Founded in 1958 as BankAmericard, Visa (V) helped pioneer modern credit. The company was the first to offer credit cards to consumers and also introduced the debit card in 1975, for example.

Today Visa has become the world’s second largest payment process network operator (second only to China’s UnionPay). Its payment network stretches the globe and connects businesses, corporations, banks, and consumers in over 200 countries and territories.

There are over 3.2 billion Visa cards (credit/debit/prepaid) in use, and the company’s network processed 111 billion transactions worth $10.2 trillion in 2017.

Importantly, Visa is not a bank and does not issue cards, extend credit, or set rates for account holders on Visa products. The company’s financial institution clients handle those matters, with Visa simply taking a slice of each transaction it helps process.

Business Analysis

Visa’s business model is centered around routing of payment data through its VisaNet payment network. This network is capable of processing 65,000 transactions per second through two highly fortified (against natural disasters, crime, and terrorism) data centers in Virginia and Colorado.

The company’s network facilitates the authorization, clearing, and settlement of transactions between credit card issuers (such as banks) and the card users. Visa doesn’t provide any credit itself, but generates revenue by taking a percentage of each transaction value as its fee.

The transaction fee percentage varies by card type and issuer (government, bank, merchant type), but is usually between 0.6% and 1.9% on every purchase. These hefty fees are made possible because the industry is fairly concentrated with only a small handful of players dominating most major regions.

Visa and its chief rival Mastercard (MA) both enjoy meaningful competitive advantages that make them essentially a duopoly in payment transfers. These two companies combined for approximately 85% market share of total U.S. credit and debt card purchase volume in 2017, according to The Nilson Report. You can see that Visa’s share more than doubled Mastercard’s last year.

On a worldwide scale, you can see that Visa is one of the largest electronic funds transfer networks. The chart below shows global data for 2016.

Thanks to its sheer size, Visa’s core competitive advantage is derived from the network effect created by its business. Since Visa cards are accepted almost everywhere (over 46 million merchants on its global network), consumers are most likely to want a Visa credit, debit, or prepaid card because they know they can use it to pay for almost any purchase anywhere and anytime.

The company’s popularity with consumers is also helped by the strong branding that Visa has spent billions of dollars in advertising on over the decades. As a result, Visa has cemented its place as one of the most trusted names in financial transactions and routinely ranks as having one of the top 100 most valuable brands in the world, according to Interbrand.

Similarly, while merchants might not like the high fees that Visa charges for access to its networks, there are over three billion Visa cards in circulation around the world to help convince merchants to keep participating in the company’s payment network. If a merchant opts not to accept Visa cards, many consumers will be inconvenienced and take their business elsewhere.

Visa’s business is also attractive because it requires very little capital to operate. When combined with its industry-leading economies of scale, Visa is able to amortize its small fixed costs over trillions of dollars of transaction volume to create incredibly low per unit costs. The end result is remarkable profitability.

For example, Visa’s operating margin approached 70% and its free cash flow margin exceeded 50%. With over half of revenue being converted to free cash flow, Visa is one of the most profitable corporations on earth, in any industry.

The company is not taking its high margins for granted and continues to improve and innovate its services, especially in cybersecurity, where it employs around 600 people. Each Visa transaction is checked using 500 variables, in order to screen for 100 fraud-detection parameters.

Visa has spent years combing its treasure trove of data (including partnering with IBM’s Watson artificial intelligence system) and using advanced data analytics to determine individual customers’ spending habits. This allowed the company to preemptively stop more than $1.5 billion in fraudulent transactions in 2017.

The importance of such security measures can’t be overstated. That’s because credit card customers aren’t responsible for unauthorized purchases, but rather banks and merchants are. By having top notch security to avoid fraud, Visa’s payment network has become even more valuable to all its end users.

And since scale is arguably the most critical component of the company’s competitive advantages (and the industry’s high barriers to entry), Visa purchased Visa Europe in 2016 for $23.4 billion.

