Qualcomm (QCOM) was founded in 1985 and is a leader in the development and commercialization of digital communication technologies called CDMA (Code Division Multiple Access) and OFDMA (Orthogonal Frequency Division Multiple Access), including LTE (Long Term Evolution).

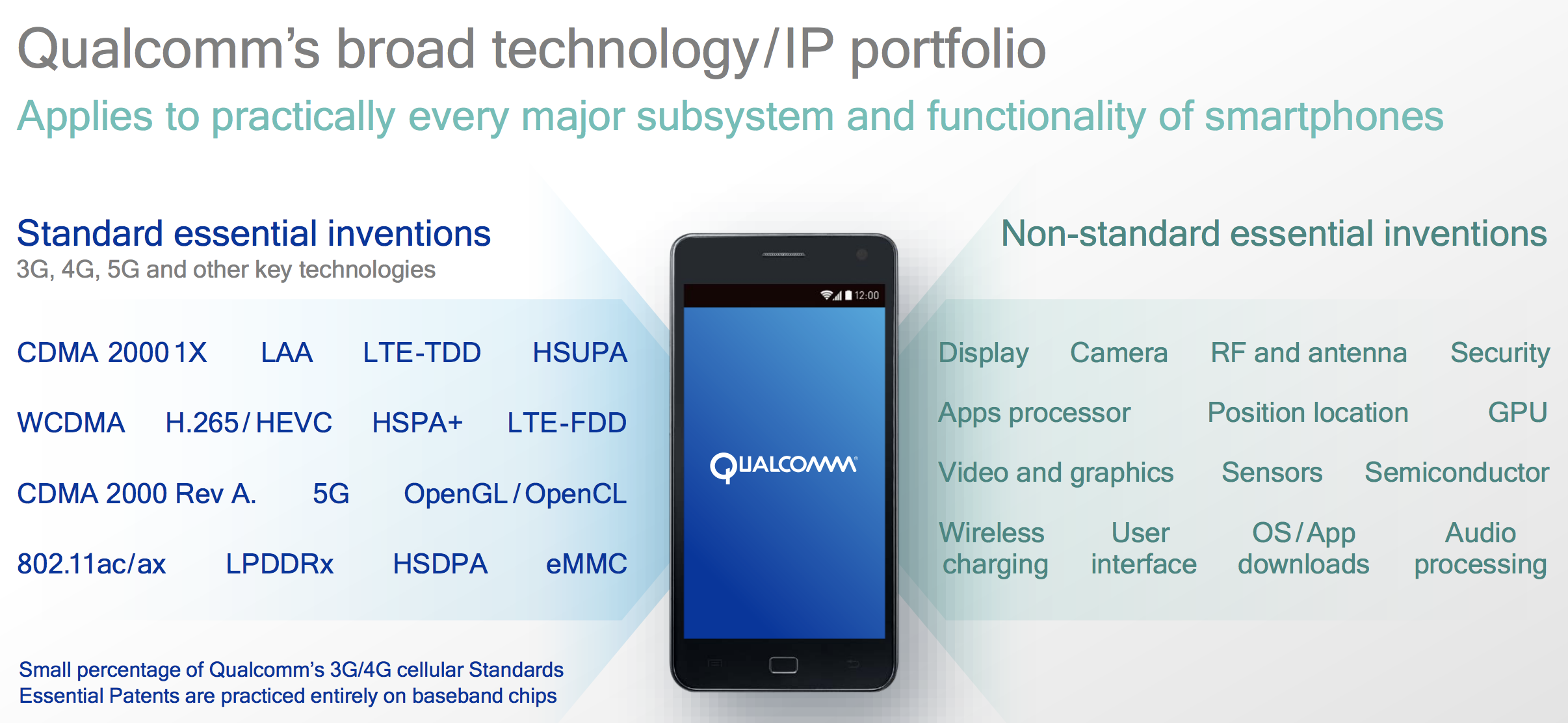

The company owns significant intellectual property applicable to products that implement any version of CDMA and OFDMA, including patents, patent applications, and trade secrets. In fact, Qualcomm has over 46,000 granted patents, with about another 107,000 pending.

