Apple (AAPL) was one of the pioneers in personal computing but has since grown to become one of the world’s most dominant forces in consumer electronics with more than $225 billion in annual revenue.

Today the company produces numerous consumer devices, including smartphones, desktop and laptop computers, tablets, smartwatches, voice-controlled smart speakers, TV boxes, and various phone accessories.

Apple also offers an increasingly wide array of software services integrated into its hardware products, including the App Store, Apple Music, iCloud, FaceTime, Apple Pay, and Apple CarPlay.

Today Apple’s business continues to be dominated by the iPhone, which accounted for 62% of revenue in fiscal 2017, with over 215 million units sold. Mac computers (11%), iPad tablets (8%), and other products (6% – Apple TV, Apple Watch, Beats products, phone accessories, iPod touch) are Apple’s other major hardware computers, although they are relatively small drivers compared to the iPhone.

With smartphone penetration exceeding 80% in America and plateauing in many other developed countries around the world, Apple’s massive iPhone business has found meaningful growth harder to achieve in recent years.

However, faster growth in other product lines, especially its services division (13% of sales – iTunes, iCloud, Apple Pay, AppleCare support, etc.), mean that the company’s future revenue and cash flow is likely to become more diversified.

Apple is also a truly global company, with its sales being far more diversified than the average U.S. multinational corporation. The Americas region accounted for 42% of revenue in fiscal 2017, followed by Europe (24%), Greater China (20%), Japan (8%), other parts of Asia (7%).

Business Analysis

Warren Buffett is famous for his strong focus on wide moat businesses. Specifically, he focuses on owning companies with meaningful competitive advantages that provide strong pricing power and excellent profitability.

Consumer electronics is a notoriously challenging industry, driven by huge competition, continually changing consumer tastes, capital-intensive operations, short product life cycles, and steadily declining margins. In other words, hardly the place that you usually find great dividend stocks.

However, Apple seems to be different thanks to several key factors, which is why Buffett’s company, Berkshire Hathaway (BRK.B), owns more than $20 billion worth of Apple stock (3rd largest Berkshire holding).

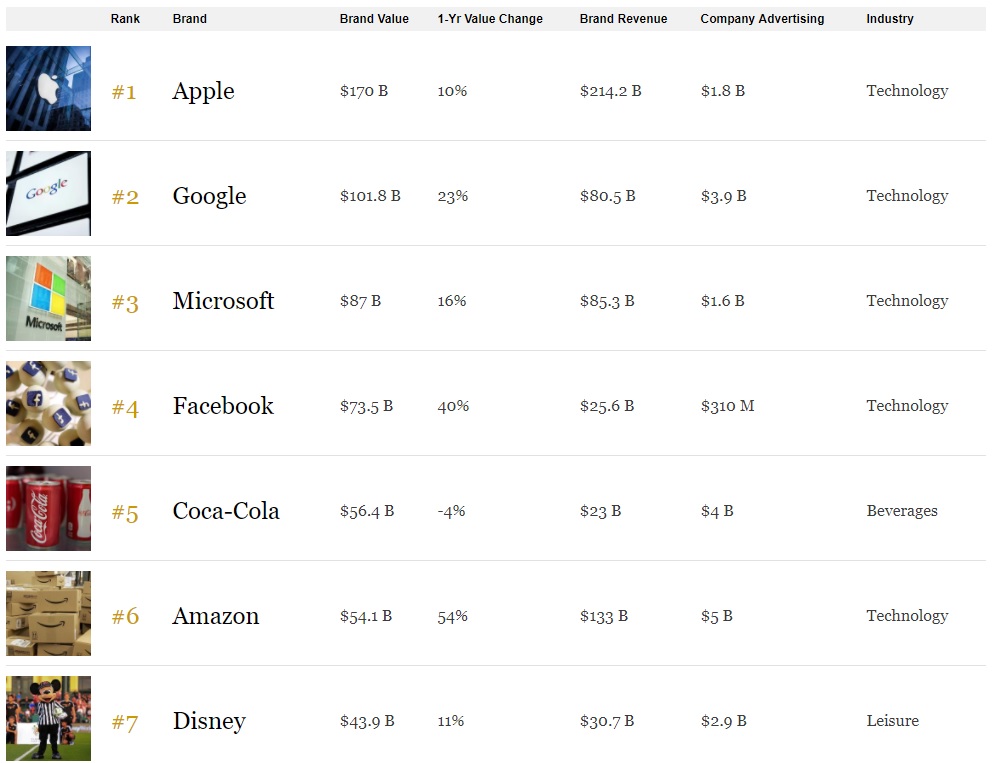

Most notably is Apple’s incredibly strong brand, which in 2017 was the most valuable in the world by a wide margin.

