Founded in 1883, Leggett & Platt (LEG) patented the first steel coil bedspring. Over the past 135 years, the company has become a diversified manufacturer that conceives, designs, and produces a wide range of engineered components (innersprings, recliner mechanisms, adjustable beds, steel wire, seat frames, carpet cushion, armrests, etc.) used in bedding, furniture, carpet, automobiles, aircraft, and other products around the world.

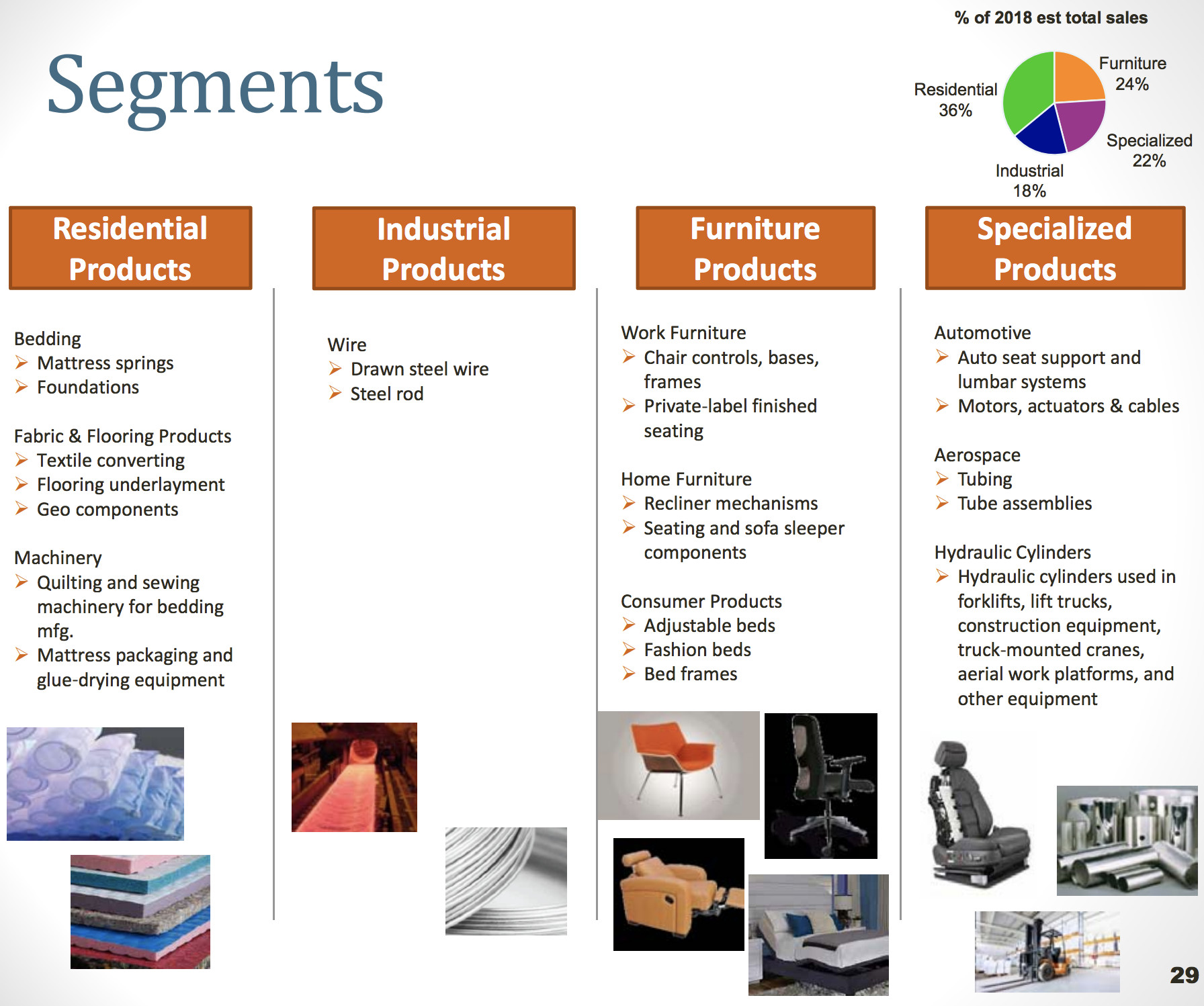

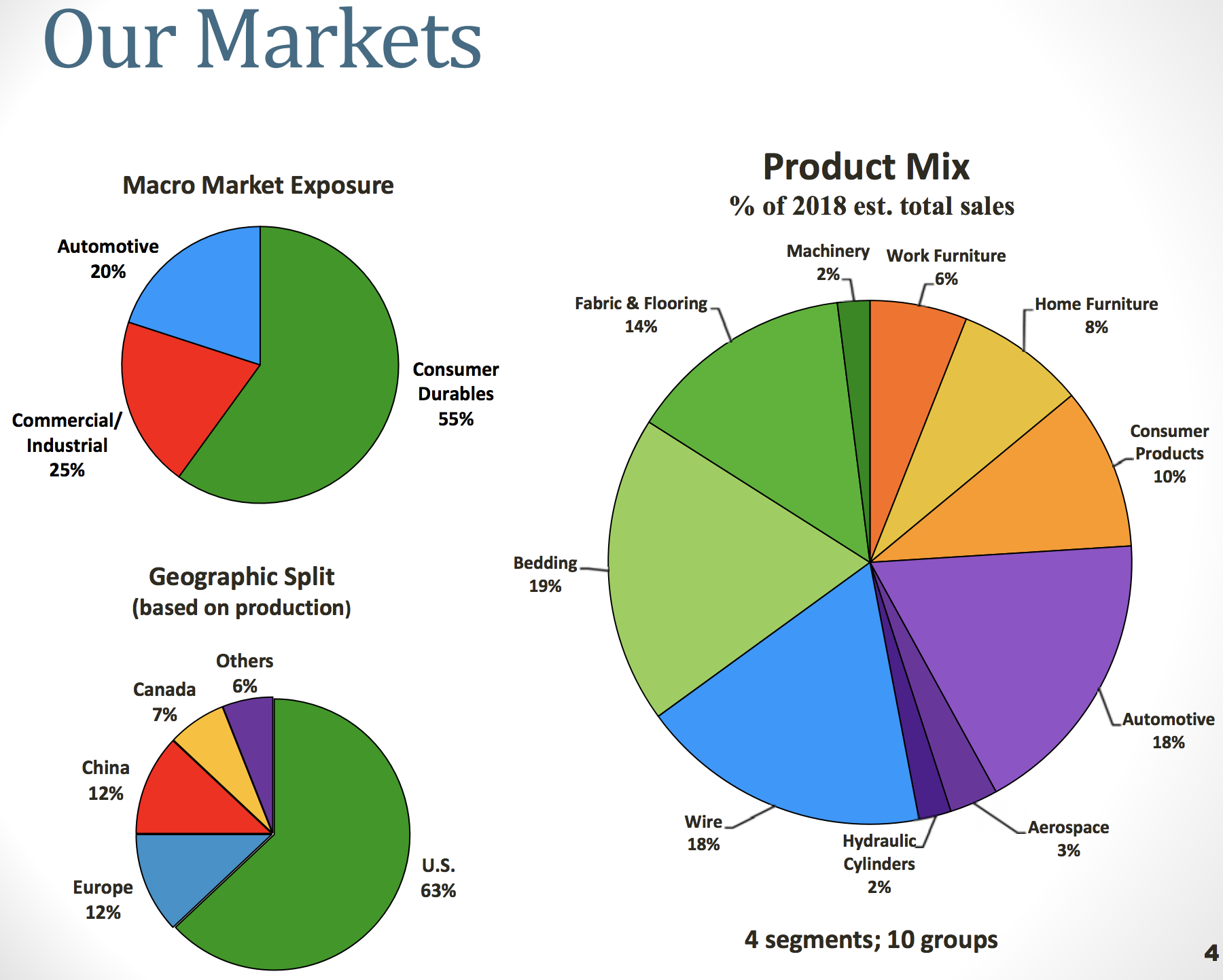

Leggett & Platt manufactures its products in 121 facilities located in 18 countries and operates through 14 business units organized under four segments:

The company’s customers include large and well established corporations, furniture makers, home improvement stores, and original equipment manufacturers (automotive and aircraft seats).

However, the majority of Leggett & Platt’s products serve the consumer durables market (furniture and bedding). The vast majority of the company’s sales are derived from the U.S. market (63%), but Leggett & Platt also has a strong presence in overseas markets, including fast-growing emerging economies such as China (12%).

Business Analysis

Leggett & Platt is a diversified industrial company which has raised its dividend for 47 consecutive years, making it a dividend aristocrat and poised to soon become a dividend king.

