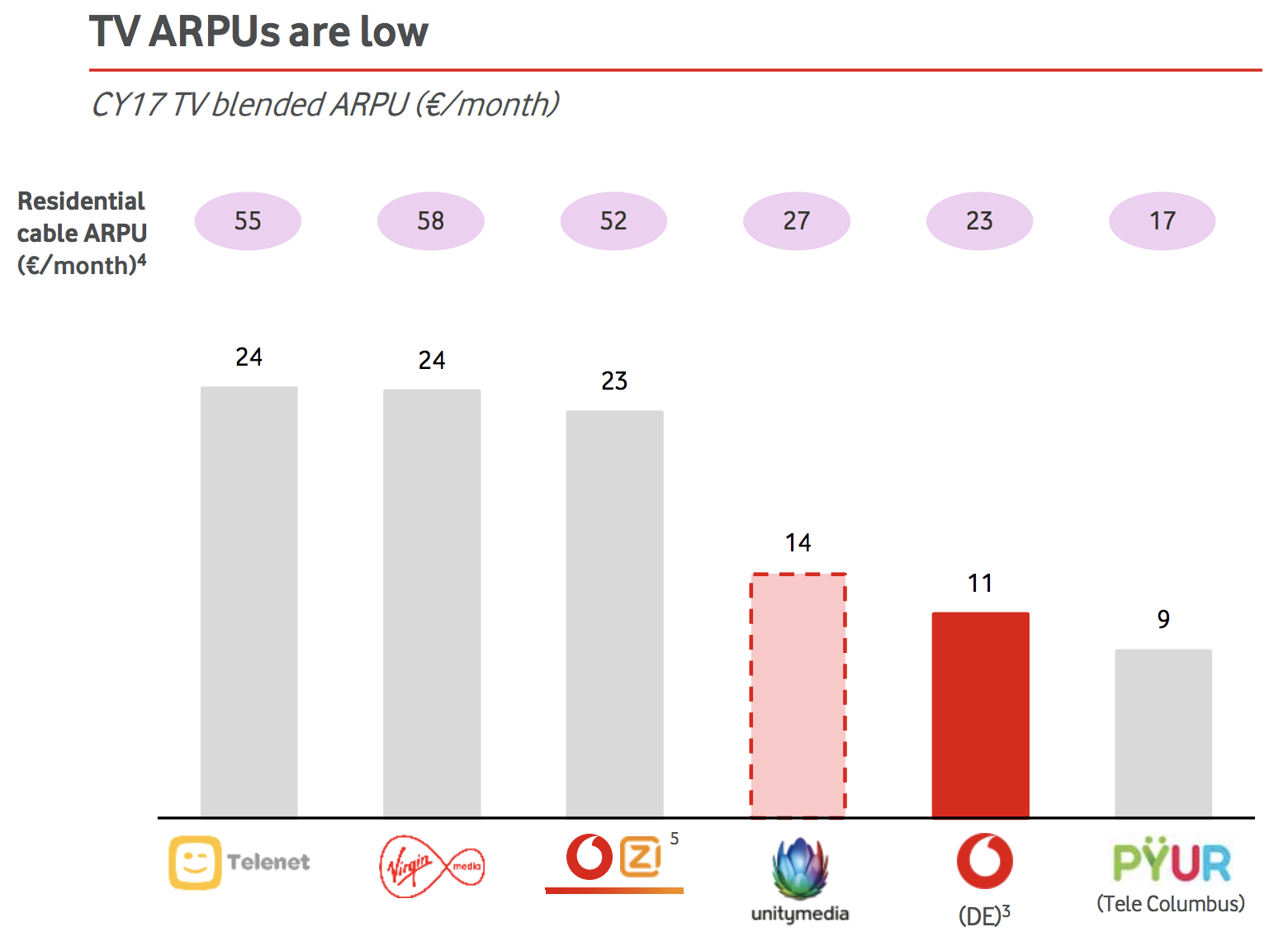

Management notes that Liberty Global's TV average revenue per user (ARPU) is lower than that of most other cable operators, hopefully reducing cord-cutting risk. However, traditional TV's weakening growth outlook is likely to remain an overhang on Vodafone's stock. After the Liberty Global deal, Vodafone will be one of the largest TV players in Europe.

So Vodafone's future cash flow could be facing some challenges in Spain and Italy, as well as from the Liberty Global deal should synergies not materialize as expected, or if cable TV subscriber growth takes a turn for the worse.

The company must also budget for the costly infrastructure investments needed to maintain the competitiveness of its wireless network, especially with 5G right around the corner.

Management is certainly aware of these risks, which is why it's so important that the company deleverages as quickly as possible following the Liberty Global deal.

With Vodafone's dividend amounting to around $4.5 billion per year (compared to more than $35 billion of debt), reducing the payout is certainly a lever management could pull to accelerate deleveraging and create more breathing room for big-ticket investments the firm's network requires.

For now, Vodafone believes it can adequately deleverage while continuing to pay uninterrupted dividends just like it has done for more than 15 consecutive years.

Nick Read took over as the company's CEO in October after previously serving as CFO. He likely does not want to start off his legacy by axing Vodafone's dividend.

While talk is cheap, in recent months his comments have been very supportive of not only the dividend, but also the company's outlook for EBITDA growth and debt reduction.