Most Valuable Brands In The World (2017)

The key to Apple’s premium brand, which has even managed to find success in emerging markets (sales growing 20% a year), is Apple’s very tight integration of its hardware and software offerings.

In other words, Apple has created a “walled garden” in which all of its products sync together through numerous software services, such as:

- iCloud – store photos, videos, documents, apps, and more across devices

- Apple TV – device hooks up to your TV to stream internet content from 60+ video services

- iTunes – download music, movies, and TV shows

- FaceTime – make video and audio calls from your devices

- Apple Pay – mobile payment and digital wallet service

- Apple CarPlay – controls iPhone through car’s built-in display

- Apple Music – music streaming service

Consumers who purchase Apple hardware are thus less likely to switch to rival devices that run on other operating systems, such as Android. If they switched, they would lose almost all of their content that can only be accessed using devices that run on Apple’s iOS operating system.

With over half a billion users on Apple’s iOS platform, third-party developers also have greater incentives to create apps designed for Apple’s devices rather than smaller alternatives with less monetization potential. This creates a virtuous cycle where Apple customers enjoy a greater selection of apps that makes their mobile devices more useful, bringing even more users onto the platform and thus making it all the more attractive for third-party developers.

The end result is a stickier ecosystem that allows Apple to command higher prices for its hardware products, even if the actual physical capabilities of its devices are largely the same as rival offerings today.

This can be seen with the average selling price of the iPhone, which has risen from $499 for the original model to a projected $740 thanks to the introduction of the iPhone X, which sells for as much as $1,050. Such premium pricing helps Apple achieve gross margins (on iPhones) of nearly 70% and is largely why it enjoys such a large portion of total global smartphone profits (over 70%, according to Forbes).

More importantly for investors, this strong pricing power means that Apple enjoys the best profitability in the industry, with returns on invested capital north of 25% and a free cash flow (what pays the dividend) margin above 20%.

Combined with its prodigious sales volumes, Apple is generating a huge river of cash flow that has given it the largest corporate cash position (more than $260 billion at the end of fiscal 2017) in corporate history. And that’s despite Apple’s largest cash return program ever, which has already returned more than $230 billion via buybacks and dividends out of a $300 billion authorization.

In addition, the new U.S. tax law means that the repatriation rate on foreign held cash (over 90% of Apple’s cash is held overseas) drops to 15.5% from 35%, so Apple has announced it plans to repatriate $245 billion over the next few years.

Even after accounting for the $38 billion repatriation tax the company will pay, Apple’s domestic cash position (which funds buybacks, dividends, and capital expenditures in the U.S.) will rise to more than $200 billion.

About $30 billion of that amount will go into increased U.S. capital expenditures, which includes $10 billion in new data centers to help power its fast-growing services division. Services is already generating over $25 billion in revenue on an annualized basis, providing largely recurring and steady revenue that the company hopes to grow to $50 billion a year by 2020.

In other words Apple’s long-term growth prospects thus appear bright, with the company increasingly focusing on better long-term monetization of its enormous user base (over 1 billion iOS devices in use worldwide).

To help with those efforts, the company is constantly rolling out new hardware products designed to further integrate with its existing offerings. This includes the Apple Watch, which already commands 41% global smartwatch market share and has seen sales rise about 50% over the past year.

While total Apple Watch sales are roughly 10 million a year, Apple has the potential to greatly increase that figure, as well as its pricing power, thanks to ongoing efforts to turn the Apple Watch into a real-time medical device.

For example, the company is currently researching how to allow the Apple Watch to generate accurate and advanced blood sugar monitoring (non-invasively) as well as warn wearers of potentially dangerous irregular heart activity.