The company’s steady dividend growth in a sector known for its volatile sales and earnings is due to several competitive advantages. Leggett & Platt primarily benefits from its long-standing customer relationships and reputation for quality (the firm has been in the industry for over 100 years), its economies of scale as the largest player in the market (the firm is also vertically integrated), its focus on innovation to improve profits and growth, and its global distribution system.

Leggett & Platt has built up a large portfolio of intellectual property over the years, including more than 1,300 patents and over 1,000 trademarks. However, the company only spends about $25 million per year on R&D, or 0.6% of revenue. This low amount of spending is due to the fact that most of Leggett’s products have fairly long life cycles, meaning the company doesn’t have to continuously redesign them and can amortize its costs better over time.

Simply put, Leggett & Platt’s markets are generally slow changing in nature. The problems solved by mattresses and furniture are timeless, and about two thirds of bedding and furniture purchases are made to replace existing products.

This is a mature market with low single-digit growth. The manufacturing processes and materials used to produce these goods are evolving (e.g. foam mattresses) but at a mild pace.

Despite being a relatively a smaller company, Leggett & Platt has also vertically integrated most of its operations to remain competitive. For instance, the firm owns a steel mill in Sterling, Illinois, that makes 500,000 tons of steel (from melting down scrap metal), covering about two thirds of the company’s needs.

The company also benefits from having manufacturing facilities located in nearly 20 countries. Leggett & Platt enjoys a robust supply and logistics network it uses to source raw material in bulk at the cheapest prices from around the world.

These advantages are especially important since manufacturing components used in mattresses, furniture, cars, and other products is usually a tough business. Buyers are focused on keeping their costs low, and many components can easily become commoditized and purchased for less overseas.

Leggett & Platt’s entry into its key markets many decades ago helped it acquire number one or number two market share positions, which it has successfully maintained through innovation and conservative capital allocation.

As the biggest player with vertically-integrated operations (Leggett owns its own steel rod mill and machinery, for example), Leggett & Platt is often one of the lowest cost providers of its products.It has also developed innovations to adjust to shifting market trends, including adjustable beds and a “Comfort Core” innerspring used in hybrid mattresses that replaces traditional foam cores and innersprings.

Beyond product innovation and cost efficient operations, Leggett has successfully expanded the scope of its business well beyond bedding components with the help of acquisitions into a number of niches that offer higher growth and profitability.

In 1960, bedding components represented nearly 100% of Leggett’s sales. Bedding represents less than 20% of the company’s revenue today, underscoring the firm’s expansion into adjacent markets over the last 50-plus years.

All of these advantages have helped Leggett & Platt generate industry leading profitability and returns on capital. However, management’s capital allocation discipline has played a big role in the company’s success as well.

