W.P. Carey was founded in 1973 by Bill Carey, who helped to pioneer the triple net lease and sale-leaseback REIT business model. W.P. Carey went public in 1998 as a master limited partnership but converted to a REIT in 2012.

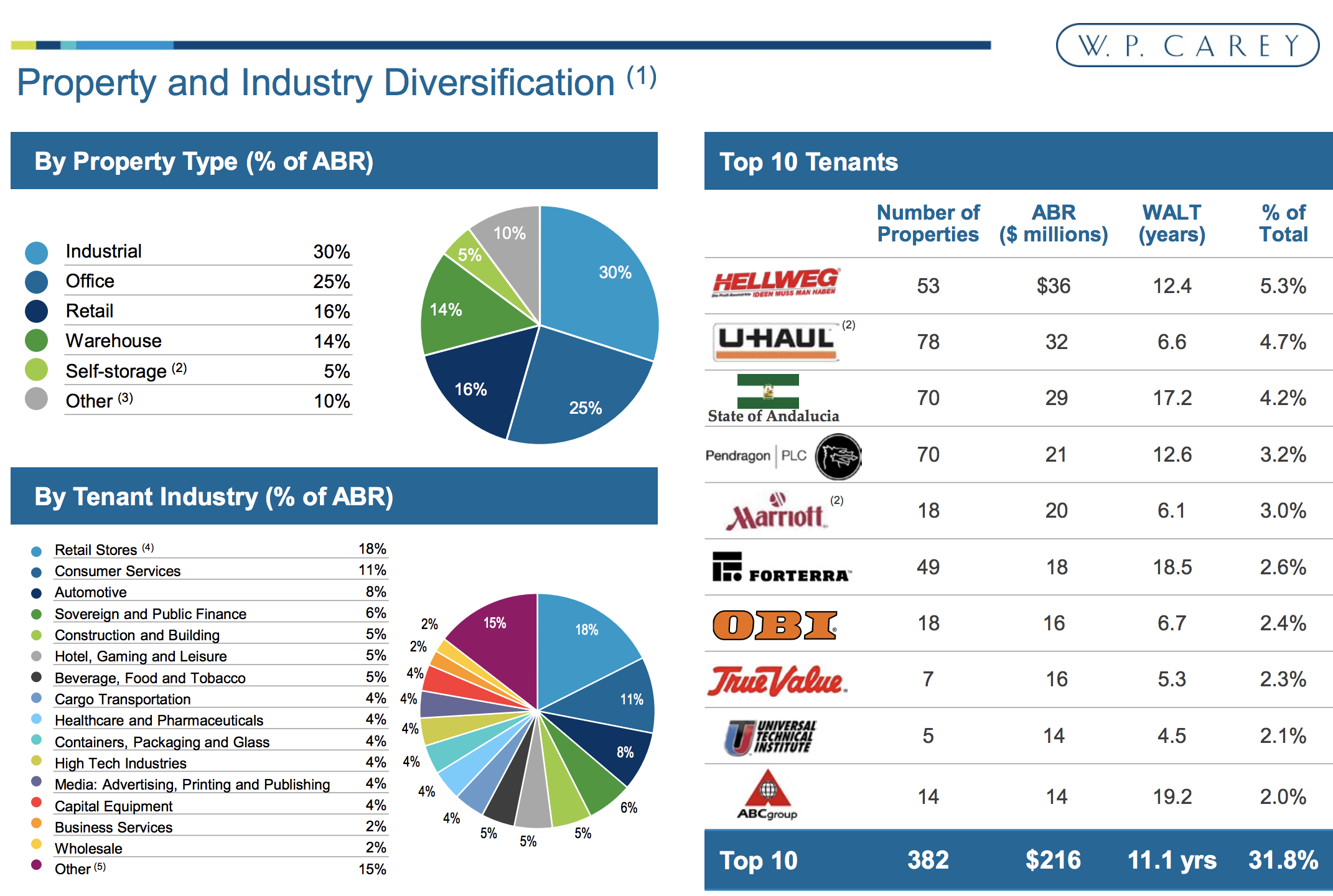

Today the REIT owns 890 properties located in 19 countries around the world. W.P. Carey’s portfolio is broadly diversified across tenants (over 200, none greater than 6% of rent), industries (29), property types (industrial, office, retail, storage), and geographies (35% of sales are outside of the U.S., primarily in Western and Northern Europe).

