Magellan Midstream Partners is one of America’s larger MLPs and specializes in refined petroleum products. Magellan’s pipeline systems primarily transport products such as gasoline and diesel fuel from refineries, helping them eventually reach gasoline stations, truck stops, airports, and other end users.

The partnership’s 13,000 miles of pipelines and over 50 storage terminals (100 million barrels of capacity) supply it with extremely steady distributable cash flow, or DCF, courtesy of the long-term contracts it has that are generally insensitive to commodity prices.

Source: Magellan Midstream Partners Investor Presentation

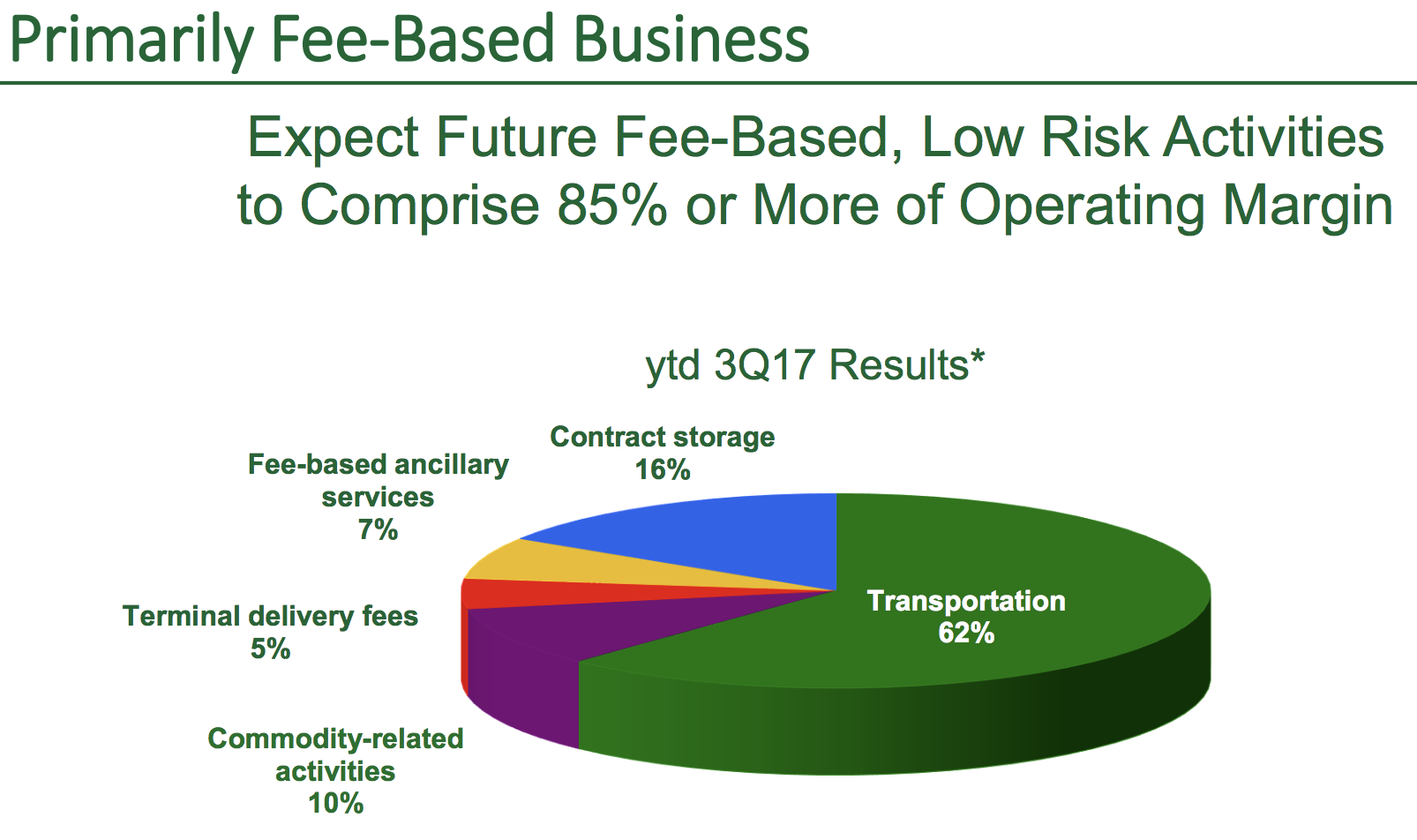

In fact, only 10% of Magellan’s operating margin has any commodity exposure at all, and management uses hedging to reduce that risk even further.

In addition, because over two-thirds of Magellan’s business is in refined products and marine storage, two sectors that do relatively well when oil prices are low (due to higher demand), the partnership’s business model is one of the most resilient MLPs in a low energy price environment.

Business Analysis

Operating pipelines is an attractive business for several reasons. First, few companies have the financial capital and industry relationships to compete.

Building a new pipeline can cost billions of dollars while taking years to complete. Without connections to oil & gas producers, refineries, and regulators, it’s not possible to run a successful pipeline system either.

Each region can only support so many pipelines as well (the refined products market is quite mature), which has resulted in a fairly consolidated market.

Additionally, there are few substitutes for pipelines thanks to their cost-efficiency and safety, as well as geographical constraints (oil and gas formations tend to be in hard-to-access areas). Most of the products moved by Magellan’s pipelines are also non-discretionary in nature, resulting in predictable demand patterns and stable cash flow.

Despite its tollbooth-like business model, like all energy stocks, Magellan’s sales are cyclical, rising and falling with the price of oil. Revenues will naturally decline when oil prices crash, as they did in 2008-2009 and 2015.

However, what investors need to focus on is that because of the way Magellan’s contracts are structured, its margins and returns on invested capital are far less volatile, making the company a dependable income investment over the years.

Perhaps most importantly, Magellan’s stable business model and lack of need for equity growth capital (which can be dilutive to existing investors) means that its DCF per unit (which funds, secures, and grows the payout) has been very stable over time.