Here are some highlights:

July 25, 2018 - Earnings Conference Call

San Dhillon, Analyst at Exane BNP Paribas

Hi, guys. My question is on the dividend. The market gives you very little credit for the dividend or, put another way, the market thinks that the current dividend is unsustainable. Is there any point at which you think it’s just better to rebase the dividend to a more prudent pay-out ratio, or at the very least change the composition of the shareholder remuneration? Thank you.

Nick Read, CEO at Vodafone

I think we stand back and we say, really reinforcing, we are on plan from what we communicated in March. In March we communicated that at the midpoint long-term incentive plan we had €17 billion of free cash flow before spectrum. So after dividend distribution, you’re talking about €5 billion of headroom for spectrum, which is significantly above our long term average of €1.2 billion.

We’re reinforcing EBITDA guidance today. That EBITDA guidance is growth going forward. We think digital is a big opportunity to contribute to growth going forward. We’re also actively working the portfolios. So I think we have a number of levers on top of also the Liberty Global transaction being accretive to free cash flow over time. We feel that we’re in a good position regarding the dividend, and we remain committed to that.

Then, on September 13, 2018, CEO Nick Read spoke at a Goldman Sachs conference and again touched on Vodafone's dividend:

Goldman Sachs Analyst

And it brings us onto the dividends. And so as we look at the Liberty deal and potential that increases your, your gearing and the direction of travel of your, your top line, some investors have got nervous about sustainability of your dividend, the dividend cover and the dividend growth. I wondered if you could talk about your confidence in, in covering and delivering the dividends.

Nick Read, CEO at Vodafone

Yeah, I think it's important to understand how the board thinks about the dividend cause the board owns the policy. And the board has a very specific view. They look at that we, we every year announce how much the cumulative free cash flow long-term incentive plan of management is. So, the midpoint of that range is €17 billion for the next 3 years. So our incentives are tied to delivering €17 billion plus or minus either side in terms of our bonuses and performance.

So they look at €17 billion. Then they say, okay, the dividend is €4 billion a year. So let's call that €12, I'm rounding €12. So they say, okay, so you got €5 billion of head room to cover spectrum, because that free cash flow is before spectrum. €5 billion to cover spectrum.

What is the long-term average of spectrum payments? €1.2 billion, so 3 years, €3.6. So they look at it as we are covered...Clearly with €17 billion, in a year one guidance of greater than €5.2, there's growth in the free cash flow profile. And that's driven by EBITDA growth, going back to the conversation we had about absolute costs coming down on a multiyear basis. So they say the dividend is covered. We're confident in the dividend policy that we have.

And that remains the case. Sometimes there's the confusion with investors about the fact that, yeah, but hold on a minute, your dividend -- sorry your spectrum cost this year and next year is not going to be €1.2 because of 5G auction.

And my point to investors is, that is a leverage balance sheet issue not a dividend policy issue. You should separate the two. Look at long-term average for spectrum. Then if you look at leverage, can I cover leverage?

Just in the same breath cause it's better, you did the Liberty. We did the Liberty Global transaction. We said we are moving to 2.5 to 3 times leverage, given the profile and the stability and makeup of our business moving forward. The transaction took us to the upper end of that.

When we were setting the 3 times goal or target, we said to ourselves, we understood the profile of 5G spectrum this year and next year. That was taken into account. And I would say that spectrum auctions are broadly going in line with our expectations, but it's, you know, we've still got some to go.

Then we said we will de-lever over time. And de-lever it through two levers. One is obviously the expansion of EBITDA, which I talked about. And the other one is obviously disposal of assets, which you know we're actively working the portfolio. And as I said about utilization of assets, of which you know towers is also a consideration going forward.

To summarize, management appears to remain confident in the company's ability to hit its goal of generating €17 billion of free cash flow over the next three years. If successful, Vodafone's dividend will be safely covered, especially since management has already baked in higher 5G spending.

However, there is admittedly not much wiggle room, and little cash flow will be retained for debt reduction after paying dividends. Should EBITDA stall or even decline, pressure on the dividend will only rise.

Management has some levers to pull, including €8 billion of addressable cash costs that have been identified and can be attacked, plus divestitures of non-core assets.

In fact, CEO Nick Read said he would entertain the idea of selling some of Vodafone's infrastructure assets to help with deleveraging efforts. The firm's towers, for example, are estimated to be worth €12 billion, which would certainly go a long way towards attacking Vodafone's €30-plus billion pile of debt.

Vodafone next reports earnings on November 13. Investors will no doubt be tuned in to the firm's results in Italy and Spain, along with the company's overall free cash flow generation. A dividend cut still seems unlikely at this stage, especially with the Liberty Global acquisition remaining several quarters away from gaining regulatory approval and closing.

With that said, hopefully you understand why Vodafone's "Borderline Safe" Dividend Safety Score is hanging by a thread. With the dividend consuming the bulk of Vodafone's free cash flow, plus rising leverage from the Liberty Global deal, the capital-intensive nature of its businesses, and very competitive telecom markets in Europe, there is little room for error.

As conservative income investors, we prefer to stick with financially stronger businesses that score closer to 60 or higher for Dividend Safety. Regardless, Vodafone shareholders should make sure they are comfortable with these risks, as well as the size of their position and their overall portfolio diversification.

The next year could be volatile for Vodafone as investors learn more about the company's health and ability to remain committed to its dividend.