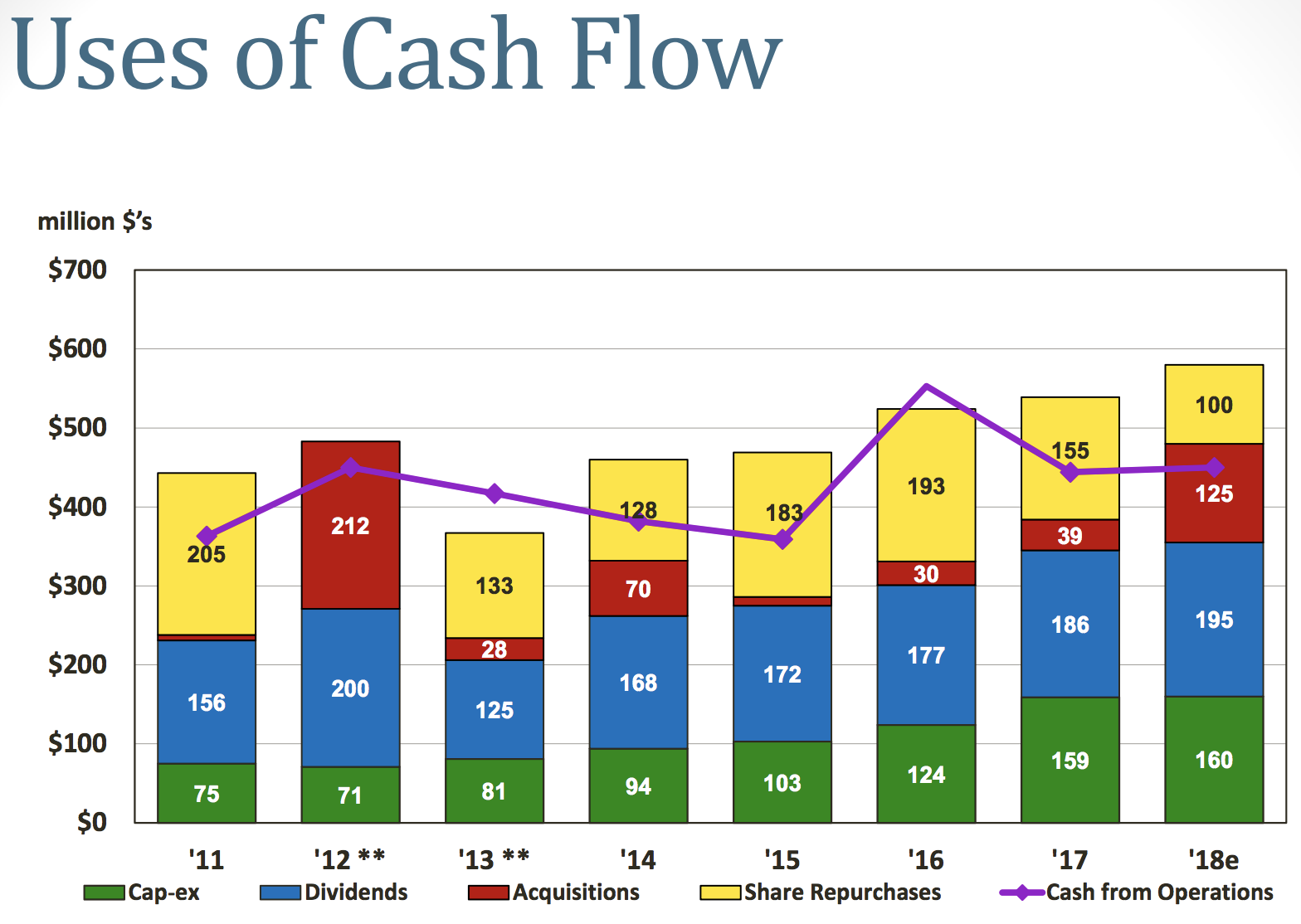

Going forward, management’s top priorities for allocating operating cash flow are:

- Investing in organic growth of its top businesses (capital expenditure), with the goal of achieving large vertical integration and economies of scale

- Steady and secure growth of the dividend (targeting 50% to 60% payout ratio)

- Growth through disciplined and accretive acquisitions

- Buying back shares with any excess remaining cash flow

As you can see, capex, dividends, and share repurchases have consumed the majority of cash flow in recent years.

Leggett & Platt is mostly focused on organic growth over flashy, large, complex and often overpriced acquisitions. That being said, the firm has steadily grown via strategic and bolt-on acquisitions, including four purchases in 2015 and 2016. In 2017, the company acquired three businesses and the remaining interest in a joint venture for a total of $56 million. These diverse deals included:

- A Canadian geosynthetic products distributor and installer for civil engineering and construction applications.

- A Michigan-based surface-critical bent tube manufacturer supporting our private-label seating strategy in Work Furniture.

- A North Carolina manufacturer of rebond carpet cushion.

- The remaining 20% ownership in an Asian joint venture in its work Ffurniture business.

Leggett & Platt’s latest purchase was the early 2018 acquisition of Precision Hydraulic Cylinders (PHC), a leading global manufacturer of engineered hydraulic cylinders primarily for the materials handling market, for $85 million. PHC represents a new growth platform for the company because it serves a market of mainly large OEM customers utilizing highly engineered, co-designed components with long product life-cycles.

The company doesn’t have to frequently redesign its products and can amortize its R&D costs better over time. Better yet, the components themselves represent just a small part of their customers’ total production costs and provide mission-critical functionality.

As a result, the company faces less pricing pressure and should enjoy longer customer relationships due to the switching costs created (changing suppliers is disruptive to a business). Perhaps best of all, the PHC acquisition means that Leggett is entering a $5 billion addressable global market that is growing at over 5% per year.

Management has a strong track record of maintaining good acquisition discipline. That means making sure that strategic deals (like PHC) are both large enough to move the needle (annual sales of $50+ million) and represent new markets that it can grow into.