Any company in the mobile communications industry trying to develop, manufacture, and/or sell products using CDMA and/or LTE standards usually requires a patent license from Qualcomm.

The company also develops other technologies used in handsets and tablets, including certain audio and video technologies, advanced WLAN functionality, and memory controllers.

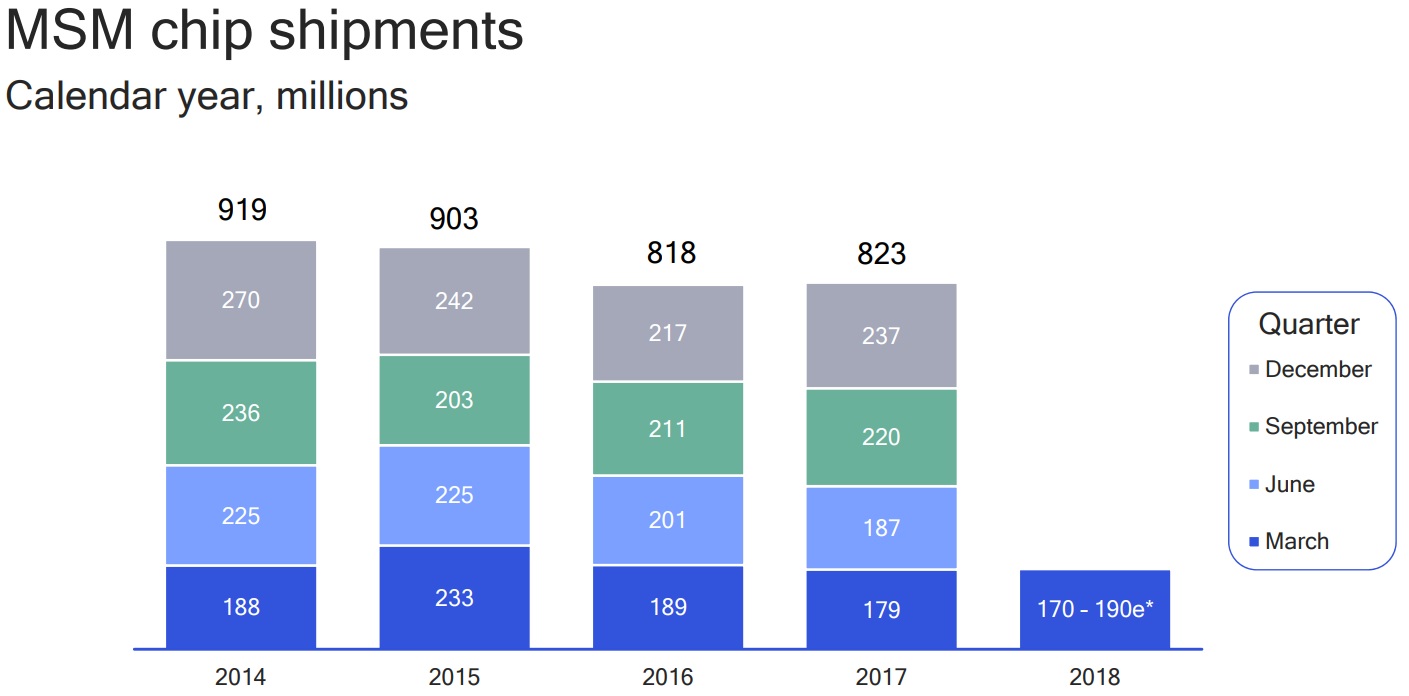

The main factor that drives the company’s performance is cell phone penetration, particularly with smartphones (where it is the leading phone modem maker). For example, about 1.8 billion smartphones were sold around the world in 2017, and Qualcomm’s chips were in 823 million of them, representing 46% global market share.

Here’s a look at a chip from Qualcomm’s popular Snapdragon series of smartphone chips.

Qualcomm operates through three business segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI).

- QCT (78% of revenue): develops new chips and software packages for CDMA and upcoming 5G-based smartphones. This includes the company’s Snapdragon series of smartphone chips, which are found in most of today’s phones, ranging from the low end (200 series) to premium phones like the Samsung Galaxy and Note product lines (800 series).

