Implications of Enbridge's Buyout of Its MLPs

Over the past few years the midstream industry, especially master limited partners (MLPs), has experienced a bear market that has disrupted its standard business model.

As a result, various companies and MLPs have had to adapt, including by simplifying their business models via mergers and eliminations of incentive distribution rights.

As a result, various companies and MLPs have had to adapt, including by simplifying their business models via mergers and eliminations of incentive distribution rights.

Enbridge (ENB) recently announced a $10.5 billion buyout of its MLPs, Enbridge Energy Partners (EEP), Enbridge Energy Management (EEQ), Enbridge Income Fund Holdings (EBGUF), and Spectra Energy Partners (SEP).

Let's take a look at why management believes this move is necessary and what it means for investors in both Enbridge itself and its MLPs.

Let's take a look at why management believes this move is necessary and what it means for investors in both Enbridge itself and its MLPs.

Why Enbridge is Buying Out Its MLPs

Enbridge set up its MLPs (and acquired Spectra Midstream Partners during its 2016 buyout of Spectra Energy for $28 billion) primarily to serve as funding vehicles to help it expand its midstream infrastructure, which is already among the largest in North America.

This includes a $17 billion growth pipeline of projects that Enbridge is attempting to complete by 2020. The MLPs would raise debt and equity capital from investors attracted to high and growing yields, backed by long-term contracted and volume committed cash flow that was largely insensitive to volatile commodity prices.

This includes a $17 billion growth pipeline of projects that Enbridge is attempting to complete by 2020. The MLPs would raise debt and equity capital from investors attracted to high and growing yields, backed by long-term contracted and volume committed cash flow that was largely insensitive to volatile commodity prices.

However, in March 2018 the Federal Energy Regulatory Commission (FERC), which regulates interstate pipelines in the U.S., made an important tax rule change. Specifically, FERC disallowed MLPs from taking an income tax allowance on interstate cost of service contracts on the pipelines it regulates. On July 18, FERC revised its policy change to minimize the cash flow disruption to MLPs. However, the damage has largely been done.

Specifically, Enbridge's MLPs all trade at substantially lower unit prices, making it extremely costly to raise capital by issuing new units in most cases.

As a result, Enbridge no longer believes that its MLPs can continue being a viable way of funding for its ambitious future growth plans. This, combined with the dampened tax benefits of MLPs, is why in May 2018 Enbridge offered to buy out the remaining portions of these partnerships that it didn't already own.

After negotiating with each MLP's conflict committee Enbridge increased its acquisition offers, which will be paid entirely with its own stock (other than a small cash component for the fund investors).

As a result, Enbridge no longer believes that its MLPs can continue being a viable way of funding for its ambitious future growth plans. This, combined with the dampened tax benefits of MLPs, is why in May 2018 Enbridge offered to buy out the remaining portions of these partnerships that it didn't already own.

After negotiating with each MLP's conflict committee Enbridge increased its acquisition offers, which will be paid entirely with its own stock (other than a small cash component for the fund investors).

By the end of 2018 the firm's MLP investors will receive the following amount of Enbridge shares for each MLP unit they own:

- Spectra Energy Partners: 1.111 (9.8% increase from May proposal)

- Enbridge Energy Partners: 0.335 (8.7% increase from May proposal)

- Enbridge Energy Management: 0.335 (8.7% increase from May proposal)

- Enbridge Income Fund Holdings: 0.735 plus 0.45 CAD per share cash (11.7% increase from May proposal)

But what exactly does this major corporate structure shake up mean for investors in these MLPs and Enbridge itself?

What the Buyout Means For Investors In Enbridge Energy Partners and Spectra Energy Partners

There are two important implications for investors in Spectra Energy Partners and Enbridge Energy Partners.

First, this MLP rollup means unitholders will effective be faced with a distribution cut. That's because Enbridge shares yield about 6% today compared to 8% for Spectra and nearly 13% for Enbridge Energy Partners.

First, this MLP rollup means unitholders will effective be faced with a distribution cut. That's because Enbridge shares yield about 6% today compared to 8% for Spectra and nearly 13% for Enbridge Energy Partners.

Another negative is that because Enbridge is a corporation buying its MLPs, its buyout will be a taxable event. In other words, the tax liabilities MLP investors have accrued over the years (MLP distributions classified as a return of capital, which most of them are, lower your cost basis and you pay capital gains taxes) will have to be paid once this merger is complete.

Thus long-term Spectra and Enbridge Energy Partners investors who have low cost bases could face significant tax bills in April 2019. Meanwhile, investors who bought the MLPs at much higher prices are still sitting on potentially large unrealized losses that might takes years to recover from.

The Specra Energy Partners deal is a sure thing at the current offer since Enbridge holds sufficient number of SEP common units to approve the merger. However, Enbridge Energy Partners unit holders will vote sometime later this year to approve the merger.