These markets have to be at least $250 million in size and growing faster than global GDP. Smaller acquisitions (bolt ons) need to have at least $15 million in sales, fit well into the firm’s existing production chain (for synergistic cost savings), and also have strong organic growth potential. Overall, management’s goal is that every acquisition generates at least 10% returns on investment.

In order to execute on this capital allocation plan, the company also maintains a strong balance sheet and has earned a solid BBB+ credit rating from Standard & Poor’s. The company should have no problem raising low cost capital and continuing to invest in long-term growth projects and acquisitions.

Thanks to a strong U.S. and global economy, management has issued guidance calling for 9% to 12% revenue growth (PHC is 2% of that) and continuing operating EPS growth of 26%. Tax cuts are helping boost earnings over the short term, but management expects the good times to continue through at least 2020:

- Sales growth (2018 to 2020): 8% per year

- Operating EPS growth: 12%

- EBIT margin: up from 12% to 13%

Over the long term (and through entire economic cycles), management wants to achieve:

- 6% to 9% revenue growth (4% to 7% organic growth, 2% from acquisitions)

- 7.5% to 10.5% growth in continuing operation EPS and dividends

Rising margins and continued share buybacks (about 1% of outstanding shares annually) are expected to drive Leggett & Platt’s earnings growth. Management’s plans for improved margins call for ongoing investment into more efficient manufacturing, continued streamlining of the supply chain (economies of scale), and a larger focus on its most profitable product lines.

This means the firm plans to keep divesting its least profitable and less important product lines over time. Management also believes the company has enough production capacity to boost operating margins by 30% as sales grow due to a strong economy.

Overall, the company’s long-term goal is to achieve total returns in the top third of S&P 500 companies, and management has proven that it has the disciplined capital allocation skills to usually hit its growth targets.

However, there are several risks investors need to be aware of that might cause Leggett & Platt to miss its impressive growth and total return targets.

Key Risks

While Leggett & Platt’s impressive track record makes it among the best furniture components manufacturers in the world, there are nonetheless some important risks for current or prospective investors to consider.

First, the company is still a relatively small industrial player competing against numerous larger and better capitalized rivals.

So while Leggett & Platt does enjoy strong relationships with its customers, the firm is hardly the only supplier of industrial components they can turn to.

Next, Leggett’s business is sensitive to several macroeconomic factors that are beyond its control. Changes in raw material costs (e.g. steel), foreign currency exchange rates, and consumer spending trends have materially impacted the company’s sales and earnings in the past, and they will remain important factors going forward over short-term periods.

The best time to buy macro-sensitive stocks is when demand is weak and sentiment around the business is overly pessimistic. This is not the case with Leggett & Platt today. Its operating margin is near its highest level since the late 1990s, and strong growth in automotive and housing markets have helped fuel Leggett’s sales growth over the last five years.

While these factors impact Leggett & Platt’s business over the near term, they are admittedly less relevant to the company’s 10-year outlook.

However, the majority of the company’s excellent returns in recent years have come from substantial margin expansion, which has benefitted from a lot of low-hanging fruit that may not be as easy to replicate going forward.

For example, between 2014 and 2017 Leggett & Platt divested the majority of its store fixtures, wire products, and part of its commercial vehicle products businesses. The company has also significantly pared back its number of business units from nearly 30 to less than 15 today as management continues moving away from commoditized (i.e. low margin) sales and towards a greater focus on specialized products.

Finally, while management has a good track record on acquisitions, the team can still make mistakes when it comes to purchases. For instance, between 2015 and 2017 the company sold off seven businesses that it considered no longer a good strategic fit. Should Leggett & Platt pursue a larger deal and overpay or miss on its expected synergy benefits, investors could lose some of their faith in management.

Closing Thoughts on Leggett & Platt

Leggett & Platt is an impressive industrial company that few investors have heard of. Management’s disciplined and conservative growth strategies, combined with the firm’s strong balance sheet and good capital allocation, have resulted in superior profitability and nearly 50 years of uninterrupted dividend growth.

While the company operates in a challenging industry, Leggett & Platt’s track record of adapting to changing conditions and paying steadily rising dividends indicate that it is a potentially attractive high-yield investment. However, investors must remember that the best time to buy a stock like this is usually during a short-lived cyclical downturn in its end markets.

To learn more about Leggett & Platt’s dividend safety and growth profile, please click here.

Leave A Comment