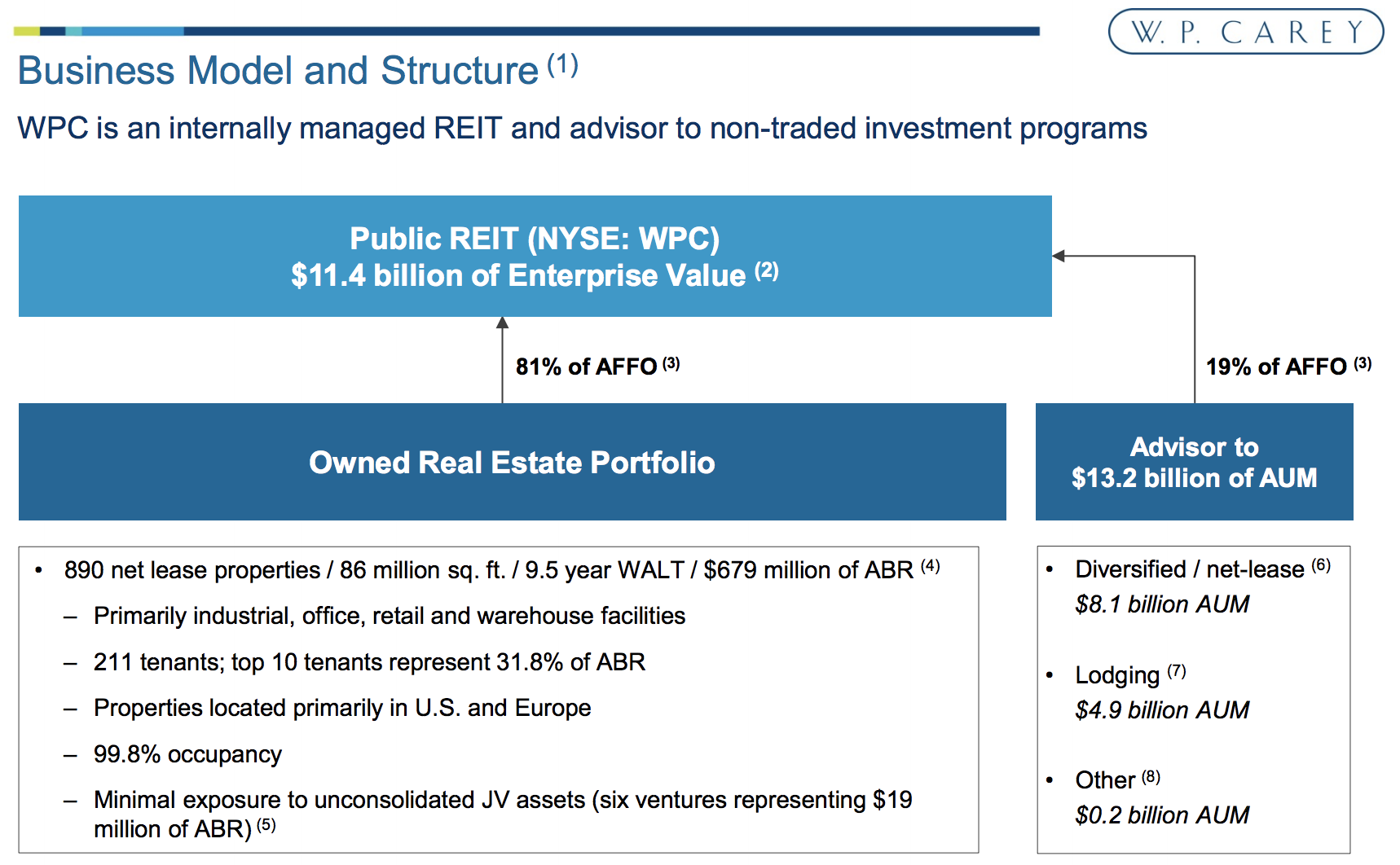

The REIT also manages more than $13 billion in non-traded REITs under its asset management business. Management fees represent 19% of W.P. Carey’s adjusted funds from operations, or AFFO, the REIT equivalent of free cash flow and what funds the dividend.

Business Analysis

Bill Carey was one of the pioneers of the triple net lease and sale-leaseback business model in real estate. Specifically, W.P. Carey would buy a free-standing property from a tenant and then lease its back to them over a very long time period, usually 20 to 25 years. The tenant would gain immediate capital from the property sale while being able to continue to use the asset.

The company structures these contracts as triple net leases, meaning the tenant pays all insurance, taxes, and maintenance costs. This creates a lucrative and very stable source of cash flow, with inflation protection created by annual rental escalators tied to the inflation rate (99% of W.P. Carey’s leases contain annual escalators).

However, W.P. Carey has several differentiating factors that make it unique compared to many of its U.S.-based peers. For example, the company is far more diversified by property type and industry, with very little retail exposure (16% of rent).

This is because Bill Carey was a large believer in a highly diversified property type portfolio, meaning that the REIT focuses more on industries such as office buildings, industrial properties, and warehouses.

Thanks to its status as one of the largest diversified REITs in America, W.P. Carey enjoys some of the industry’s lowest costs of capital, including an average interest rate of just 3.5%. As a result, the company can profitably invest in non-retail properties which have lower cash yields (cash flow / property price) but more favorable long-term rental growth rates.

Another big differentiator is W.P. Carey’s large exposure to international markets, mostly in Europe (30% of sales). Management has long believed that the U.S. retail property market is overbuilt (which has since proven true), and so the company has focused on more profitable opportunities abroad.

W.P. Carey has been investing in Europe, via its Amsterdam-based acquisition office, for nearly 20 years, giving it the experience to know which deals make sense and which to pass on. That’s a big advantage for the REIT because of the long learning curve created by the highly localized nature of the countries and industries in which it operates.

Finally, W.P. Carey’s asset management division has been a great source of long-term growth. This is because it primarily invests in non-publicly traded properties which have higher cash yields (due to lack of liquidity) and generally can only be done by highly experienced management teams with deep industry contacts.

However, going forward, W.P. Carey has decided to focus on its core triple net lease business and gradually shut down its asset management division. The company will potentially roll up some of the triple net lease properties in its asset management portfolio (over $10 billion under management), absorbing them into itself to create a substantial short-term catalyst for growth (potentially in 2018 and 2022).

W.P. Carey has actually pursued this strategy in the past, specifically in 2013 when it purchased one of its property portfolios for about $4 billion.