This deal added around 3,000 banks to Visa’s network, expanding it by over 20%. Since then Visa Europe’s network has been gradually transitioned over to VisaNet, with 75% of the changeover complete at the end of 2017 (full integration is expected by early 2019). Management now expects this deal, by the far largest in the company’s history, to ultimately prove more accretive to earnings and cash flow than previously believed.

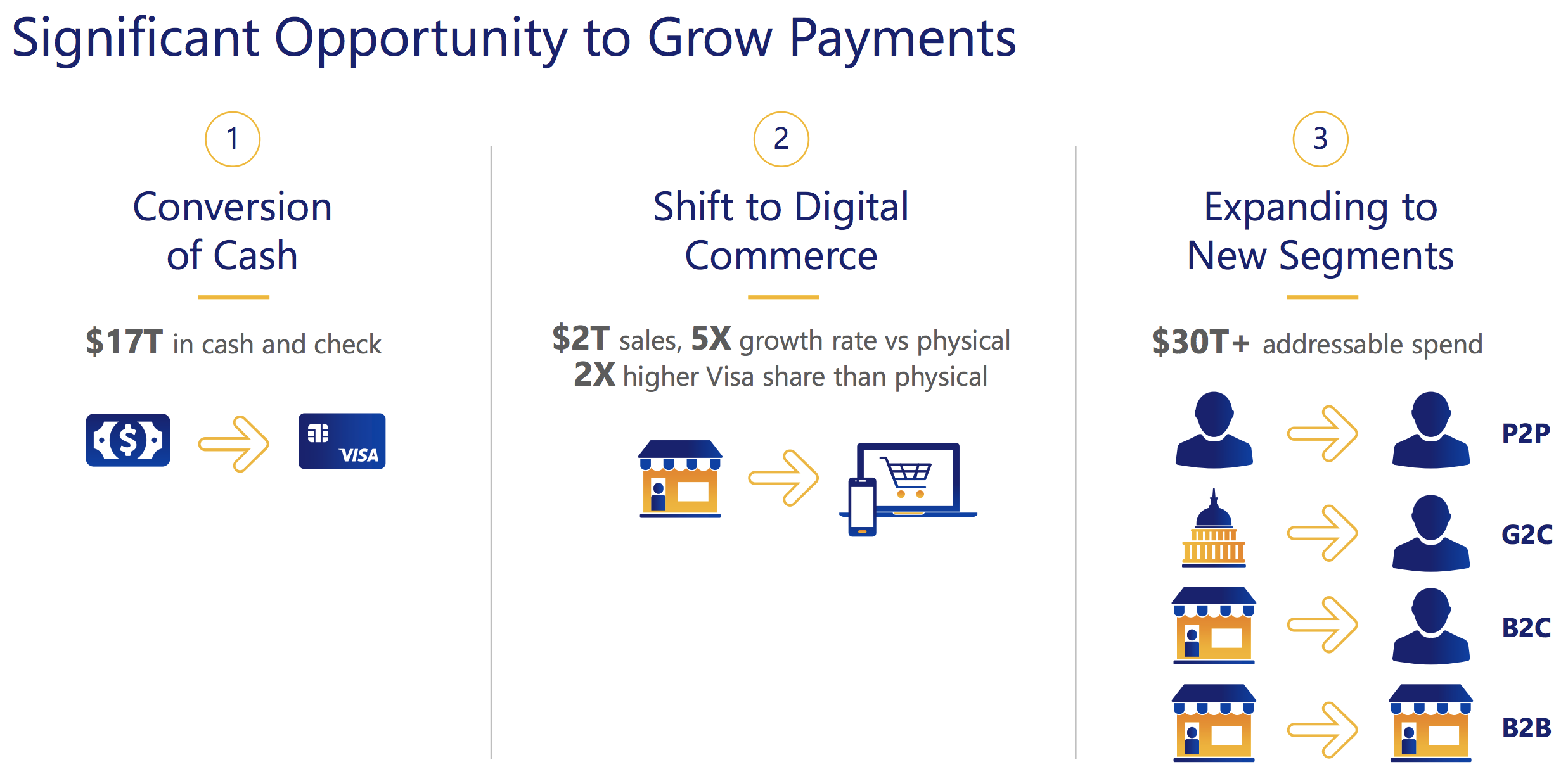

To help ensure its long-term target of high single-digit sales growth and high double-digit earnings growth, Visa has been steadily expanding beyond just traditional physical location purchases.