While such features may still be years away from perfection, if Apple can master them, then the potential applications for the Apple Watch to become an insurer-sponsored medical device could prove to be a game changer.

To help continually improve its products and services, as well as launch new ones, Apple has also been increasing its R&D efforts. For example, when Tim Cook took over as CEO in 2012, Apple was spending under $3 billion in R&D, or about 2% of revenue. However, today Apple spends nearly $12 billion a year on new product and service development, or about 5% of revenue.

All this extra spending has been targeted in a highly disciplined fashion into continuous improvements to Apple’s ecosystem, including acquiring and upgrading Siri, Apple’s digital personal assistant.

Also key to Apple’s success has been its disciplined approach to acquisitions. Despite having a continuously growing mountain of cash that has caused some analysts to call for Apple to make giant, splashy acquisitions (such as buying Tesla or Netflix), Apple’s approach to M&A has been far smaller and more targeted.

For example, over the decades Apple acquired less than 100 companies, the largest of which was its 2014 purchase of Beats Electronics for $3 billion. More recently, Apple announced a $400 million deal to purchase Shazam, the song identifying application with 120 million users.

This bolt-on acquisition is precisely the kind of purchase that Apple is famous for. Rather than try to buy large growth at any cost, Apple instead purchases companies whose products and services can directly be plugged into its current ecosystem and improve it. Shazam will help Apple acquire more customers for its music streaming service and drive more iTunes sales by directly helping people discover new songs and buy them on the spot.

Simply put, Apple has done a remarkable job of managing its brand and increasing the switching costs of its high-quality hardware and software ecosystem. This has allowed the company to achieve industry-leading profitability and reward dividend investors with excellent growth.

In fact, since reinstating its dividend in 2012, Apple has raised its payout by about 10% annually, and CEO Tim Cook has publicly committed to raising the dividend each year. With the company seemingly firing on all cylinders and about to see its domestic cash position soar, those dividend hikes are likely to keep coming for the foreseeable future.

Key Risks

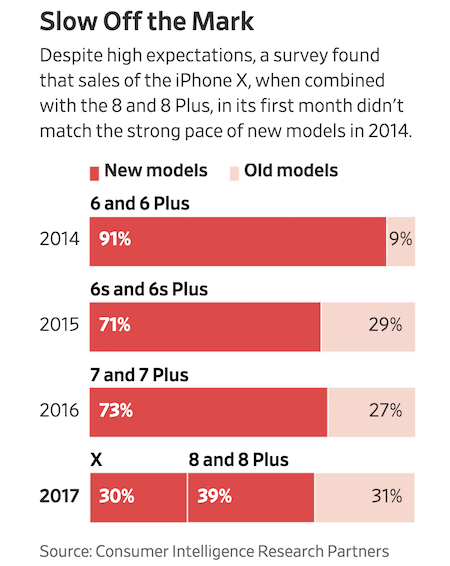

Apple has two major challenges it’s facing in the years ahead. First, on the hardware side of the business, the company might struggle with longer upgrade cycles for its products, especially the all-important iPhone.

In order to compete with other smartphone makers such as Samsung, Apple must continually invest substantial amounts of money (including into its suppliers) in order to upgrade its iPhone’s capabilities each year.

However, as recent phone upgrade cycles have shown (see below), consumers are increasingly demanding major upgrades to justify purchasing a new phone and are instead sticking with older models. That’s especially true with smartphone subsidies from carriers decreasing, iPhone list prices rising with each new model, and feature differentiation proving to be more difficult.

As a result, Apple is facing the “old phone is good enough” problem that could create greater cyclicality in its most important source of revenue and profits than it has seen in the past.

Meanwhile, another major threat to Apple’s continued dominance is the fact that its ecosystem, while sticky, doesn’t necessarily enjoy an insurmountable moat. In other words, it’s possible for rival companies to still convince customers to switch to their competing hardware products.

For example, iOS is becoming a much fuller and richer platform over time, thanks to features such as Apple Pay, CarPlay, iCloud, and FaceTime. However, rivals like Alphabet’s (GOOG) Android operating system offer similar software platforms. As a result, it’s possible for Apple users to move platforms should Apple’s hardware products and/or service offerings fall short of their users’ needs or desires.