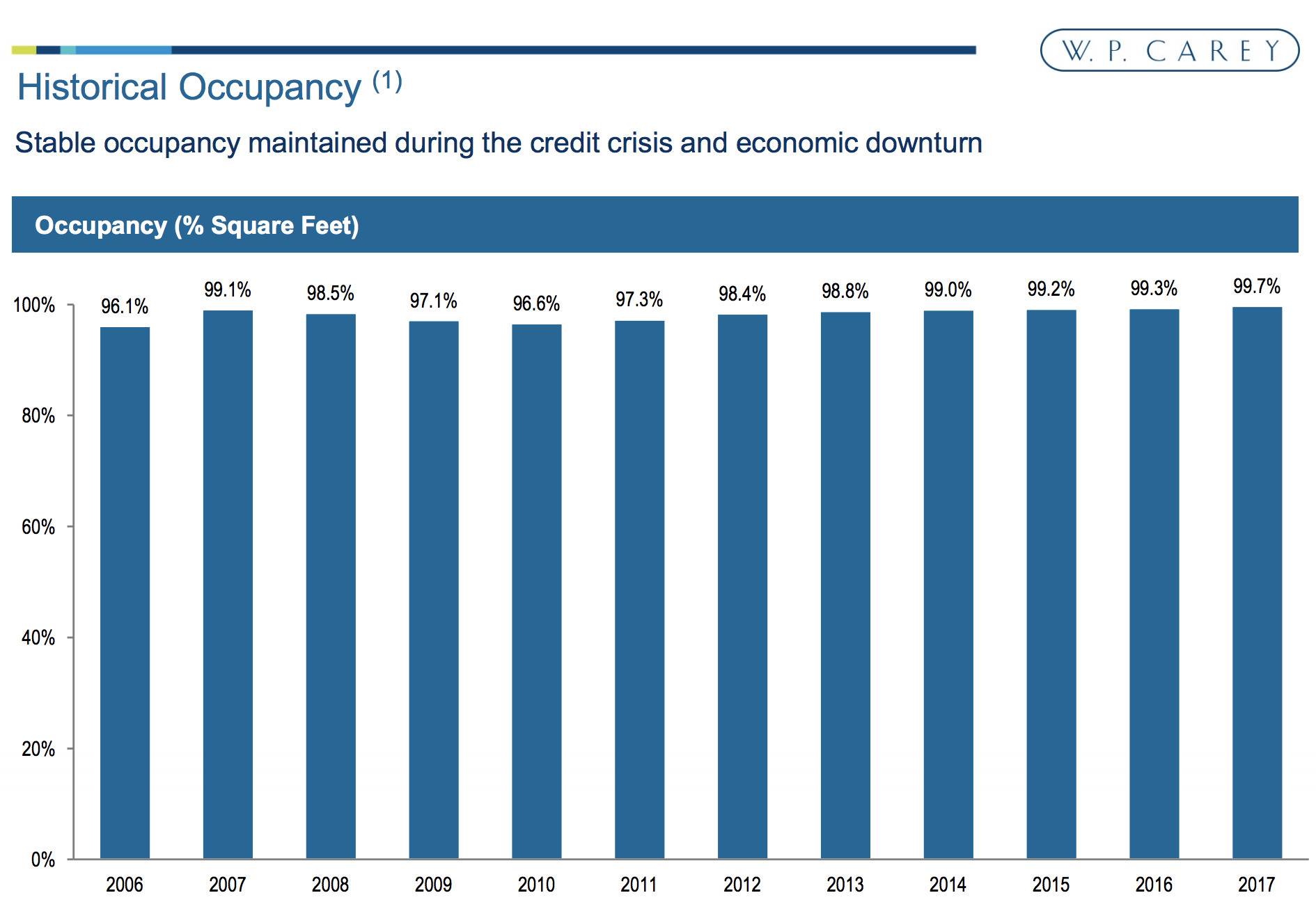

The company’s CPA 17 and CPA 18 funds, which are the most likely rollup targets, own a total of $8.2 billion worth of assets, consisting of 469 triple net lease properties with the same type of high-quality assets owned by W.P. Carey. For example, the occupancy rates of CPA 17 and 18 are 99.7%, which is in line with the REIT’s own 99.8% occupancy rate.

If W.P. Carey does end up acquiring these funds’ properties, it would represent more than a 50% increase in its property count and could potentially result in a commensurate increase in the payout.

