Founded in 1911, International Business Machines (IBM) is one of the world’s oldest tech companies. Today IBM is the largest IT provider (5.5% global market share) for businesses around the world. It operates in five main business segments.

- Technology Services & Cloud Platforms (43% of revenue, 29% of operating income; declined 3% in 2017): provides cloud and project-based outsourcing services to help improve clients’ IT infrastructure. This segment also offers technical support for integrated software solution products the company sells.

- Cognitive Solutions (23% of revenue, 46% of operating income; grew 2% in 2017): includes Watson, the cognitive computing (artificial intelligence) platform that uses natural language, processes big data, and learns from interactions with people and other computers. This segment offers data and analytics solutions, cloud data services, enterprise social software, talent management solutions, and software tailored to various industry specific needs, including banking, airlines, and retail industries.

- Global Business Services (21% of revenue, 9% of operating income; declined -2% in 2017): business consulting services, system integration, application management, maintenance, and support for packaged software applications, as well as outsourcing services. As clients transform themselves in response to market trends like big data, social and mobile computing, IBM helps clients use these technologies to reinvent relationships with their customers and realize new standards of efficacy and efficiency across their businesses.

- Systems (10% of revenue, 8% of operating income; grew 6% in 2017): the legacy hardware business that provides server and data storage infrastructure for various corporate clients. This segment saw a large but temporary spike in 2017 due to the launch of new mainframe server models and a favorable IT hardware replacement cycle. However, it has seen significant revenue declines in recent years due to product cycles, client losses, and certain clients migrating to the cloud.

- Global Financing (2% of revenue, 9% of operating income; grew 1% in 2017): finances company sales via lease, installment payment plans, and loan financing. Also provides short-term inventory and accounts receivable financing to suppliers and distributors.

The company has been in a multi-year turnaround where it is refocusing its business from legacy hardware and IT software to what it calls “strategic imperatives,” or SI. These are increasingly subscription-focused cloud computing, advanced AI data analytics applications, and cyber security products that IBM believes represent the future of global IT.

SI accounted for 46% of IBM’s total revenue in 2017 and grew 11%. Cloud revenue represents 22% of total sales and grew 24% last year. The company also has strategic partnerships with ABB, a Swiss-Swedish robotics and automation company, as well as Salesforce.com, a leading cloud computing service provider.

Business Analysis

IBM has long been known for its legacy IT services, which have been the backbone of corporate IT departments around the world for decades. This created a highly stable and recurring revenue source since there are huge challenges with switching IT vendors, including the potential for meaningful business disruption that most companies would rather not face.

Warren Buffett infamously invested in the stock in 2011 for many of these reasons. Although he has since changed directions and is in the process of exiting his position, his familiarity with IBM goes back a long ways – he says he has read every annual report since 1961.

His public comments suggest he was most attracted to IBM’s trusted brand name and the stickiness of its customer relationships:

“I imagine as you go around the world that there are – there’s a fair amount of presumption in many places that if you’re with IBM, that you stick with them, and that if you haven’t been with anybody, you’re developing things, that you certainly give them a fair shot at the business.”

“The IT departments, you know, we’ve got dozens and dozens of IT departments at Berkshire. I don’t know how they run. I mean, but we went around and asked them and you find out that there’s – they very much get working hand in glove with suppliers. And that doesn’t mean things won’t change but it does mean that there’s a lot of continuity to it… Now, I would imagine if you’re in some country around the world and you’re developing your IT department, you’re probably going to feel more comfortable with IBM than with many companies.”

In other words, IBM has historically enjoyed a wide moat, thanks to high switching costs that allowed its legacy businesses to command strong pricing power and generate gross margins of 55% to 60%. While IBM’s legacy IT and server business remains large (with a backlog of well over $100 billion), in recent years the trend has been for businesses to shift more and more of their IT needs to the cloud, especially software applications that greatly help boost efficiency and cut costs.

IBM took a long time to accept this new reality, but in 2012 the company embarked on a massive turnaround plan (one of several it’s done over the past 100+ years). The new focus would be on strategic imperatives, specifically cloud computing, AI-driven software applications, and advanced cyber security offerings.

In recent years IBM has also decided to dip its toe into blockchain and quantum computing, both which could potentially be world-changing technologies in future decades but aren’t likely to be monetized in a meaningful way for some time.