This is a major concern for Apple because in the fastest-growing markets, such China and India, it faces low-cost competition from the likes of Chinese phone giants Huawei and Xiaomi, as well as Indian phone maker Micromax.

The problem for Apple is that the same network effects that give it strong brand loyalty today can also work in reverse. In other words, Apple’s ecosystem strength is predicated on a large, stable, and steadily growing global user base that attracts top partners and app developers to its iOS-powered platforms.

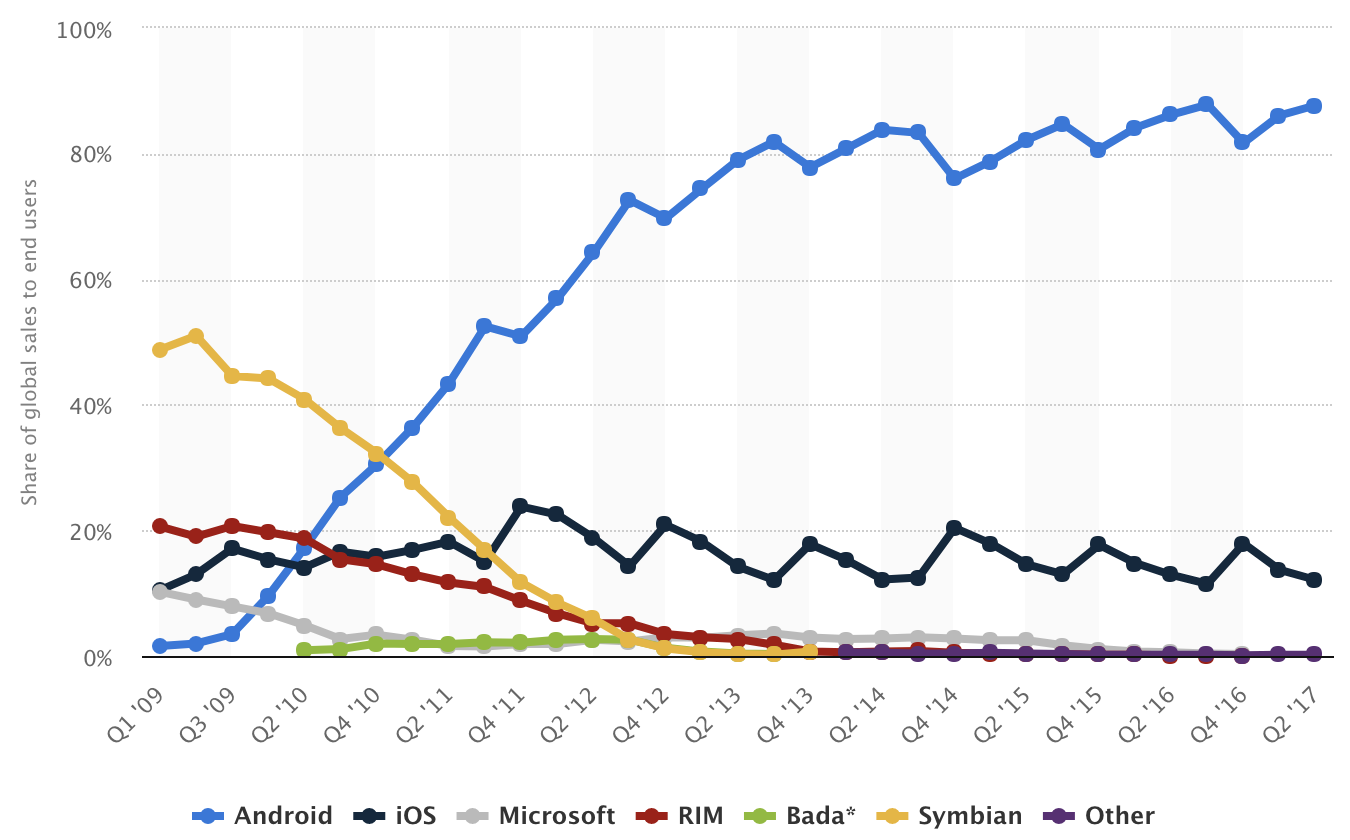

Previous phone giants such as Blackberry, Nokia, and Motorola all once enjoyed dominant market positions but saw their market share dwindle under a constant barrage of improving technology and lower cost competing products.