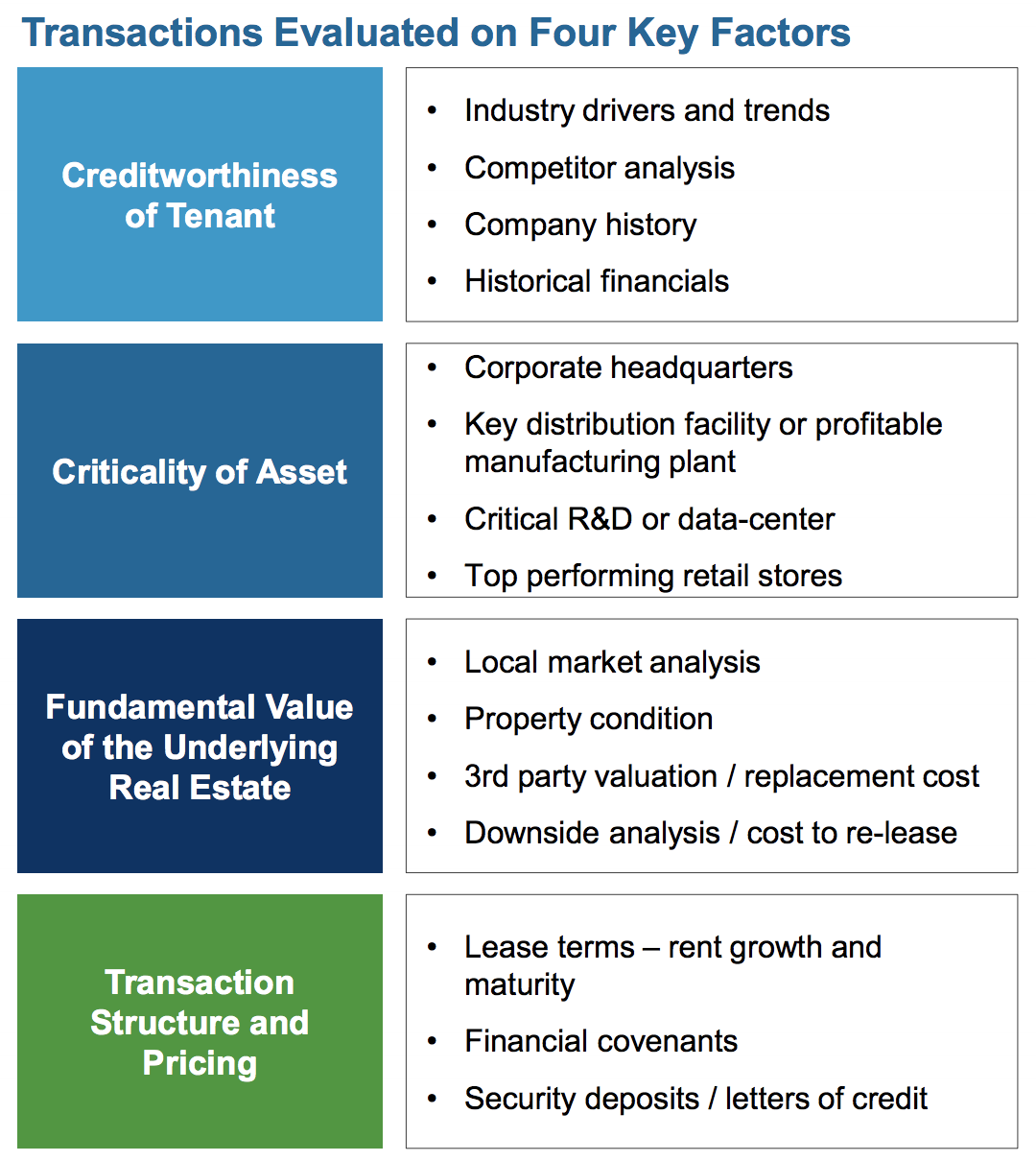

No matter what happens, the company’s management team has shown a strong dedication to disciplined acquisitions, very much focused on quality over quantity. The company only works with tenants who are on very strong financial footing and are at low risk of falling into financial distress. Focusing on mission-critical assets is another priority.

Those are key reasons why the REIT has historically enjoyed some of the industry’s best occupancy rates, a key factor in generating a very safe and steadily rising dividend over the years.