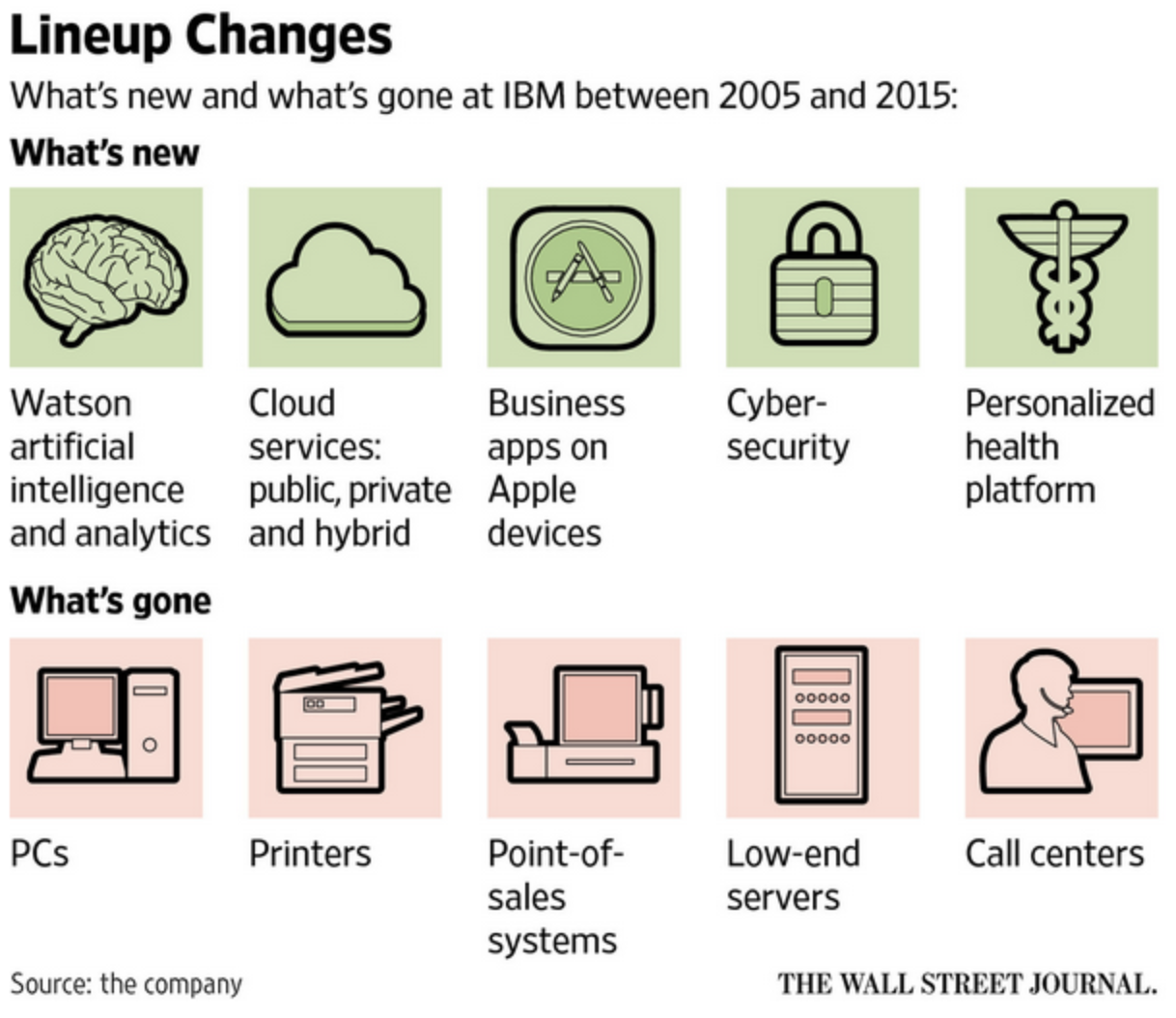

As you can see below, IBM has divested many of its legacy hardware lines as well, which were once very profitable and competitive for the company, but later became unprofitable and uncompetitive. Perhaps these divestitures serve as examples of a once-dominant company sitting on its laurels for too long, forgetting how to profitably innovate to maintain a strong market position.

Helping to drive this pivot into the most important tech markets has been the company’s legendary R&D unit. IBM employs 8,500 researchers, engineers, scientists, and designers working out of 12 research centers on six continents. Total R&D spending in the past year was more than $4 billion.