The chart below shows global mobile operating system market share from 2009 through 2017. You can see that Nokia’s operating system, Symbian (orange line below), enjoyed over half of the market in early 2009 but was discontinued within the next five years as consumers quickly moved to smartphones running Android and iOS operating systems.

Apple is essentially stuck in a constant race with numerous rivals, both big and small, to not only maintain high quality services across its ecosystem, but continually improve them as well.

However, over time this becomes more challenging. That’s because every new feature Apple adds needs to be updated, improved, and debugged in real time. The rocky rollouts of Apple Maps in iOS 6, as well as the rough launch of iOS 8 (which rendered some phones useless and had to be immediately recalled), show that Apple’s “it just works” reputation isn’t guaranteed in the future.

Another thing to consider is that Apple’s future growth largely hinges not so much on hardware (though this will always be important) but primarily on software. After all, we’ve now reached a point where even low cost phones have very good capabilities and feature sets, which means that Apple will likely find it harder to differentiate on physical hardware capabilities alone.

The real determinant of Apple’s future ecosystem stickiness could come down to how well it integrates artificial intelligence (AI) into its software offerings. On that front, Apple is actually slightly behind the curve relative to giant rivals such as Alphabet, Facebook (FB), Amazon (AMZN), and Microsoft (MSFT).

All of these cash-rich competitors are investing heavily into advanced machine learning algorithms that use mountains of consumer data to learn and adapt to better suit individual user needs and wants. This can most readily be seen in personal assistants such as Microsoft’s Cortana, Amazon’s Alexa, and Alphabet’s Google Now, all of which are more capable than Apple’s Siri in many regards.

Many of these giants are increasingly focused on collecting valuable consumer data at any cost. As a result, there is risk that smartphones and other hardware devices become increasingly commoditized, serving as loss leaders in exchange for higher market share and greater amounts of data that can be used to generate profits in more important areas of their businesses.

While Apple still enjoys a well-earned reputation for quality hardware and a great consumer experience, it’s far from assured that the company can maintain these advantages in an increasingly fast-changing, data-driven technology world.

As a result, the company’s huge ramp up in R&D spending, while a great long-term strategy, may merely represent a hamster wheel in that Apple must be constantly running faster (and spending more) just to remain in the same place (i.e. preserve market share).

In other words, there is no telling whether or not simply spending more on an ever-widening array of products and services ultimately results in the same kind of high growth and returns on invested capital that the company has enjoyed in the past.

Should any competitive developments or major internal oversights alter the lucrative iPhone economics that Apple enjoys, a company of this size could have a hard time righting the ship in a timely manner. Fortunately, Apple’s cash hoard and track record of innovation help mitigate this risk.

Closing Thoughts on Apple

Consumer electronics has traditionally been a very challenging industry marked by cut-throat competition, highly cyclical sales, unpredictable technology changes, and declining margins over time.

However, Apple has proven itself a standout in its space, thanks to a strong focus on building and maintaining a premium, aspirational brand over time. The company’s efforts to constantly improve its sticky iOS ecosystem and deeply integrate all of its various hardware and software offerings have resulted in greater customer loyalty that has translated into industry-leading profitability.

Combined with its disciplined capital allocation that forgoes the splashy mega-mergers tech companies are famous for, Apple has shown itself to be a wise steward of shareholder capital. And thanks to the new U.S. tax code, Apple will now have full access to nearly all of its massive cash pile (well over $200 billion), which bodes well for future dividend growth prospects. In fact, income investors can likely count on Apple offering double-digit dividend growth prospects in the years ahead.

With that said, Apple will remain largely dependent on hardware sales for the foreseeable future. Dividend investors considering the company should remain aware that the company’s long-term growth prospects could come into question if the economics of the iPhone were to unexpectedly breakdown. For now, this seems unlikely thanks to the company’s incredible brand strength, customer intimacy, and excellent balance sheet, which provides greater flexibility for Apple to adapt as needed.

To learn more about Apple’s dividend safety and growth profile, please click here.

Leave A Comment