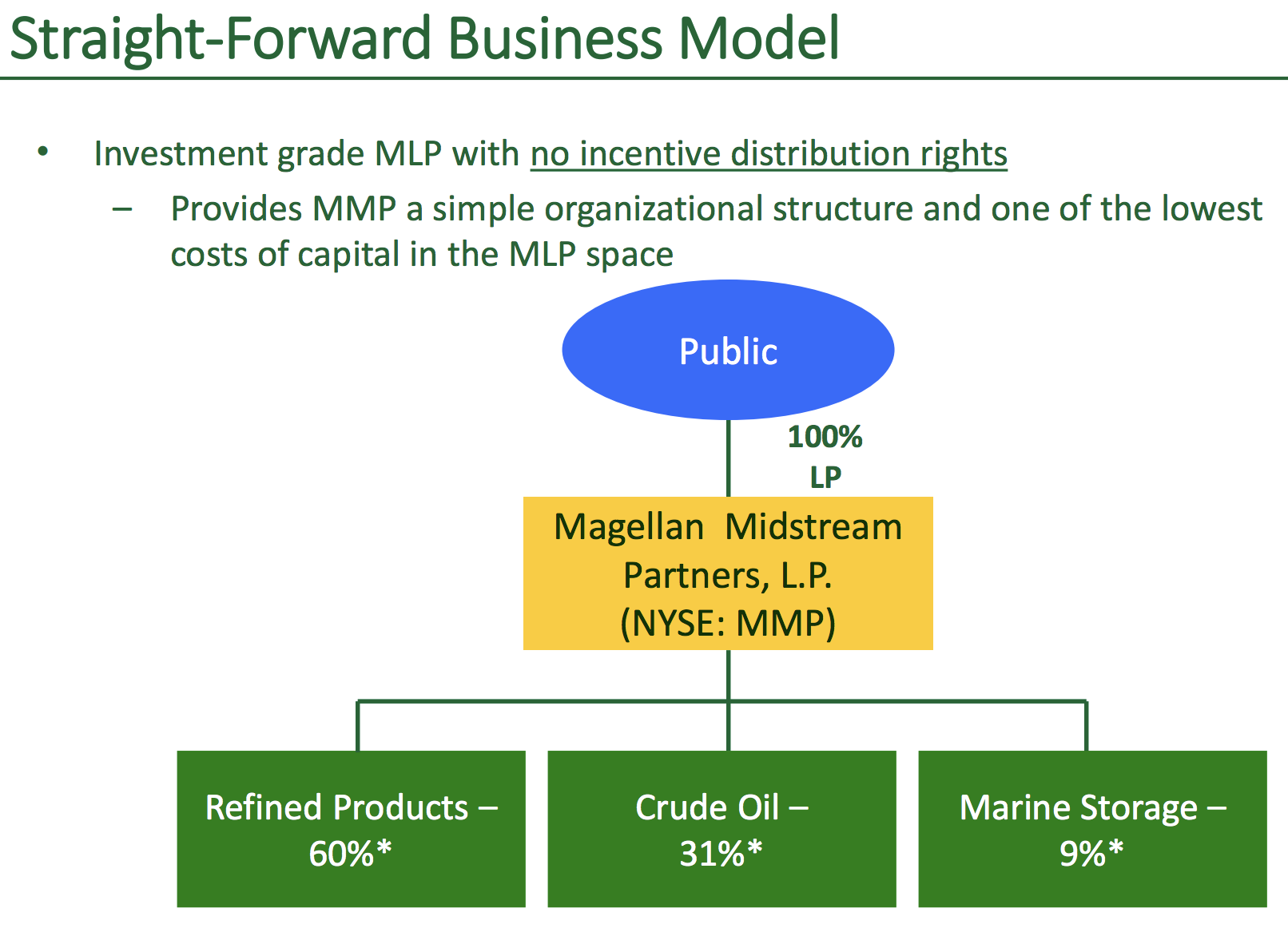

Magellan’s stable DCF is possible in part because of the MLP’s buyout of its general partner back in 2009, at the height of the financial crisis. That proved to be a brilliant move because it allowed management to acquire its sponsor at fire-sale prices, and it means that Magellan Midstream is one of the few midstream MLPs that doesn’t have incentive distribution rights, or IDRs.

IDRs give the general partner (the manager and sponsor of the MLP) an increasing percentage of marginal DCF, up to 50% once the distribution climbs high enough. IDRs provide the sponsor with an incentive to drop down (i.e. sell) assets to the MLP in order to grow its DCF, and thus the payout, quickly.

However, the downside to IDRs is that they increase an MLP’s cost of capital, since only 50% of a new project’s DCF ends up going to investors. A higher cost of capital means that finding profitable enough growth opportunities, in which DCF per unit grows, becomes harder over time. That’s especially true in a rising interest rate environment, which we are now facing.

Equally important is Magellan’s very disciplined growth strategy. Specifically, management has chosen to specialize in refined product pipelines because they are a much higher returning business than regular natural gas and oil pipelines. The company now boasts the longest refined products pipeline system in the country and can access nearly 50% of refining capacity, making it an attractive partner for its customers.

Combined with smart diversification into other specialty refining segments, such as natural gas liquid (NGL) fractionation, Magellan is able to achieve very high EBITDA yields on its new projects between 12% and 17%.