- QTL (22% of revenue): the company’s licensing business, in which smartphone manufacturers pay royalties Qualcomm’s 3G and 4G LTE patents. Typically this amounts to 3% to 5% of the wholesale cost of the phone.

- QSI (1% of revenue): invests in early-stage companies in various industries, including automotive, internet of things (IoT), mobile, data center, and healthcare.

While the vast majority of Qualcomm’s sales come from QCT, the company’s profit margins are far higher in its licensing business (QTL) due to the lack of manufacturing and overhead costs.

In fact, QCT’s pre-tax margin is currently 21% compared to 68% for QTL. As a result, despite only generating about 20% of revenue for the company, the QTL segment is responsible for 48% of profits.

Meanwhile, QSI has a negligible amount of revenue and generates essentially no profit on its own. That’s because it’s role isn’t to be a direct money maker but rather an incubator for new technologies that Qualcomm is working on perfecting and bringing to market.

Business Analysis

Qualcomm’s dominance has traditionally been in its near monopoly on essential 3G (voice) and 4G (data) wireless patents. The company also holds numerous non-essential patents pertaining to how smartphones operate, manage power, process audio/video, and charge.

This massive intellectual property moat is due to the company’s massive commitment to R&D, including spending $5.5 billion (25% of revenue) over the past year to continue innovating new phone chip technologies.

These patents have allowed Qualcomm to sign numerous lucrative licensing deals in the past with pre-tax profit margins as high as 85%. When combined with the fast growth of smartphones around the world, Qualcomm quickly became a wildly profitable and fast-growing company. In fact, Qualcomm’s free cash flow (what pays the dividend) margin has usually been above 25%.