For example, the company introduced Visa Checkout in 2014 to allow for faster and more secure online ordering. At the end of 2017, Visa Checkout had over 25 million consumer accounts in 26 countries, with more than 350,000 participating merchants.

In 2017, about 10% of all global retail took place online, totalling $2.3 trillion in transactions. By 2021 research firm eMarketer estimates that this will double to $4.5 trillion, creating a meaningful growth catalyst for Visa.

The company also has its fingers in other growth markets, including peer-to-peer payments (P2P) via its Visa Direct platform. This system has over 1 billion cards enabled for P2P transfers, allowing consumers to directly transfer money from themselves to someone else. That’s thanks to Visa’s partnerships with P2P leaders such as: Adyen, Braintree, Hyperwallet, Ingo Money, OnDeck, PayPal, Stripe and Vantiv.

Meanwhile, perhaps the biggest potential growth market is in business-to-business (B2B) payment transfers. This is a market that Mastercard CFO Martina Hund-Mejean estimates to be more than $120 trillion in size.

In mid-2017 the company launched its Visa Ready Program for Business Solutions platform to create a one-stop shop for small to medium-sized businesses to exchange funds. The platform also offers enhanced data, virtual card integration, payables automation, and payment controls (data analysis and maximum security).

Finally, the company continues to aggressively expand in emerging markets such as India, where it already has over 2.5 million merchants on network. India is in the process of shifting to a less cash intensive economy with more digital transactions. When combined with the nation’s fast population and economic growth, this makes India (and other developing nations) one of Visa’s best long-term growth catalysts.

And despite UnionPay’s dominance in China, the company hasn’t given up on that giant market either. In August 2017, Visa filed for regulatory compliance in China and hopes to one day win significant market share in that nation as well. By 2020 China’s middle class is expected to hit 600 million people (nearly double the entire U.S. population), so China would indeed represent a further expansion of Visa’s growth runway.

Given that over $17 trillion in global annual spending continues to be handled using cash and checks, converting these transactions over to Visa cards remains a significant opportunity for the company.

When combined with the continued growth of e-commerce and Visa’s efforts to extend into additional markets for transactions, Visa seems likely to continue generating strong cash flow and dividend growth for many years to come.

That being said, no company is a perfect investment and Visa has its fair share of risks.

Key Risks

Visa’s high market share and juicy profit margins have unsurprisingly put the company directly in the middle of several legal and regulatory battles over the years.

That includes class action lawsuits from ATM operators, and even giant corporations such as: Walmart (WMT), Target (TGT), Home Depot (HD), and hundreds of other businesses.

At the heart of that lawsuit (filed in 2005) was the charge that Visa and Mastercard used their monopoly-like network effects to collude on how high of a transaction fee they can charge merchants to use their networks.

The companies settled for $7.25 billion in 2012 and agreed to lower their transaction fees by 0.1% for eight months. However, such large, long (the lawsuit dragged on for eight years in total), and costly legal battles are hardly just a U.S. problem for Visa.

European Union antitrust regulators have similarly spent years suing the company, including a 2010 settlement in which Visa agreed to lower its transaction fees by 0.2%. Such legal and regulatory challenges could potentially permanently impact the company’s future margins by limiting transaction fees.

In addition, during its battle with the EU one senior politician recommended breaking up the Visa/Mastercard duopoly in Europe by backing a consortium of over 20 major European banks that wanted to create a pan European payment rival to the two companies.

The main challenge for Visa (and Mastercard) in the future is that while everyone might use their networks, their partners are all unhappy with their high fees.

For example, in 2016 Walmart Canada threatened to stop accepting Visa cards in its stores over fees it considered excessive.