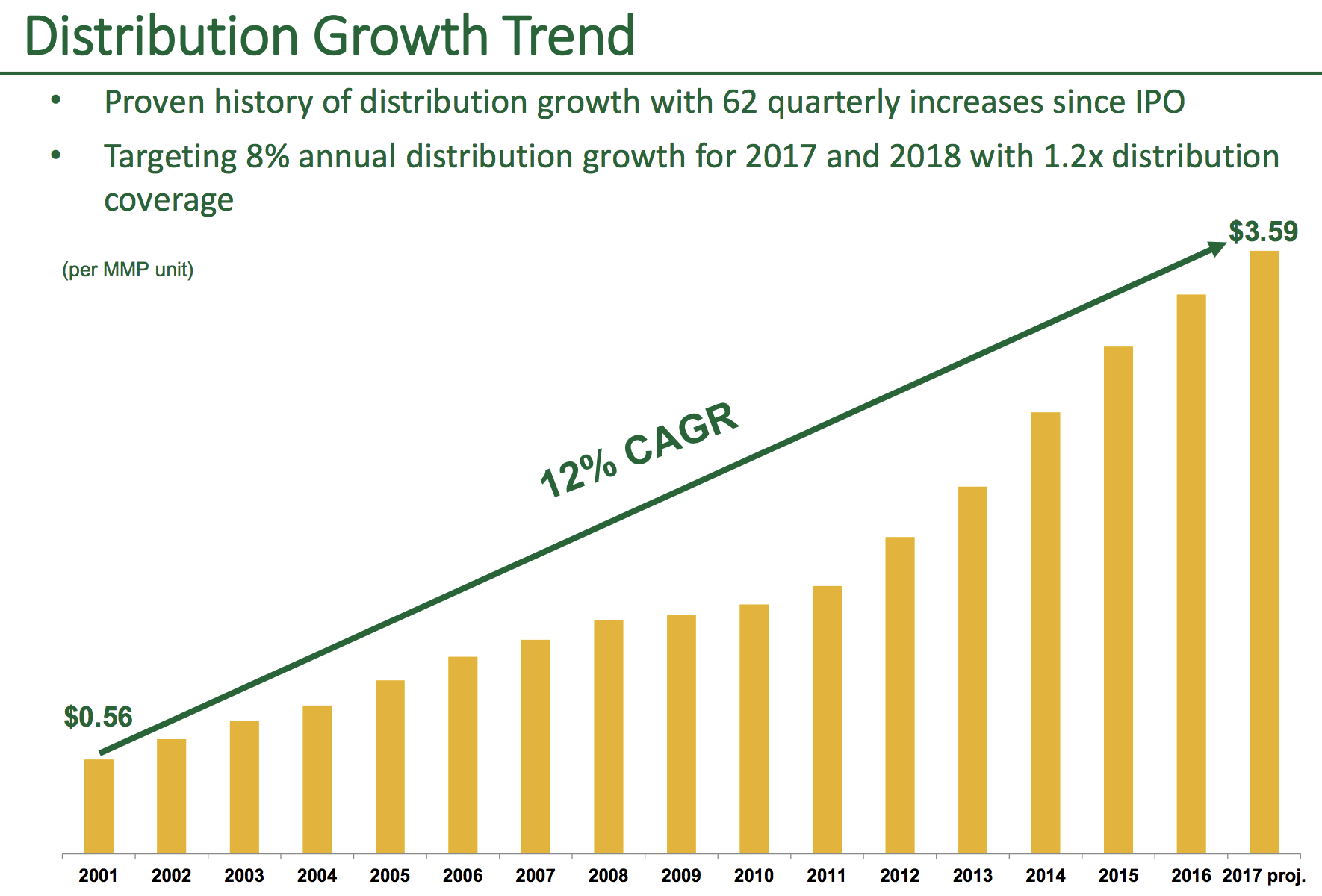

As a result, Magellan Midstream Partners has achieved phenomenal DCF margins, which, combined with a conservative distribution coverage policy (retaining extra DCF to create a strong payout buffer), has allowed Magellan to achieve one of the best long-term distribution growth track records in the industry.