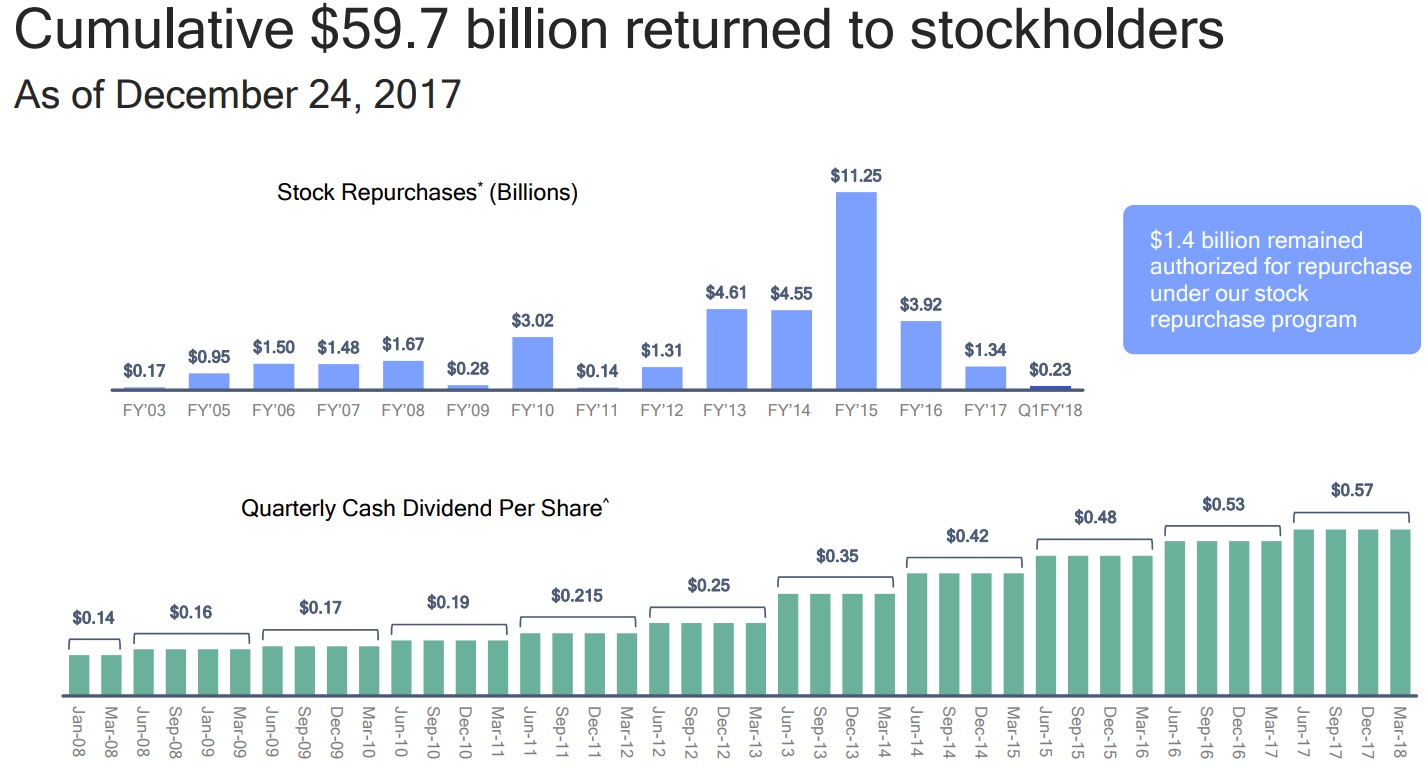

This has allowed the company to be very generous with its cash returns, including massive share buybacks and a highly secure and fast-growing dividend that has compounded at a double-digit annual pace over the long term.

Qualcomm is also a leading chip designer, selling its “systems on a chip,” or SOC, to various phone makers around the world. This is where much of the company’s R&D goes, in order to continually upgrade its offerings for the highly competitive and fast-changing world of consumer electronics.

For example, the company’s premier phone SOC is the new Snapdragon 845, which includes some of the industry’s top specs:

- Download speeds of 1.2 GBps

- 30% more efficient (than last year)

- 30% faster graphic rendering

- Supports dual phone cameras up to 16 MP

- Proprietary Quick Charge 4+ technology (50% charging in 15 minutes)

While the company’s IP dominance has been waning in recent years (it’s 3G patents are stronger than its 4G patents, and 5G patent strength is uncertain), Qualcomm is still likely to benefit from a strong royalty stream for the next 10 to 20 years. That’s because even as wireless technology evolves and advances, phone makers still need to ensure backwards compatibility for long periods of time.

Going forward Qualcomm believes that it has a strong position to benefit from 5G, the next generation of wireless and data technology. And since the company expects global 5G related goods and services to total $12 trillion in 2035, this is certainly a large market for Qualcomm to grow into.

Qualcomm’s plans for the 5G future go far beyond just smartphone chips. For example, it has outlined several areas that it believes can represent strong growth in the coming years and decades:

- Automotive: including vehicle computer systems and autonomous driving technology

- Smartphones: SOCs, near field communication (NFCs) such as that enable mobile payments via phone

- Infrastructure connectivity and data center chips

- Internet of things: connecting billions of devices, from consumer to industrial to create a real time data stream to improve maintenance, reliability, and safety