IBM has historically been known as one of the greatest innovators in tech, having received the most patents of any U.S. company for 25 straight years (IBM now has over 100,000 patents). That includes a record 9,043 patents granted in 2017, including:

- 1,900 cloud patents

- 1,400 AI patents

- 1,200 cyber security patents

IBM’s R&D facilities have helped generate a number of impressive and potentially game-changing products and services for the company.For example, the Watson cognitive computing (AI) deep learning platform, which underpins IBM’s cloud computing business, has already been adopting by hundreds of corporate clients around the world, in dozens of industries.

In fact, according to Virginia Rometty, IBM’s CEO, by the end of 2018 Watson will be serving 1 billion people around the world, in everything from GM’s OnStar, to advanced medical diagnostic screening.

The market for machine learning-based cloud services is expected to be about $2 trillion per year by 2025, meaning that IBM could have huge growth potential. That’s if it can manage to win enough market share in a highly competitive field filled with numerous other giants hungry for this prize (more on this in a moment).

In the meantime the company’s legacy businesses, while in gradual decline, continue to generate significant free cash flow ($13 billion in 2017) from which IBM can pay its generous, secure and growing dividend.

In fact, IBM raised its dividend for more than 20 straight years and is expected to soon announce its 2018 increase, meaning that it has a good chance to become a dividend aristocrat in 2020.

At first glance, IBM may seem like a potentially good choice for yield-seeking tech investors. However, IBM’s future may not be as bright as management might have you believe.

Key Risks

In the fourth quarter of 2017, for the first time in 23 quarters (over five years), IBM was finally able to achieve positive revenue growth. However, investors probably shouldn’t get too excited about the pace of IBM’s turnaround, which continues to move at a glacial pace.

This is because IBM’s sales growth was mostly fueled by a 71% boom in its new Z14 mainframe servers, which are part of the company’s legacy hardware business and were introduced about six months ago.

In IT hardware, sales generally see strong demand for two to four quarters before leveling off. Thus it’s likely that the company’s legacy hardware sales will soon return to their long-term secular decline, which is why IBM is guiding for only a small increase in 2018 revenue (essentially flat).

Meanwhile, it’s true that the company’s all-important “Strategic Imperatives” (the future of the company) continue to see strong double-digit growth, but there is a potential downside to this.

Specifically, while servers may be a declining business, they still represent IBM’s second most profitable segment. Only Watson-based Cognitive Solutions generates greater gross margins.

In other words, as IBM transitions away from legacy businesses and towards an ever-larger percentage of revenue from SI, margins could decline. For example, what if IBM catches up to Amazon, Microsoft, Google and other cloud providers only to find that industry profitability has been completely eroded in a race to the bottom? Double-digit price cuts are not unheard of in these markets.

Business applications, security, and analytics are also much more dynamic markets than mainframes, making it more difficult to forecasting future cash flows. Even if the margins end up being there, it could take a decade before IBM’s new businesses are generating the same level of sales and income as the legacy businesses they are intended to gradually replace.

These questions will likely remain unanswered for quite some time and shrouded in uncertainty given IBM’s recent results. In fact, thanks to slow execution on cost cutting and competitive market environments, the fourth quarter of 2017 marked the 9th consecutive quarter of year-over-year gross margin declines for the company.

Management is hoping to achieve $40 billion of SI sales in 2018 (up from $36.5 billion in 2017), driving the company’s first full annual revenue growth in six years. SI would represent just over 50% of total sales, which means IBM needs to execute much better on on its long-term cost savings initiatives in order to restore growth to the bottom line.

That’s especially important because the dividend is ultimately paid not out of revenue, but free cash flow, which was flat in 2017 and is expected to remain so in 2018. And while IBM’s $13.0 billion in free cash flow last year was impressive on an absolute basis, it represents a margin of just 16.4%. That’s not that impressive for a technology company, especially one that is increasingly shifting its focus to a less capital intensive business model driven by cloud computing and digital software subscriptions.

For example, Microsoft (MSFT), a major rival to IBM’s cloud computing ambitions, has recently been generating free cash flow margins of about 33%, double that of Big Blue.

Speaking of competition, be aware that IBM’s future cloud and AI-driven ambitions are not guaranteed to succeed. In fact, while IBM’s cloud computing business is growing strongly (around 20%), that’s far less impressive than growth seen by major cloud rivals Microsoft and Amazon (AMZN), who have larger scale but are still seeing cloud revenue increase between 40% and 60%.