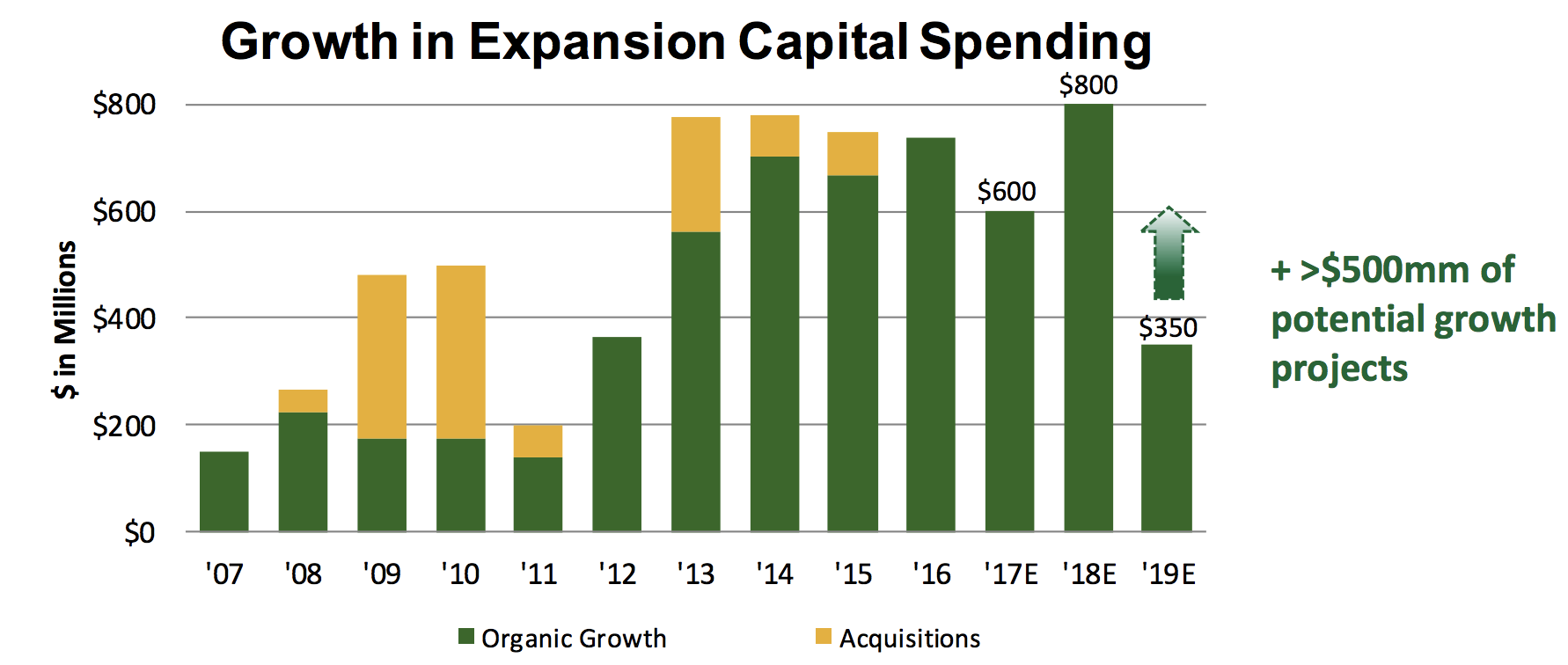

Magellan’s growth runway appears to remain long, with a total growth pipeline (projects scheduled to be completed within the next two to three years) in excess of $1.5 billion.

While that’s certainly not as impressive as some of its larger MLP rivals, such as Enterprise Product Partners (EPD), there are two important things to keep in mind.

First, Magellan’s relatively small size means that it doesn’t need a large number of new projects to grow DCF and its payout quickly and sustainably.

Second, unlike some other MLPs, Magellan’s management likes to keep its growth plans close it its vest, only announcing a new project once it has ensured there is enough profitable demand and very little volume risk.