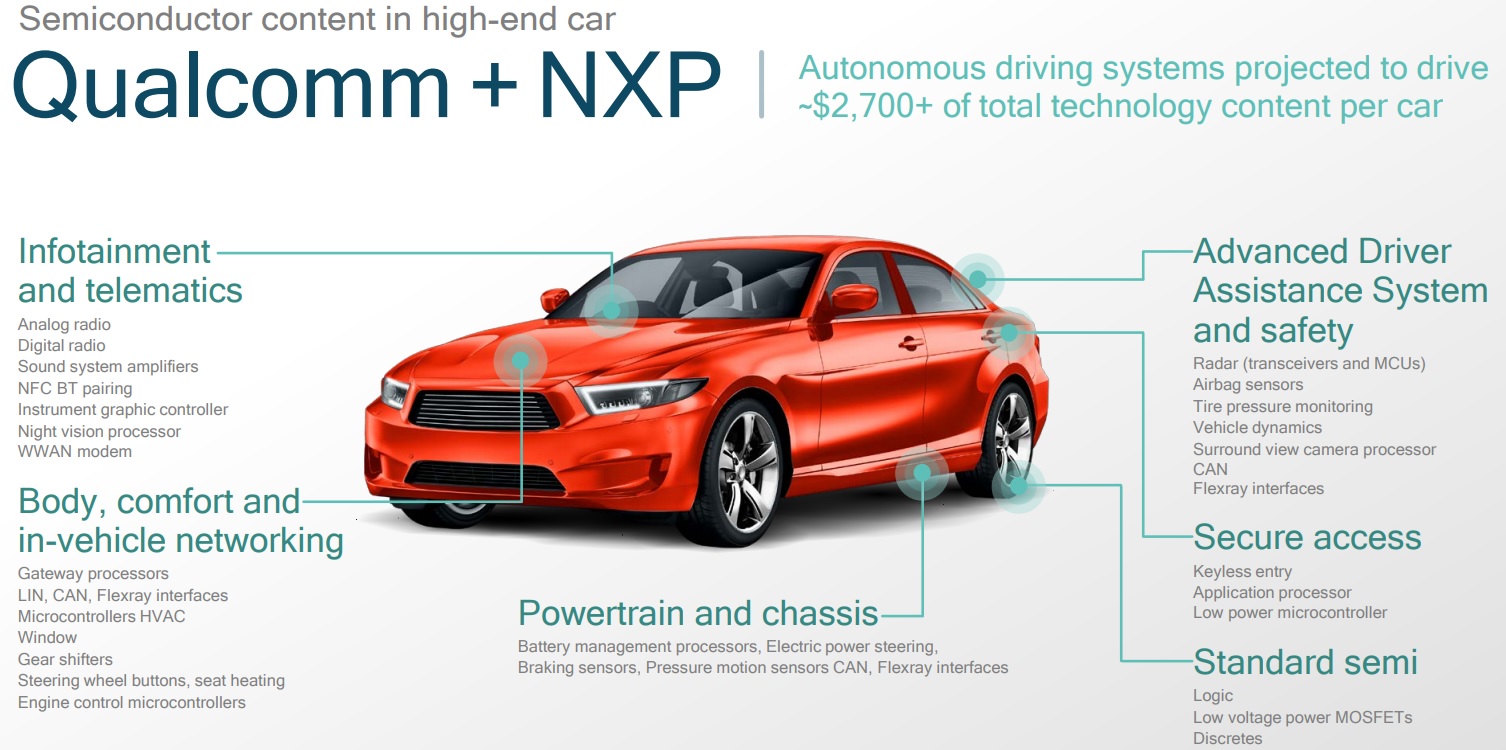

Part of this effort includes Qualcomm’s $47 billion attempt to acquire NXP Semiconductors (NXPI), the Dutch semiconductor maker who dominates the global automotive industry. In 2016, for example, 14 of the top 15 automakers used NXP chips in their infotainment systems. NXP is also dominant in near-field communication, where its products help power mobile payments, including Apple (AAPL) Pay, as well as a deep IoT chip portfolio.

More exciting for Qualcomm is that NXP is a leading innovator in driverless car technology that is expected to revolutionize the future of transportation. Level 4 autonomous cars (fully automated but only in well-mapped areas) are expected by as early as 2021, according to Ford’s former CEO Mark Fields (although these will be limited to fleet services such as ride sharing).

However, between 2022 and 2025, self-driving cars are expected to become available for sale to the public, and their adoption is projected to grow to 33 million a year (26% of all vehicles) by 2040, according to analyst firm IHS Markit.

This is potentially great news for Qualcomm because the large amounts of hardware and computing power required by self-driving cars is expected to amount to about $2,700 per vehicle.

Qualcomm’s potential growth has even attracted the attention of fellow chip giant Broadcom (AVGO), which recently launched a hostile takeover attempt to buy the company for $70 per share, consisting of $60 in cash and $10 in Broadcom shares. The deal values Qualcomm at $130 billion, but management has rejected the offer and is advising shareholders to vote “no.”