In the future, it’s possible that enough merchants and banks can agree to work together to create a truly competitive network that might force Visa to lower its fees. That or they might simply lobby world governments to cap the company’s profits as one would a regulated utility.

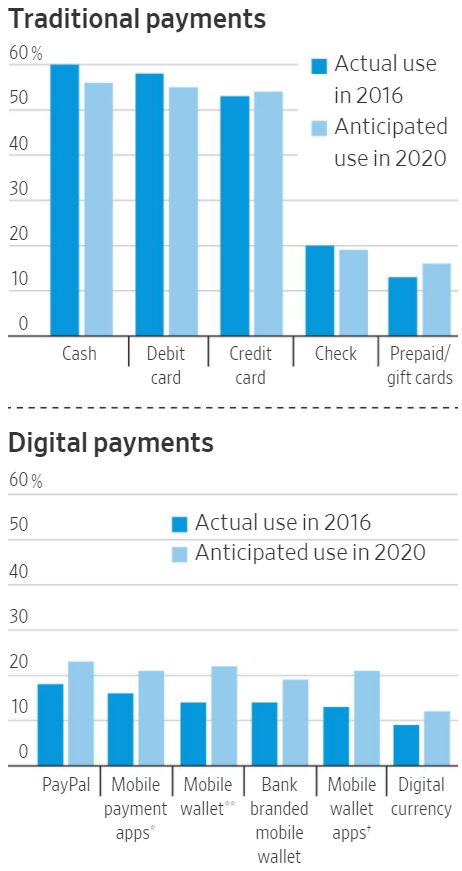

Another major risk to consider is the rise of digital payment technologies (mobile payment apps, mobile wallets, etc.), which could reduce the need for credit and debit cards in the future. Simply put, the proliferation of smartphones and low-cost internet connectivity have spawned a number of rival upstarts.

Courtesy of The Wall Street Journal, the chart below shows the share of consumers who use or anticipate using various payment types in-store or online at least weekly. You can see that debt card use is expected to decline and credit card use moderately ticks up through 2020, but digital payments are projected to see the biggest share gains by far.

Advancements in facial recognition and fingerprint technology could further propel the use of digital payments higher. However, once a user has authorized himself to the payments network, whether through a mobile device or another form factor, there is still a lot that needs to happen to authorize, clear, and settle an account.

In other words, the behind-the-scenes plumbing of how payments work themselves, which is Visa’s expertise, seems less likely to see a rapid change in the future.

Overall, it appears unlikely that new digital payment methods will render credit cards useless anytime soon. Cards are simple, lightweight, easy to use, and, in many cases, rather complementary to digital payments in that consumers have a need for both types of payment forms.

Visa has also been proactively partnering with these newer organizations, who also benefit from working with the company’s giant network. For example, Visa inked an agreement with PayPal in July 2016 to make it easier for Visa cardholders to choose Visa as a preferred payment method within PayPal, and they can transfer funds on their Visa cards from PayPal in the U.S.

While the payment space does seem like it is evolving faster than ever before, the value of Visa’s network continues to grow as well. For now, it is hard to imagine a risk that could really set the company back.

Closing Thoughts on Visa

Visa arguably enjoys some of the most substantial competitive advantages of any company in the world, which is perhaps why Warren Buffett’s firm Berkshire Hathaway initiated a position in the firm back in late 2011.

The company’s scale, well-known brand, capital-light business model, and powerful network effects make for an extremely profitable firm. When combined with the secular themes of more transactions moving from cash to credit cards, the continued rise of e-commerce spending, and big opportunities in other payments markets (P2P, B2C, etc.), Visa’s long-term outlook for growth is impressive.

While the company’s high profits and impressive market share can at times create high regulatory and legal risk, ultimately Visa’s numerous large markets should allow it to continue generating strong double-digit dividend growth for years to come.

The stock’s low yield may not make it an ideal candidate for income-focused portfolios, but Visa appears to be one of the most interesting choices to consider for a long-term dividend growth portfolio.

To learn more about Visa’s dividend safety and growth profile, please click here.

Leave A Comment