Given that America’s shale revolution seems likely to continue, courtesy of shale producers becoming incredibly efficient with fracking advancements and reducing the breakeven price of production, U.S. oil production could continue to soar in the coming years.

In fact, even at just $55 per barrel, America’s shale formations are still capable of generating sufficiently high internal rates of returns that U.S. production is expected to hit a new record in 2018 and continue rising through at least 2025, according to Enterprise Products Partners.

Since $55 per barrel oil is low enough to reduce the price of refined petroleum products (and thus increase their demand), Magellan should see plenty of profitable growth opportunities over the next decade.

Key Risks

There are two major risks that apply to all MLPs, even the highest quality players such as Magellan Midstream.

First, MLPs are highly interest rate sensitive. Due to the highly capital-intensive nature of the midstream industry, as well as the fact that MLPs payout the majority of DCF to investors, all MLPs need to take on a relatively large amount of debt to fund their growth projects.

Rising interest rates will increase the cost of future debt, as well as the cost of refinancing older bonds that currently enjoy relatively low interest rates.

Fortunately, management runs the company in a very conservative manner, especially when it comes to debt. Management’s policy is to keep Magellan’s leverage ratio (debt / EBITDA) no higher than 4.0, for example, which is one reason why it is tied with Enterprise Products Partners for the highest credit rating (BBB+) in the MLP industry.

As a result, Magellan’s borrowing costs are relatively low for an MLP, and the partnership is likely to continue enjoying plenty of access to low cost debt capital that it can use to grow its DCF and distribution over time.

In addition to debt, MLPs will periodically sell new units to raise equity growth capital, which dilutes existing investors.

Of course, great management teams make sure that any projects they invest this capital into are profitable enough that DCF per unit continues to grow, despite the rising unit count.

Magellan has also historically retained a higher-than-average amount of DCF to fund much of its growth internally, reducing its dependence on external capital markets.

That being said, Magellan’s long-term distribution growth target of 8%, with a distribution coverage ratio (DCF/distributions paid) of 1.1 to 1.2 times, means that, while the payout will likely remain highly secure, its growth will remain sensitive to the whims of fickle debt and equity markets.

Here’s why that matters. While Magellan’s DCF is not very sensitive to oil & gas prices, its unit price (and that of all MLPs) has been. Should oil prices crash again or the broader stock market experience a bear market (which it eventually will), Magellan’s unit price could fall low enough to make large-scale, accretive growth much harder to achieve. That in turn could slow the pace of DCF growth, as well as that of the distribution.

It’s also worth mentioning that during the past decade, record low interest rates have been a major growth catalyst for all MLPs. Low rates resulted in very low borrowing costs, but they also enticed yield-starved investors to hunt for high-quality bond alternatives.

Magellan, as one of the “best-in-breed” partnerships in the midstream industry, was a major beneficiary of this abundance of cheap capital.

However, as interest rates rise and risk-free yields, such as U.S. Treasury bonds, become far more appealing, Magellan might have to compete with safer, longer-term government bonds yielding as much as 5% or 6%. The stock’s yield would need to rise, which means Magellan’s share price could suffer or stagnate over the short to medium-term.

Finally, investors should note that Magellan Midstream Partners, as an MLP, issues K-1 tax forms instead of 1099s. Owning the stock results in greater tax complexity, including potential headaches when held in tax-deferred accounts such as IRAs or 401Ks.

Closing Thoughts on Magellan Midstream Partners

Magellan Midstream Partners typically trades at one of the highest valuation premiums in the MLP industry for very good reason.

The partnership’s long-term focused management team, industry-leading balance sheet, impressive payout security, relatively low cost of capital, and solid long-term growth prospects make it one of the few compelling MLPs for conservative income investors to consider.

To learn more about Magellan’s dividend safety and growth profile, please click here.

Great analysis!!!!