Simply put, Qualcomm believes the deal greatly undervalues its shares. The company is confident that once the NXP acquisition closes in early 2018, it will be able to generate more than 50% and 100% sales and earnings growth, respectively, by the end of 2019.

This is a bold claim indeed, but since Qualcomm is paying all cash (with a lot of debt financing), the lack of shareholder dilution would mean that the company’s free cash flow per share would likely double as well, cutting its payout ratio in half. As a result, if everything goes as expected with management’s targets, Qualcomm’s dividend could have solid growth potential in the years ahead.

Overall, Qualcomm has always been, and continues to be, a highly innovative technology leader for some of the fastest-growing industries of the future. When combined with its valuable intellectual property, the company has the potential to be a solid long-term dividend growth stock.

However, before getting too excited, there are some major risks involved with Qualcomm.

Key Risks

Qualcomm faces major threats on three fronts.First, it has pinned its hopes on future growth and diversification away from its QTL troubles on acquiring NXP Semiconductors. However, there is a lot of uncertainty regarding whether or not this deal can close, and under what terms.

For example, EU regulators recently approved the deal, but with a major caveat. Qualcomm can only buy NXP if it forgoes that company’s standard essential NFC (near-field communications) patents.

Basically, European regulators are leery of Qualcomm’s IP moat becoming even wider and it potentially using super aggressive licensing terms with future customers in other industries, most notably in the automotive industry. U.S. regulators have already approved the deal, leaving only China as the one remaining regulatory approval required to acquire NXP.

Further muddying the waters on the NXP deal is that activist investor Elliott Management (which owns 6% of NXP) has claimed that the $110 per share Qualcomm is offering is way too low. Based on NXP’s 2018 projected earnings, Qualcomm’s bid represents a P/E ratio of 15.

Elliott wants $135 per share, which would represent an additional 23% premium for NXP shares and raise the acquisition price to $58 billion compared to the original $47 billion offer. Since NXP’s NFC patents would no longer be included in the deal, it’s not certain that the deal makes sense under those terms.

Furthermore, in order for the NXP deal to close, which is essential to Qualcomm’s long-term investment thesis, 70% to 80% of NXP shareholders would have to tender their shares at $110.

However, NXP shareholders have been very slow to accept that offer, and Qualcomm has had to extend its tender offer deadline twice. The risk here is that, because the rest of the tech world enjoys a continued strong stock market rally, NXP shares have been rising in price above the Qualcomm offer (they recently hit $120).

As a result, Qualcomm might be running out of time to actually close the deal, at least unless it raises its offer substantially and risks overpaying for NXP’s slightly less valuable assets (due to the decreased intellectual property they come with).

In the meantime, Qualcomm’s lucrative licensing business (close to half of company-wide profits) faces massive legal and financial battles from every corner of the globe. For example, just days after EU regulators approved the NXP acquisition, they also levied a $1.2 billion fine against Qualcomm over its exclusivity deal with Apple (AAPL), who is a 10%+ customer for Qualcomm.

Specifically, the deal referenced was when Qualcomm paid Apple rebates to choose its baseband chips over rivals back in 2008, when smartphones were beginning to blow up. The agreement had two stipulations that regulators are crying foul over. First, Apple agreed to exclusively use Qualcomm’s chips from 2011 through 2016. In addition, Apple was not allowed to sue Qualcomm for unfair licensing practices.

In 2017 (when the deal was up), Apple did sue Qualcomm for $1 billion. Apple alleges that the company had essentially bribed/forced it into not switching to rival products, a charge the FTC is now investigating. Apple has since also indicated that it’s switching to rival phone modem maker Intel (INTC) and looking to potentially stop buying any of Qualcomm’s products.

There is a very real risk that U.S. regulators will end up fining Qualcomm over such practices, because numerous other governments have, including China, South Korea, Taiwan, and now Europe. In fact, the total fines come to over $4 billion, or about 6% of all the revenue Qualcomm has earned over the last three years.