In other words, while IBM’s cloud services are growing nicely, it’s still losing market share to better-run rivals. Worse, according to analyst firm Gartner, this trend is likely to continue, with Microsoft and Amazon expected to own 90% of the cloud computing market by the end of 2020.

Unfortunately, IBM isn’t just competing with Microsoft’s Azure cloud platform and Amazon Web Services (the dominant industry leader), but numerous other giant and cash-rich rivals, including:

- Alphabet (GOOG), parent company of Google

- Oracle (ORCL)

- Alibaba (BABA)

- Numerous fast-growing niche players, such as Virtustream, CenturyLink, Rackspace, Joyent, Interoute, Fujitsu, Skytap and NTT Communications

In other words, the cloud computing space, while large and growing fast, has attracted numerous well-capitalized giants who are outspending IBM when it comes to building out feature rich and sticky ecosystems. There are also numerous smaller and more nimble start ups that could potentially disrupt the company’s plans.

For example, Microsoft is hard at work converting its massive (1+ billion) global enterprise user base to its Office 365 Enterprise and Dynamics 365 subscription services, which run on its Azure cloud computing platform.

Microsoft’s goal is to create very high switching costs for its fast-growing cloud user base (consumers, too) by offering a one-stop shop for all IT and enterprise needs. Everything from accounting, to HR, to artificial intelligence-driven deep data analysis and business optimization programs. In other words, Microsoft is hard at work trying to become the next IBM of the cloud (and doing very well at it).

Meanwhile, Amazon Web Services is described by Gartner as “the most mature, enterprise-ready provider, with the deepest capabilities for governing a large number of users and resources.”

And while Google Cloud may be a relatively small player, with 6% market share, Urs Holzle, head of Google Cloud, has a goal of making cloud service revenue larger than advertising by the end of 2020. To that end, Alphabet has two subsidiaries working on deep cognitive machine learning.

But what about the huge potential for Watson, which famously crushed Jeopardy’s greatest champions in 2011? Well, as impressive as Watson is, and as large as the potential future market for its applications are, keep in mind that IBM is actually far behind major rivals in the AI arena.

That’s partially due to deeply underfunding its R&D department on a relative basis to keep earnings rising over the past decade despite stagnant revenue. For example, over the past 12 months, here’s how much IBM and its AI-focused rivals have spent on R&D as a percentage of revenue:

- IBM: 5.5%

- Amazon: 12.2%

- Microsoft: 14.1%

- Alphabet: 15.0%

- Facebook: 19.1%

In other words, IBM might not have the resources to compete with its more nimble rivals. Many of its competitors also do not have to fund large dividends ($5.5 billion in 2017 for IBM) and therefore have more resources to develop the dominant tech that will become the cornerstone of the future global economy.

These are all likely reasons why Warren Buffett decided to exit his position in the company. At Berkshire Hathaway’s annual shareholder meeting in May 2017, Buffett said, “I don’t value IBM the same way that I did six years ago when I started buying. I’ve revalued it somewhat downward…they’ve run into some pretty tough competitors.”

At the end of the day, IBM is saying all the right things about its SI-focused future and appears to be making progress in expanding its highly profitable Watson-based cloud offerings. However, the company has a long way to go to demonstrate that it can effectively compete with giant rivals that have already proven themselves far more innovative and adaptive to the fast-changing pace of technology.

Closing Thoughts on IBM

IBM has traditionally been seen as a relatively safe, high-yield dividend grower, and indeed it continues to be just that.

However, whether or not IBM can retain this status over the long term is still questionable. That’s especially true because of major technological advancements (e.g. the cloud) and management’s struggles with execution on its seemingly never-ending turnaround, which is now entering its 6th year.

Even if IBM is finally able to return to sustainable revenue, earnings, and free cash flow growth, management’s inability to deliver on its timelines and cost-cutting promises calls into question the company’s culture and just how profitable that future growth will be.

In addition, unless IBM is able to somehow accelerate its pace of strategic initiatives and cloud growth (and win greater market share), it’s likely to end up a small player in the dominant tech industries of the future. As a result, the company could ultimately lose the competitive IT position it currently enjoys, which has been the basis for its long track record of strong and steady dividend growth.

Only time will tell if IBM’s fast-growing but largely still unproven strategic initiatives will be able to more than offset the slowing down of older cash cow businesses over the long term. Conservative dividend investors may be better off sticking with other companies that have clearer paths to profitable long-term growth and operate in markets with a slower pace of change.

To learn more about IBM’s dividend safety and growth profile, please click here.

Leave A Comment