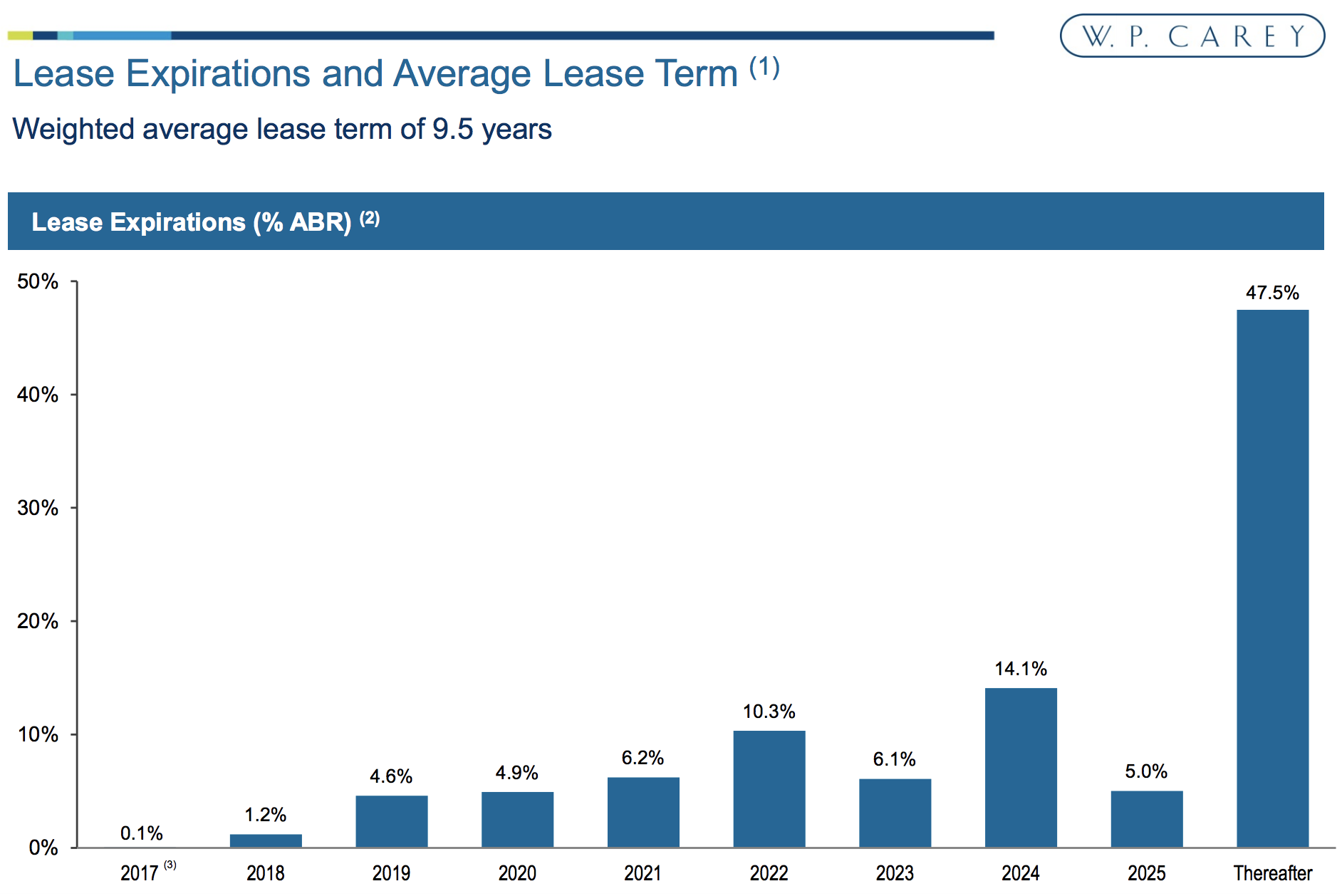

The company has also worked to extend the length of its average lease term to 9.5 years and better stagger its lease expiration schedule, which results in cash flow that is even more stable and reliable over time.

Not surprisingly, W.P. Carey’s track record of raising its dividend is among the best of any U.S. REIT, with 20 consecutive annual increases. In 2023, the REIT will become a dividend aristocrat.