Worse yet? While the case is being litigated, Apple has stopped paying Qualcomm’s QTL division royalties and insisted that its suppliers do the same. Rival phone makers like Chinese juggernaut Huawei have apparently done so as well. This has caused QTL revenue, pre-tax profits, and profit margins to decline precipitously, and the negative trend may just be starting.

Or to put it another way, Qualcomm’s formerly most profitable and fastest-growing division now looks like it might take a permanent hit. That’s because all of the regulatory scrutiny from around the world may end up invalidating its original licensing fees, forcing Qualcomm’s royalties to be based on wholesale component costs rather than the price of the entire smartphone.

For example, in 2015 Chinese regulators forced Qualcomm to amend its royalty deals to 5% and 3.5% royalties on 3G and 4G chips, respectively, but only collect on 65% of the phone’s wholesale price. Analysts estimate that should regulators force Qualcomm to move to a wholesale component royalty model, this might result in an approximate decrease of 75% of its future royalty stream.

What about Qualcomm’s QCT division (close to 80% of sales), which has continued to enjoy strong double-digit growth due to rising global smartphone sales? Well, here too there are potential risks to consider.

For example, in recent years, while Qualcomm’s QTC sales and earnings have remained strong and rising, the number of actual chips sold and its overall market share for smartphone chips has actually been declining.

The problem for Qualcomm stems from the increasingly commoditized nature of smartphones. For example, analysts currently estimate that only three phone makers in the world are actually profitable when it comes to hardware: Apple, Samsung, and Huawei. The rest are running at a loss (and thus arguing that Qualcomm’s royalty that’s based on the entire phone is unfair when they are merely licensing wireless components).

These three companies have all begun moving their wireless chip designs in-house, meaning designing and manufacturing their own chips. Thus Qualcomm has been facing declining demand from its largest customers, as well as increased competition from low-cost wireless chip makers such as Himax Technologies (HIMX).

While Qualcomm’s larger R&D budget and decades of expertise in wireless chips give it a technological edge over rivals like Himax, at the end of the day cost could prove the driving factor for many smaller phone makers struggling to stay in business.

After all, as technology advances, wireless chips become “good enough” for low to medium end phones. Therefore, Qualcomm’s market share and pricing power could come under increasing pressure.

Finally, we can’t forget the Broadcom hostile takeover attempt for Qualcomm.

The problem is that because of the Broadcom offer, Qualcomm shares have soared from a 2017 low of $50 to nearly $70 (the offer price).

As a result, investors are not being very well compensated for the all the risks facing the company. Should Qualcomm triumph in its fight against the Broadcom buyout (convincing shareholders to vote “no”), then Qualcomm shares could potentially drop significantly, barring a closing of the NXP acquisition.

Closing Thoughts on Qualcomm

Qualcomm has proven itself to be a highly innovative and dominant force in the world of tech for decades. Its industry-leading intellectual property has made QTL a massive cash cow for the company, helping the company to historically serve as a fast-growing tech stock and appealing income growth investment.

However, it is looking more and more likely that Qualcomm’s best days are behind it. That’s because its IP-driven QTL business is under siege from both companies and governments around the world, resulting in multibillion-dollar fines, a seemingly never-ending stream of litigation, and collapsing revenue and profitability.

Meanwhile the QTC business, while still growing, is facing ever-larger competition from giant and very well-capitalized phone makers who are increasingly taking their integrated chip design needs in-house. This bodes poorly for Qualcomm’s future pricing power, further pressuring its moat.

Finally, there is a huge amount of uncertainty regarding the NXP Semiconductors acquisition, as well as Broadcom’s hostile takeover attempt. It is extremely challenging to determine whether or not Qualcomm will be able to achieve its targeted growth (including continued dividend raises) in the future, or will continue to see sales, earnings, and free cash flow decline. In fact, we can’t even be sure that Qualcomm will exist as a stand-alone company a year from now.

Given all of this uncertainty, as well as the industry’s sheer complexity and the fact that Broadcom’s takeover offer has raised Qualcomm’s price to less attractive levels, conservative dividend growth investors may be best off passing on this troubled chip maker at this time.

To learn more about Qualcomm’s dividend safety and growth profile, please click here.

Leave A Comment