It's possible they reject Enbridge's terms in an effort to sweeten the deal, in which case it could make sense to hold your units. However, no one can predict what will happen, and since Enbridge has already sweetened its offer once and EEP's board and special committee have unanimously approved it, it seems unlikely that unit holders will reject the offer.

So investors in these MLPs don't have many great options. They will face a tax consequence whether they sell their units now or hold until the merger closes. Either way, the real question is if they want to end up owning shares in Enbridge or move their money into a different business altogether.

Thus long-term Spectra and Enbridge Energy Partners investors who have low cost bases could face significant tax bills in April 2019. Meanwhile, investors who bought the MLPs at much higher prices are still sitting on potentially large unrealized losses that might takes years to recover from.

The Specra Energy Partners deal is a sure thing at the current offer since Enbridge holds sufficient number of SEP common units to approve the merger. However, Enbridge Energy Partners unit holders will vote sometime later this year to approve the merger.

It's possible they reject Enbridge's terms in an effort to sweeten the deal, in which case it could make sense to hold your units. However, no one can predict what will happen, and since Enbridge has already sweetened its offer once and EEP's board and special committee have unanimously approved it, it seems unlikely that unit holders will reject the offer.

So investors in these MLPs don't have many great options. They will face a tax consequence whether they sell their units now or hold until the merger closes. Either way, the real question is if they want to end up owning shares in Enbridge or move their money into a different business altogether.

What the Buyout Means For Enbridge Investors

Enbridge made the difficult decision to buy out its MLPs because these mergers will provide the firm with numerous benefits that will hopefully help it grow its cash flow and dividend at a healthier and more sustainable pace.

Specifically, Enbridge has raised its dividend for 23 consecutive years (including 2018's 10% increase), at an average rate of 11% annually. Management is guiding for 10% dividend growth in 2019 and 2020 as well, meaning that Enbridge is one of the highest-yielding and fastest-growing dividend stocks in the market.

Specifically, Enbridge has raised its dividend for 23 consecutive years (including 2018's 10% increase), at an average rate of 11% annually. Management is guiding for 10% dividend growth in 2019 and 2020 as well, meaning that Enbridge is one of the highest-yielding and fastest-growing dividend stocks in the market.

There are three primary benefits to Enbridge from this merger. First, the FERC rule change announced earlier this year only applies to MLPs. Thus by bringing all of its assets under its corporate umbrella, Enbridge will neutralize the negative impact to its cash flow from the FERC rule change.

The second benefit is that Moody's has said it will upgrade the company's credit rating following the merger, which will further strengthen Enbridge's industry-leading BBB+ credit rating. That in turn will help the firm maintain low borrowing costs to fund future growth, even if long-term interest rates should rise.

The second benefit is that Moody's has said it will upgrade the company's credit rating following the merger, which will further strengthen Enbridge's industry-leading BBB+ credit rating. That in turn will help the firm maintain low borrowing costs to fund future growth, even if long-term interest rates should rise.

Finally, Enbridge will now retain all of the cash flow generated by its assets rather than sharing the profits with its former MLPs. This allows the firm to pursue a self-funding business model beyond 2020 when its current growth backlog of projects will be complete, reducing Enbridge's risk profile by lessening its dependence on favorable conditions in capital markets. It's also worth noting that funding for Enbridge's current slate of growth projects has been obtained or will be shortly.

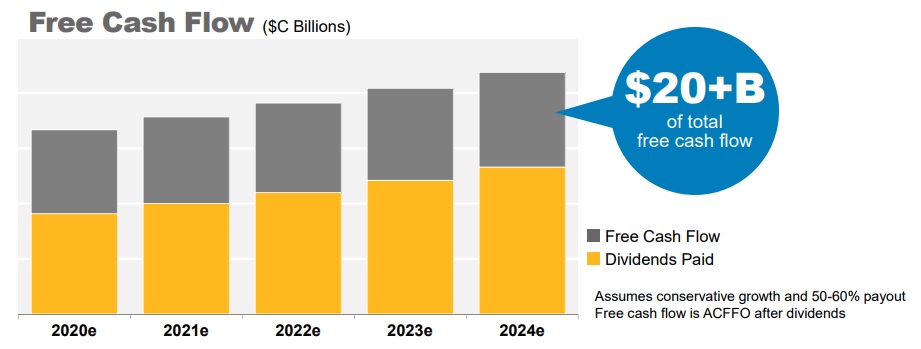

Ultimately, Enbridge plans to maintain a 55% adjusted cash flow from operations (ACFFO) payout ratio. That will still allow the business to grow its dividend at a strong pace but also allows Enbridge to retain over 20 billion CAD ($15.5 billion) in cash flow between 2020 and 2024.