With a highly stable and conservative payout ratio below the industry average, a relatively low cost of capital, a diversified property portfolio, and a strong balance sheet (the company has an investment grade credit rating), W.P. Carey seems like a safe bet for dependable income and moderate growth in the years ahead.

Key Risks

While W.P. Carey possesses a number of fundamental strengths, there are nonetheless several risks to keep in mind.

First, W.P. Carey’s international properties, while providing valuable diversification, also create currency risk. Specifically, a strengthening dollar reduces the cash flow generated in local currencies when it’s brought back to the U.S. for accounting purposes.

Of course, W.P. Carey’s management team is well aware of this risk and generally uses significant hedging to minimize its currency-induced cash flow fluctuations. So while currency risk is something to keep in mind, it’s not a big concern for long-term investors.

A larger concern might be that W.P. Carey’s largest property growth (which has fueled most of its dividend growth over time) has come from acquiring its managed non-traded portfolios at highly favorable terms.

Now that management has decided to focus exclusively on its owned triple net lease portfolio, the eventual liquidation of its funds could create a large short-term growth catalyst. However, there is no guarantee that W.P. Carey will be able to swallow the entire $8+ billion in properties held by these funds.

In addition, once W.P. Carey is out of the REIT management game, it will have to rely on far more gradual property growth, usually one property at a time. However, W.P. Carey’s super disciplined approach to acquisitions also means that its growth rate could slow substantially in the future.

The risk is that W.P. Carey’s business model is going to change substantially, with the focus shifting from managing third-party REITs to owning its own triple net lease property portfolio.

Fortunately, W.P. Carey’s long-term management track record is impressive, and new CEO Jason Fox has been with the REIT for well over a decade. In that time he’s been responsible for over $10 billion in acquisitions. In other words, investors should remain confident in the REIT’s long-term growth, although it’s hard to say what the ultimate pace will be.

Finally, interest rates are always a factor to consider when investing in any REIT. However, the interplay between interest rates and REIT share prices is more complex than many investors initially think.

For one thing, the rate sensitivity of REITs varies over time and by industry, meaning that it can be surprisingly difficult to accurately predict how rising long-term interest rates will affect prices and yields.

In general, there is an inverse correlation between price volatility and interest rate sensitivity. In other words, the least volatile REIT industries, such as triple net lease REITs, can also be the most sensitive to interest rates.

That’s because the same long-term leases that ensure strong cash flow predictability (and dividend security) also mean that these REITs have more inflation sensitivity given their bond-like qualities (slow growth, annual rent escalators could fail to keep pace with inflation).

However, there are two important things to keep in mind. First, because WPC negotiates rental escalators on a property by property basis (no master leases) and 69% of its contractual rent increases are also linked to CPI, its inflation sensitivity (and thus rate sensitivity) is much lower than most of its triple net lease peers.

The second and most important thing to consider about interest rates is that they don’t usually threaten the long-term growth rate of the REIT or its dividend. Simply put, REITs like WPC have experienced management teams that know how to carefully tune their capital structure to keep their costs of capital lower than the cash yields on new investments.

Or to put it another way, W.P. Carey has been growing steadily for more than 40 years, during which management has proven itself capable of growth in all types of economic, and interest rate environments, including when 10-year Treasuries yielded 16.5%.

While rising interest rates can cause W.P. Carey’s share price to fluctuate, perhaps even significantly, they seem unlikely to threaten the company’s long-term earnings power.

Closing Thoughts on W.P. Carey

With a time-tested management team, strong global property portfolio, healthy tenants, and cash flow secured by rental agreements as long as a quarter century, W.P. Carey represents a high-yield, quality REIT that appeals to many income investors.

The company has increased its dividend every year since going public in 1998, and W.P. Carey’s business model seems likely to continue that trend for the foreseeable future.

To learn more about W.P. Carey’s dividend safety and growth profile, please click here.

Leave A Comment