Ultimately, Enbridge plans to maintain a 55% adjusted cash flow from operations (ACFFO) payout ratio. That will still allow the business to grow its dividend at a strong pace but also allows Enbridge to retain over 20 billion CAD ($15.5 billion) in cash flow between 2020 and 2024.

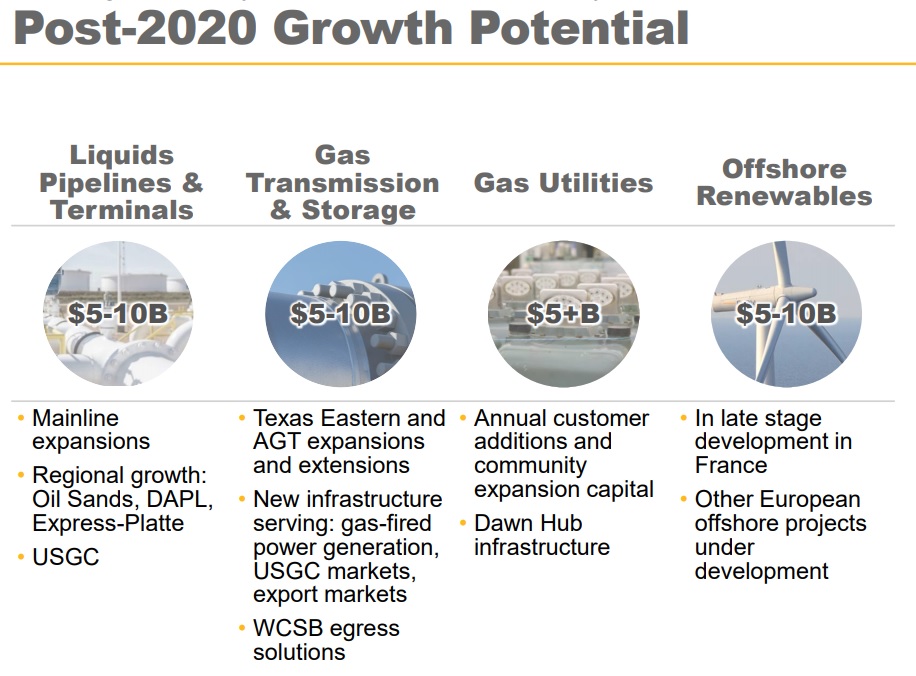

This money can be used to internally fund more growth projects in the years ahead, which will likely be driven by the immense need for new North American energy infrastructure that's coming in future.

For example, by 2035 close to $800 billion in new gas & oil infrastructure will be needed to support America's fracking boom, according to the Interstate Natural Gas Association of America. That figure doesn't include Canadian infrastructure needs to support that country's growing oil & gas production.

For example, by 2035 close to $800 billion in new gas & oil infrastructure will be needed to support America's fracking boom, according to the Interstate Natural Gas Association of America. That figure doesn't include Canadian infrastructure needs to support that country's growing oil & gas production.

At the end of the day, the Enbridge MLP merger means that the company will be able to retain about 5 billion CAD in cash flow each year, allowing it to fund the bulk of its future backlog with retained cash.

The remainder will be funded with low cost debt, made possible by Enbridge's strong balance sheet. To put it another way, going forward Enbridge plans to grow without the need to issue new shares, making its long-term growth potential independent of its volatile share price.

The remainder will be funded with low cost debt, made possible by Enbridge's strong balance sheet. To put it another way, going forward Enbridge plans to grow without the need to issue new shares, making its long-term growth potential independent of its volatile share price.

As a result, Enbridge seems likely to become an even safer dividend growth investment in the coming years.

What Should Investors Do Now?

Given the negative implications to its MLP investors, many Enbridge Energy Partner and Spectra Energy Partner unitholders might think the best course of action to sell their units and move on.

However, this isn't necessarily a good long-term move. That's because the tax implications of this deal can't be avoided by selling your units before the buyout closes. When you sell an MLP, for any reason, you will incur the same tax liabilities.

Instead, these investors need to decide if they want to hold their units and accept the Enbridge shares that are coming by the end of the year.

The new, simpler Enbridge should have an even stronger balance sheet, a more conservative business model, and arguably one of the best long-term payout growth profiles in the midstream space. Sometimes doing nothing is the best thing to do.

However, this isn't necessarily a good long-term move. That's because the tax implications of this deal can't be avoided by selling your units before the buyout closes. When you sell an MLP, for any reason, you will incur the same tax liabilities.

Instead, these investors need to decide if they want to hold their units and accept the Enbridge shares that are coming by the end of the year.

The new, simpler Enbridge should have an even stronger balance sheet, a more conservative business model, and arguably one of the best long-term payout growth profiles in the midstream space. Sometimes doing nothing is the best thing to do.